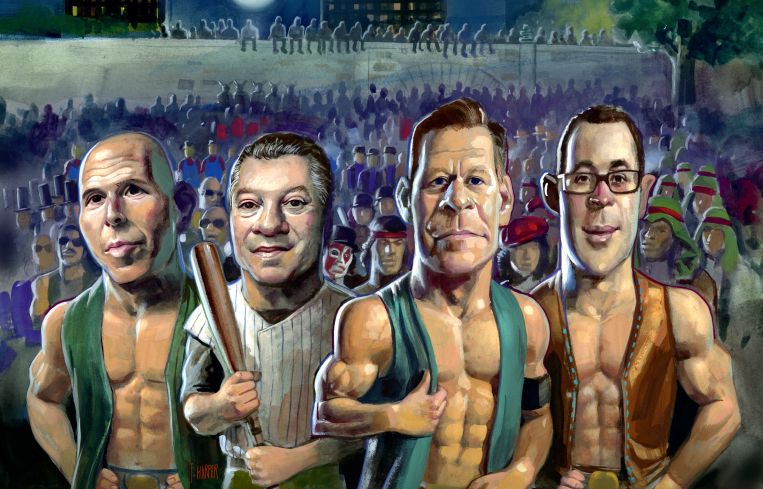

The Power 100

By The Editors April 25, 2018 9:00 am

reprints

When interviewing Jeff Blau, the CEO of Related Companies, for this year’s Power 100 we asked a question Commercial Observer had never raised in the past:

Who do you think should be No. 1 on our list?

To revamp the old saw that every time a senator looks in the mirror they see a president, we imagine that every time a developer is asked his or her position in the real estate pecking order the only number they recognize is “one.” (Blau—along with Stephen Ross and Bruce Beal—got the nod himself last year.) However, if they took themselves out of the equation, who should be No. 1?

“You should pick Google,” Blau said. “They’re doing more real estate than anybody. You put Google on, everybody will say, ‘Holy shit!’ ”

Google’s $2.4 billion purchase of Chelsea Market in February was the third-largest single-building office transaction ever in New York City history—and the buy also said something even subtler about the future of the city. As Gotham jockeys to be named the new East Coast headquarters of Amazon with 19 other cities, this was a remarkable vote of confidence in this city. It said something about where the newer, techier, younger workforce wants to be.

The other thing the Google real estate purchase proved was that while many real estate players regularly say that real estate is in a holding pattern, or that we’re in “extra-innings” in an interminably long market cycle, there are players who are taking the initiative and not shying away from big things.

And that was one of the most important characteristics of those who rose in our estimation this year—they didn’t shy away from thinking big.

Brookfield Property Partners’ Ric Clark was No. 8 last year, but the company seemed unusually peckish this year; not only was it wading into multifamily with The Eugene at Manhattan West and Greenpoint Landing with the Park Tower Group in Brooklyn; not only was it leasing millions of square feet of space (like, say, EY taking 600,000 square feet at 1 Manhattan West, or Amazon taking 305,000 square feet at 5 Manhattan West); not only was it making big trades (a $2.21 billion sale of 245 Park Avenue to HNA) but after a first rebuffed attempt it managed to acquire GGP, itself one of the country’s heavyweight REITs.

Some of the heavy hitters didn’t have much room to go any higher. RXR Realty was tapped—along with Vantage Airport Group—to lead the multibillion-dollar expansion of the JetBlue terminal at John F. Kennedy Airport. Normally, this is the kind of deal that could send a developer into the top five. Unfortunately, RXR CEO and Chairman Scott Rechler was No. 4 last year, so there wasn’t a lot of room for improvement. (He’s No. 4 again.)

Silverstein Properties has always had a fairly high ranking in Power 100, but with its winning $1 billion-plus bid for the Upper West Side ABC campus it merited a spot in the top 10.

Every year publicists, landlords and brokers call Commercial Observer and ask two things: Where are they on the list? (We keep that strictly under wraps.) And what’s our methodology?

