Sunday Summary: Big Boss Is Watching

By The Editors January 16, 2022 9:00 am

reprints

Those who believed that the best thing America needed to get back to work was a good strong push from their employer (i.e., a vaccination mandate) suffered a severe setback this week.

The Supreme Court said no dice to the Biden administration’s mandate for companies with more than 100 employees to require a COVID-19 vaccination or proof of weekly negative testing.

Settle in for more work from home, people!

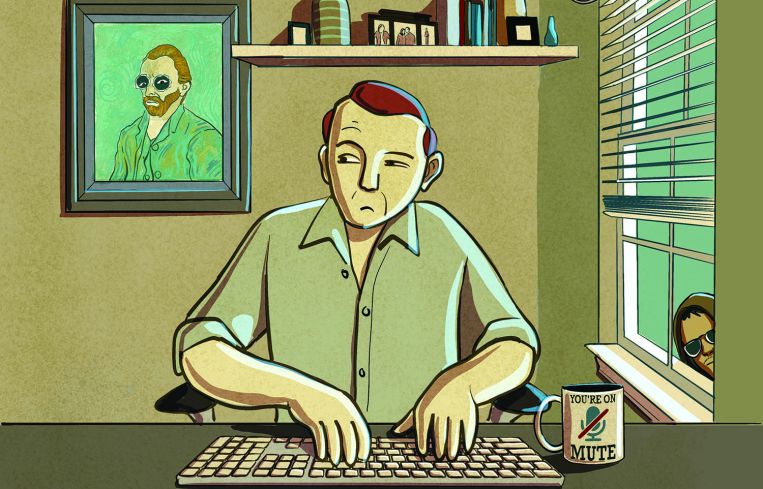

But at least as WFH is fully normalized we won’t have to deal with the one thing that we most hated about working in an office: the boss leaning over your desk to make sure you’re actually busy!

Or, will we?

Some companies have already floated the idea of “periodic unplanned visits from a supervisor during scheduled work shifts” to make sure that you’re actually working. (Mattel, which put this specific wording in a job description, quickly backed down once this was publicized.) And your company computer is perfectly able to be surveilled.

“It would be naive to think that your data is not being gathered and collected,” said Mauren Ehrenberg of Blue Skyre. “It’s important that employees know that they have a responsibility to their employer, that they have to be trustworthy. It’s not just a one-way street.”

Sigh. This is why we can’t have nice things.

Multifamily mania

We were thinking a lot about our homes this week. Throughout the pandemic multifamily has been remarkably resilient. Companies like Blackstone and Ivanhoé Cambridge have done huge multibillion-dollar deals and positive growth in the sector is expected in 2022. Just last week Marcus & Millichap acquired the multifamily advisory firm Eisendrath Finance Group, and CIM Group ponied up $52 million to buy a 117-unit apartment building in Inglewood, Calif., from Meldia Group.

It’s almost as if … it’s doing too well!

Could multifamily, the golden boy of real estate, be floating into bubble territory?

It’s certainly possible. More and more borderline deals with little room for error are crossing the finish line.

“Multifamily is definitely the most liquid, most accepted product type, which in some ways helps keep pricing more stable,” David Perlman, managing director of capital markets and head of the New York office at Thorofare Capital, told Commercial Observer this month. “At the same time, how much can rates go down and how much can pricing go up before you have a retreat in that space?”

Although at the CRE Finance Council’s annual Miami conference last week nobody seemed to worry about multifamily. CO was on the ground fanboying out over Derek Jeter’s keynote, but when it came to multifamily the conversation was mostly about rising interest rates, which didn’t seem to concern panelists too much, either. (You can read the rest of our coverage here, here and here.)

Leasing, selling and financing!

Multifamily aside, there were plenty of interesting deals that happened last week.

To start off, Roku signed a monster lease at RXR Realty’s 5 Times Square, taking 240,000 square feet. Corporate law firm Carter, Ledyard & Milburn took 36,124 square feet at Fosun International’s 28 Liberty Street; golf club fitter and retailer Club Champion took 5,399 square feet at the old Daily News building at 220 East 42nd Street and The Bromley Companies leased an 8,000-square-foot space to the clothing and shoe retailer Allbirds at 120 Fifth Avenue in a space that The Gap had occupied for some 30 years. (Leasing was not just good in New York; in Miami, SoftBank Group is in negotiations for office space at L&L’s Wynwood Plaza.)

As for sales, Columbia University snapped up the old Harlem location of Fairway for $84 million. (No surprise there; the university has been building all around it.)

In Miami, Aby Rosen is making moves; the real estate maven’s RFR just picked up 100 Biscayne after its previous owners, East End Capital and Australian investors Errol Dorfan and Kim Davis, wound up suing each other over the management and redevelopment of the property. (No word on how much RFR paid for the property.)

Starwood is also liking South Florida. Despite the fact that it sold off a big mall in Hialeah a week ago it plunked down $130 million for a Whole Foods-anchored mall in West Palm Beach.

Thor Equities sold off The Lab, a 72-acre life science complex in North Carolina’s Research Triangle Park that itpurchased only a year ago, for $20 million to Alexandria Real Estate Equities for $80 million, four times what Thor paid for it!

Thor has had a busy 2022. Jeff Sutton, its partner along with A&H Acquisitions and aurora capital on 529 Broadway (home to the Nike Store), is putting up for sale the $195.3 million loan on the property.

Speaking of financing, the 30-story One Wilshire in Downtown L.A. landed a massive $389.3 million refinancing from Goldman Sachs.

All in good taste

Remember that New Year’s resolution to lose weight?

If you’re a Miami resident, Major Food Group seems determined to make you break it.

The company behind such wildly popular spots as Carbone, Parm and Dirty French is planning yet another Sadelle’s at 69 NE 41st Street across the street from the Institute of Contemporary Art in the Design District in tandem with the streetwear brand Kith.

And over in D.C., the famed restaurant Philippe Chow signed up for a 7,373-square-foot outpost at The Wharf.

There’s always 2023 to start your diet.

For a relaxing Sunday

It was kind of a packed week in terms of news. Convicted murderer (as well as a son of one of the great real estate families) Robert Durst died at 78. And tragedy struck the Bronx with a fire that killed 17, including eight children, where the building in question (owned by Belveron Partners and Camber Property Group) had dozens of complaints filed against it by residents.

But for a much less fraught Sunday morning reading experience we at CO have noticed that New York’s biggest commercial landlord, SL Green Realty Corp., has been shedding space and equity.

How come?

We took a deep dive into the reasoning behind the real estate investment trust’s strategy.

See you next week!