Our methodology is never going to satisfy everybody. (A “popularity contest” is how one publicist dismissed it when I tried to walk him through it.) How does one compare a landlord with a broker? It’s a difficult question. If the broker disappears from the deal, can he be replaced? Sure. But if a landlord has a great piece of real estate and nobody believes in the project or the neighborhood or the transportation, will it go empty? Sure again. Who’s more powerful? The answer is that it depends. CO’s editorial staff spent many hours wading through these questions, assigning spots on the list and trying to provide answers to questions like, “Is Google—a tech company—really a real estate powerhouse?”

Answer: Absolutely.—Max Gross

The Power 100 2018 Issue:

1. Ric Clark

Senior Managing Partner and Chairman of Brookfield Property Partners

Last Year’s Rank: 8

While investment sales slumped last year, retailers filed for bankruptcy left and right and large real estate companies slowed their transactions, Brookfield Property Partners stood out among the devastation as a hungry giant.

It made bold attempts to consume mall operator GGP, developer Forest City Realty Trust and IWG—the office space provider formerly known as Regus (although Regus-branded coworking spaces remain). And although its first offer for GGP was rebuffed, the developer’s appetite could not be sated. It bolstered an aggressive second bid and reached an agreement to gobble up the remaining 66 percent of GGP that it did not own for roughly $15 billion.

But that was just the appetizer!

In 2017, Brookfield completed about 1.8 million square feet of leasing at its 7-million-square-foot mega-development, Manhattan West. Currently, the 67-story 1 Manhattan West, the 15-story 5 Manhattan West and 13-story The Lofts building are 92.3 percent leased. In addition, Brookfield leased another 1.1 million square feet to tenants in its 8.5-million-square-foot retail and office complex Brookfield Place, 2.4-million-square-foot One Liberty Place and 2.7-million-square-foot One New York Plaza.

“Brookfield’s New York team had a really big year in 2017,” Ric Clark said. “There was just a lot that we got done last year.”

Brookfield was behind a few of the largest trades: It unloaded 245 Park Avenue, which it owned with the New York State Teachers’ Retirement System, for $2.21 billion in May 2017 to HNA Group, and then Brookfield purchased the 350,000-square-foot office building at 333 West 34th Street from New York REIT for $255 million in November.

It also sold a 49 percent stake in the 2.3-million-square-foot One Liberty Plaza for $742.4 million to Blackstone Group in December.

In March 2017, Brookfield acquired a leasehold at 1100 Avenue of the Americas with Swig Company, leased the entire 386,000-square-foot office section of the property to Bank of America and, this January, leased another 127,000 square feet to the bank in the adjacent Grace Building at 1114 Avenue of Americas (which Brookfield and Swig already owned).

By the way, Brookfield isn’t satisfied with the commercial offerings, either: It’s also craving residential properties. The company, known for its office and retail developments, entered New York City’s multifamily realm last year with the 844-unit The Eugene at Manhattan West. It has already leased 82 percent of the luxury tower.

Brookfield is also partnering with Park Tower Group for the 22-acre Greenpoint Landing mixed-use project, which will have 5,500 apartments when it’s completed. The first residential tower is set to be completed in August.

And earlier this month, Brookfield reportedly purchased a 1.3-million-square-foot site in the waterfront section of Mott Haven in the Bronx for $165 million where the company will erect a residential building.

In the past “we shied away from apartments, which has one-year leases or hotels with daily leases,” Clark said. But “the apartment sector is one of the best performing sectors in a long period of time. It’s an exceptional sector in which we took our time to educate ourselves. Now that we are educated, we are actively looking to build our local portfolio.” Bon appetite.—Liam La Guerre

2. Marc Holliday and Andrew Mathias

CEO; President of SL Green Realty Corp.

Last Year’s Rank: 2

In a previous life Marc Holliday and Andrew Mathias might have been the world’s greatest jugglers. At least, running SL Green Realty Corp. in the last year they’ve managed to keep their eye on a lot of things that they have in the air.

They’ve bought. They’ve sold. They’ve lent. They’ve leased. They’ve developed. And, true to their pedigree of being the biggest and best (SL Green is the largest landlord of commercial real estate in New York City with ownership interests in 29.5 million square feet, as per the company website) it has done so on an immense scale.

“Every department here is very busy and very engaged,” Mathias said.

On the buying front, SL Green purchased a 48.7 percent stake in One Worldwide Plaza with RXR Realty, which had an appraised value of $1.7 billion.

“It’s a prototypical asset,” Holliday said of the purchase. “Midtown, great building, great tenants, great location, high cap rate, low-per-square-foot acquisition price and room to run on the bulk of the rents.”

As for sales, there were quite a few notable ones: The company sold a 43 percent minority stake in 1515 Broadway to the German financial services company Allianz Real Estate in a deal that valued the building at $1.95 billion; it sold 600 Lexington Avenue for $305 million to an insurance company; 16 Court Street in Downtown Brooklyn to CIM Group for $171 million; and just at the beginning of the month it sold the 674,000-square-foot office condo it owned with Ivanhoé Cambridge at 1745 Broadway to Invesco for $633 million.

SL Green also put an immense amount of money out as a lender. “We do about a deal a week,” Holliday said. While the company limits its lending to 10 percent of its assets, this has still meant $1.5 billion in originations and $210 million in revenues for the company.

With a portfolio that is 96 percent leased, it’s not as if the real estate investment trust hasn’t been striking deals—like, say, powerhouse law firm Greenberg Traurig taking more than 130,000 square feet of new office space at an SL Green property.

Which brings us to the last—and most exciting—ball in SL Green’s orbit (where Greenberg Traurig is taking all that space): One Vanderbilt, the super-tall, 1.6-million-square-foot skyscraper across the street from Grand Central Terminal that SL Green is developing.

Having taken years to get off the ground and including hundreds of millions of dollars pledged in transit improvements this project has played a critical role in the passage of the Midtown East rezoning and no doubt blazed a path for J.P. Morgan Chase’s announcement earlier this year that it would demolish and rebuild its building at 270 Park Avenue.

“Obviously, the centerpiece for us is One Vanderbilt,” Mathias said. “That’s requiring an enormous amount of my time and Marc’s time. Every discipline in the firm is getting ready for that building to open up in September 2020.”—Max Gross

3. Stephen Ross, Jeff Blau and Bruce Beal

Chairman and Founder; CEO; President at Related Companies

Last Year’s Rank: 1

Jeff Blau was in a good mood on the morning he spoke to Commercial Observer for Power 100: The day before, Page Six reported that Sting rented an apartment at 520 West 28th Street—Related Companies’ property that straddles the High Line and was designed by the late Zaha Hadid.

This might seem a relatively modest thing to be happy about; after all, Related’s deals at Hudson Yards over the last 12 months have been worth billions. In May 2017, Related landed the kind of white whale landlords only dream about: BlackRock paid $1.25 billion for a 20-year, 847,000-square-foot lease at 50 Hudson Yards. (The deal was reached a few months earlier but not finalized until then.)

Still, Sting is yet another data point in the great accumulation of evidence that Related’s big bet on the Far West Side of Manhattan is paying handsome dividends. The long-ago fear that a project that far west would have a tough time competing with the more well-trod sections of the city sounds like the cries of a Cassandra. (Sting’s last apartment, it should be noted, was one he sold for $50 million at 15 Central Park West, proving he knows a thing or two about decent real estate.)

“The whole thing started with Time Warner Center,” Blau said. Time Warner Center, which opened in 2003, served as a model for a large-scale project that involved retail, hospitality and residential all under one roof. “What do you do for an encore? That’s when Hudson Yards came up,” he noted. Now, a grand project like Hudson Yards, he added, is Related’s “true core competency. Nobody else in the country that comes up [can do this]. Not at this scale.”

And duplicating this success seems to be Related’s plan. “In Chicago we have a 62-acre site right in the middle of the city [that’s] 12 million square feet,” Blau said. “It’ll be the Hudson Yards of Chicago.” In Santa Clara, Calif., Related has a 240-acre mixed-use development in the planning stage. He called it, “San Francisco’s Hudson Yards.”

And we haven’t even mentioned the Grand Avenue complex in Downtown Los Angeles, a $1 billion mixed-use complex that Frank Gehry is designing and will feature an Equinox hotel.

“In retail, it’s been nothing but remarkable,” Blau said of the company’s business during a year dogged by retail implosion.

Indeed, Cartier, Van Cleef & Arpels and Piaget and the London-based hospitality group Rhubarb all announced late last year that they were coming to Hudson Yards, and after having once struck retail gold at Time Warner Center with what has been sometimes cheekily called the most expensive food court in history counting the likes of Masa and Per Se amongst its eateries, Related is assembling a similar murderers’ row at the Shops & Restaurants at Hudson Yards, a 1-million-square-foot retail complex anchored by Neiman Marcus that will include restaurants by Thomas Keller, David Chang and José Andrés.—Max Gross

4. Scott Rechler

CEO and Chairman of RXR Realty

Last Year’s Rank: 4

Two-thousand-and-eighteen has already taken off like a supersonic jet for RXR Realty. We’re referring, of course, to the March announcement that JetBlue Airlines tapped RXR and Vantage Airport Group to lead the multibillion-dollar expansion of its terminal at John F. Kennedy International Airport.

“The big thing is JetBlue,” Scott Rechler said. But in a year when a lot of real estate professionals have been content to sit back and see what the market does, RXR has been doing “big, bold deals.”

Case in point No. 1: One Worldwide Plaza. Along with SL Green Realty Corp., RXR purchased a 48.7 percent stake in the Midtown West skyscraper, which was valued at a whopping $1.7 billion.

Case in point No. 2: RXR bought the development rights to replace Long Island University’s athletic fields at 161 Ashland Place in Brooklyn to put up a new complex that will include 476 apartments.

Case in point No. 3: It is continuing its “suburban-urban strategy”—i.e., developing thousands of units in the areas surrounding New York City with projects like Larkin Plaza, the $200 million mixed-use complex in Downtown Yonkers, which topped off this past November.

Case in point No. 4: RXR sold NewYork-Presbyterian Hospital 500,000 square feet of space at 237 Park Avenue for $250.8 million (with the sweet condition that RXR gets the property back in 30 years).

And Rechler has certainly not neglected the bread-and-butter leases that make a real estate empire hum. It might have disappointed some that Anthony Bourdain’s Singapore-inspired market bit the dust, but RXR managed to replace him with a nice, juicy Google expansion. (As far as tenants go, yes, that counts as an upgrade.)

The civically engaged (and former vice chair of the Port Authority of New York & New Jersey) Rechler has taken a very public stand on the issue of gun control in the last year.

In November, RXR lit up 230 Park Avenue for 58 nights in orange in honor of each of the victims of the massacre at a concert in Las Vegas a month earlier. Earlier this month Rechler appeared with former Secretary of Homeland Security Jeh Johnson, John Feinblatt of Everytown for Gun Safety and Linda Beigel Schulman, a mother who had lost her son in the Parkland shooting in February, at Merkin Concert Hall to advocate against gun violence.

“It’s time for business to step up,” Rechler declared to the audience.—Max Gross

5. Sundar Pichai

CEO of Google

Last Year’s Rank: New

Any company that spends $2.4 billion to acquire a property in New York City should be considered a major real estate player—especially one that does so in an all-cash transaction. Google, you are officially a serious real estate player.

The tech giant’s gargantuan deal to purchase Chelsea Market at 75 Ninth Avenue from Jamestown in March is the third-largest-ever single-building office transaction in Gotham and a show of force from Google that says, if it should so desire, it could easily compete in the real estate capital of the world. As Google’s parent company, Alphabet Inc., brought in $110.8 billion in revenue last year, $2.4 billion is child’s play.

“This purchase further solidifies our commitment to New York, and we believe the Manhattan Chelsea Market will continue to be a great home for us and vital part of the neighborhood and community,” according to a Google statement about the purchase.

Google first entered New York in 2000 with a single salesperson who worked from a Starbucks. Today, it has more than 7,000 employees in the Big Apple.

Before its big Chelsea Market buy, Google had already occupied 400,000 square feet in the 1.2-million-square-foot building. Google’s main New York offices are across the street at 111 Eighth Avenue, a building that the company purchased for $1.77 billion in 2010.

And thanks in part to Google’s presence in the Chelsea-Meatpacking area, which dates back to 2006, hordes of tech companies and brands have flocked there, making it a hot spot for the industry.

Also last year, the company expanded its lease at 85 10th Avenue by 60,000 square feet, to 240,000 square feet total. And at Pier 57, which RXR Realty is currently redeveloping, Google added 70,000 square feet of office space and 50,000 square feet of public engagement space to its 250,000-square-foot lease at the property.—Liam La Guerre

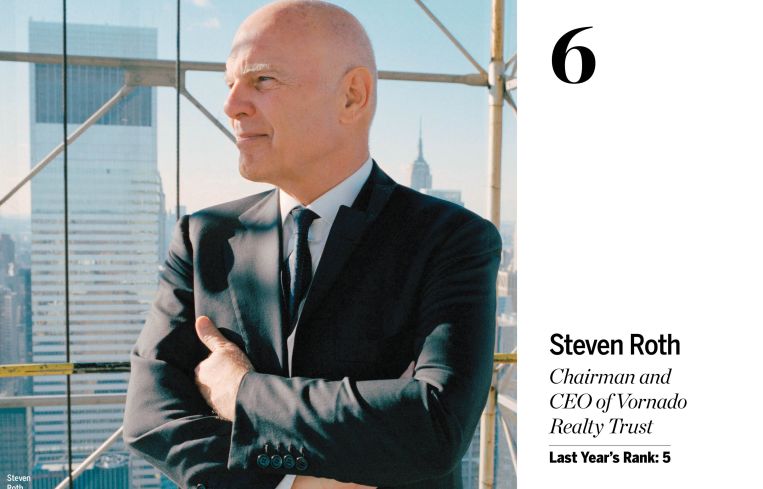

6. Steven Roth

Chairman and CEO of Vornado Realty Trust

Last Year’s Rank: 5

If you’ve kept an eye on Vornado Realty Trust over the years, you will know that Steven Roth’s designs on repositioning the firm’s expansive Penn Plaza assets are nothing new. Indeed, on earnings calls and letters to shareholders, Vornado’s head honcho has for years talked up the embedded upside within the 9 million square feet of real estate that the company owns in the area surrounding the Penn Station transit hub.

Except now there are signs that Roth’s Penn Plaza puzzle is finally starting to come together. The past 12 months saw Vornado (alongside Related Companies and Skanska) win the right to redevelop the James A. Farley Post Office Building, adjacent to Pennsylvania Station, into the new Moynihan Train Hall. In addition to reinvigorating the transit hub for Amtrak and Long Island Rail Road travelers, the project will yield 730,000 square feet of new office space and 120,000 square feet of new retail.

Meanwhile, Vornado is finally getting to work on renovating the massive 57-story, 2.5-million-square-foot 1 Penn Plaza, a $200 million undertaking expected to commence later this year that aims to boost the office tower’s asking rents by $20 per square foot and will see it rebranded as “Penn 1.”

Across the street at 2 Penn Plaza, a proposed Bjarke Ingels-helmed redesign of the building could be scrapped for a ground-up redevelopment of the property, Roth said in a recent shareholder letter, while the real estate investment trust continues to vet its long-planned 15 Penn Plaza skyscraper on the Hotel Pennsylvania site on Seventh Avenue.

Elsewhere in Manhattan, Vornado appears set to rid itself of 666 Fifth Avenue after Roth revealed a “handshake” agreement to offload its 49.5 percent interest in the office tower to co-owner Kushner Companies. And at 350 Park Avenue, the company could be the latest developer to tap into the benefits of the Midtown East rezoning, with Roth describing the property as “the best candidate on Park Avenue to next take advantage of the new zoning incentives” available under the redrawn guidelines.

There’s been much conjecture about when Roth, who is in his mid-70s, will relinquish the Vornado helm; despite undergoing heart surgery last August, he’s said he feels “fine” and has no plans to step down. For a man whom President Donald Trump counts as one of his friends in the real estate industry, it’s a lot of power to walk away from.—Rey Mashayekhi

7. Rob Speyer

President and CEO of Tishman Speyer

Last Year’s Rank: 7

Rob Speyer may have stepped down as chairman of the Real Estate Board of New York, but he still controls his family’s sprawling and active real estate business, Tishman Speyer.

“I’m proud of what we accomplished [at REBNY],” Speyer said. “Getting done the Affordable New York Housing Program and the rezoning of Midtown East are two legacy items that will leave the city and the industry in good stead for a long time to come.”

Under the leadership of Speyer, the firm manages a New York City commercial real estate portfolio spanning 16 million square feet and is developing another 4.5 million square feet of commercial projects. Tishman is also building its first two New York City-area residential developments—a 1,900-unit, three-building development called Jackson Park in Long Island City, Queens, and a 51-story, 480-unit condominium tower at 11 Hoyt Street in Downtown Brooklyn.

Jackson Park includes a 1.6-acre park and a 60,000-square-foot amenity building, both of which will open in the next month or two. The first residential building is leasing up now, and the other two will be complete this summer. Across the street, Tishman has poured concrete for 10 floors of the JACX, a 1.2-million-square-foot, two-building office and retail complex. The pair of 26-story towers is already 70 percent leased to Bloomingdale’s and WeWork, with construction expected to finish in mid-2019.

Meanwhile in Downtown Brooklyn, the Rockefeller Center-based company recently started on foundations for the Studio Gang-designed residential condominium project at 11 Hoyt Street. And it’s stacking six new stories of commercial space atop Macy’s four-story office building across the street at 422 Fulton Street.

But Tishman’s most exciting project is unquestionably The Spiral, a Bjarke Ingels-designed, 2.8-million-square-foot office tower at 66 Hudson Boulevard.

Pfizer just inked a deal for 800,000 square feet of office space at the property, which will start construction in July and finish in 2022. The structure will feature cascading, connected terraces that wrap around the building and double-height floors connected by open stairs “to provide the perfect point for informal collisions and discussions and the kind of environment companies want from their new real estate,” Speyer said.—Rebecca Baird-Remba

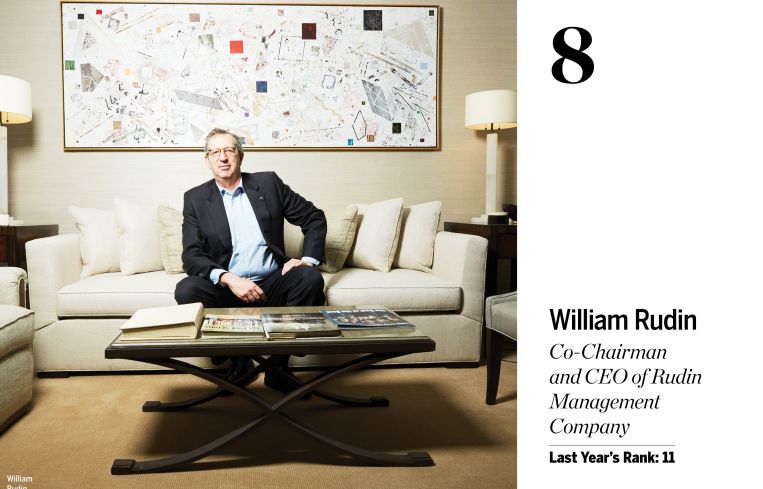

8. William Rudin

Co-Chairman and CEO of Rudin Management Company

Last Year’s Rank: 11

At the end of 2016, Rudin Management Company’s patriarch Jack Rudin died at age 92, so “2017 was a year of transition and moving our company forward,” said William Rudin, whose company’s portfolio includes 35 commercial and residential buildings in the city, comprising about 15 million square feet.

William’s children, Samantha and Michael Rudin, were both promoted to senior vice president from vice president last year, so they could have more responsibility and learn to run the company, the senior Rudin said.

“Watching them grow and develop and take more of a leadership role in this organization is a priority for [Rudin Management President and co-Chair] Eric [Rudin] and myself,” Rudin said. “Because in any company you need to make sure, just like Jack and Lew [Rudin, who ran the company with Jack] did with Eric and myself, that there is a smooth transition, and the next generation has the support to take over and run the company.”

The timing was also appropriate because William became the chairman-elect of the 122-year-old Real Estate Board of New York in June and would have to split his time between Rudin Management, REBNY and his efforts with the Association for a Better New York. His three-year term at the helm of the strongest real estate advocacy group in New York City started on Jan. 1, 2018.

But that doesn’t mean that Rudin is shying away from the development that has been the calling card of the family for generations. Another major highlight for Rudin Management last year was topping out its first-ever Brooklyn development in October: the 675,000-square-foot Dock 72 office building, which Rudin is building in partnership with Boston Properties and WeWork.

Finally, Rudin has been heavily investing in real estate technology companies and is becoming a major player in the property tech world.—Liam La Guerre

9. Jonathan Gray, Ken Caplan and Kathleen McCarthy

President and COO; Global Co-Heads of Real Estate at Blackstone Group

Last Year’s Rank: 3

Changes were afoot at Blackstone Group in 2017 as a trio of the firm’s leaders climbed a rung on the ladder: Jonathan Gray, the company’s global head of real estate since 2011, became its president and COO, while his longtime deputies, Kathleen McCarthy and Ken Caplan, now sit atop the real estate totem pole (hence why McCarthy and Caplan have been added to the list).

After a transition that McCarthy and Caplan described as seamless, the gargantuan private-equity firm remains laser focused on executing on the constantly refined strategies it calls “convictions.”

“You need every investment to stand on its own, but we do orient our team around things we have more conviction in,” McCarthy said.

Lately, one of the most powerful of those convictions has been investment in housing.

“We continue to like multifamily here in New York and, more broadly, across the country,” Caplan said. “We’re investing in residential globally.”

That attitude was reflected in one of the private-equity firm’s biggest deals last year, the marriage of its single-family rental business, Invitation Homes, with Starwood Capital Group’s rental homes arm. The resulting firm, which kept the I.H. name, became by far the country’s biggest single-family landlord.

Strong momentum in American e-commerce and European office markets was behind some of Blackstone’s other major moves in the last 12 months. Last June, Blackstone paid $2 billion for the office and retail holdings of Sponda, a Finnish firm that owned commercial space throughout that country.

And this March, Blackstone Real Estate Income Trust, the company’s subsidiary real estate investment trust, closed on the $1.8 billion purchase of a 22-million-square-foot nationwide warehouse and distribution network, bringing the REIT’s total assets under management to $7 billion.

Those new acquisitions will be folded into a property mix that has indisputably provided results. “Last year was our fourth year in a row of over $20 billion distributed to our investors,” McCarthy said.—Matt Grossman

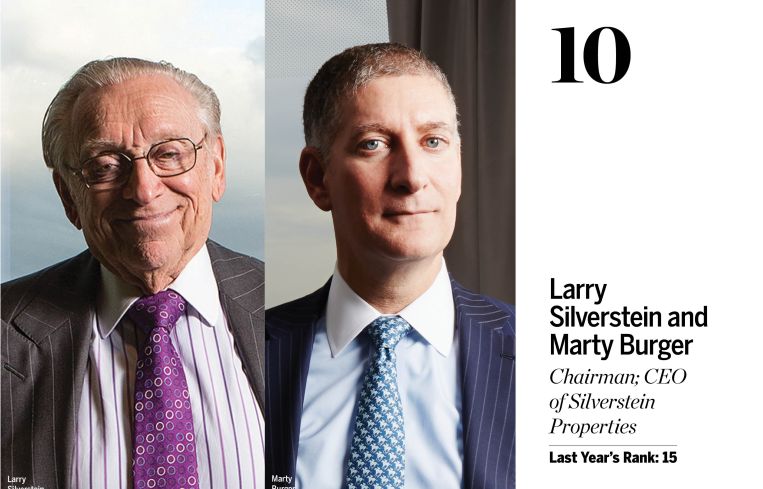

10. Larry Silverstein and Marty Burger

Chairman; CEO of Silverstein Properties

Last Year’s Rank: 15

It’s safe to say that Silverstein Properties has had its hands full. Silverstein signed roughly 1.2 million square feet worth of office leases across the city last year with most of its wheeling and dealing at the World Trade Center, where it fully leased both 4 and 7 World Trade Center.

That was headlined by the company nabbing one of the city’s largest leases of 2017 when Spotify took 378,000 square feet at the top of the 72-story 4 World Trade Center last February. With the move to 4 World Trade, Spotify planned to add 1,000 jobs and keep an additional 800 more in New York. The State of New York also guaranteed Spotify an $11 million rent reduction over the course of its 15-year lease for its pledge to hire more employees and keep its workforce in the city.

Just five months later, the music-streaming giant executed a lease option to expand by an additional 100,000 square feet to occupy an additional three floors in the 2.3-million-square-foot tower, which brought the building to full occupancy.

Also last February, law firm Kramer Levin renewed its lease at Silverstein’s 1177 Avenue of the Americas—albeit resigning for slightly less space (roughly 265,000 square feet) as it planned to chop underutilized square footage and revamp its office layout, according to Marty Burger. Silverstein also locked in Macmillan Publishers in July 2017 for 261,000 square feet at the firm’s 41-story 120 Broadway.

As for Silverstein’s roughly $1 billion luxury residential development at 30 Park Place, the building was listed by PropertyShark as one of the city’s best-selling residential properties in the first quarter of 2017, with 38 condos sold at a median sale price of $5.8 million. The condos at 30 Park Place are now 85 percent sold, according to information from Silverstein. Larry Silverstein and his wife Klara are moving in there this spring.

“I have to say that the last nine months of 2017 were very slow for us in the condo market,” Burger said. “In 2018, we’ve had more sales in the first quarter than in the last nine months of 2017.”

To start 2018, the firm scooped up just over $300 million from Deutsche Bank to refinance One West End, its luxury condominium property completed in 2014 as part of the sprawling seven-building Riverside Center residential development.

But an even bigger prize awaited: In April, Silverstein signed a deal with the Walt Disney Company to acquire the American Broadcasting Company’s New York City headquarters, a multibuilding Upper West Side office portfolio along West 66th Street, as Commercial Observer first reported.

With construction on its 80-story, 2.5-million-square-foot 3 World Trade Center set to wrap in June, the company’s grip on Downtown is only getting tighter. Three World Trade Center is also ahead of schedule, with a grand opening set for June.”—Mack Burke

11. Douglas Durst and Jody Durst

Chairman; President of The Durst Organization

Last Year’s Rank: 6

Although The Durst Organization made headlines over the past year for its public fights with Mayor Bill de Blasio’s administration, the family-run real estate firm made plenty of progress building residential projects and leasing up commercial ones.

Overall, Durst is developing 5 million square feet of residential space with 3,500 units and manages 2,500 apartments and 13 million square feet of commercial property. Last year, the firm leased up all 709 apartments at the triangular, Bjarke Ingels-designed VIA 57 West. In Long Island City, Queens, it recently started excavating the former Clock Tower site at 29-55 Northern Boulevard to make way for a 63-story, 763-unit building.

On the commercial front, Durst rented 1 million square feet of office and retail space over the past year. One World Trade Center is 75 percent leased, and the developer is slowly filling Condé Nast’s vacant 817,000-square-foot office space at 4 Times Square, which is technically leased through 2019.

As for the squabble Durst stepped into with de Blasio, it was staged against the backdrop of the decaying New York City Housing Authority development at Astoria Houses, where Durst Organization had promised to upgrade the boilers as part of the work for its massive Halletts Point project across the street.

City Hall canceled $43.5 million in bond financing for Halletts Point in late January. Then the City Council launched an investigation into why the city pulled the financing in the midst of a heating crisis in public housing developments across the five boroughs. While a city spokeswoman argued that NYCHA had already set aside $20 million to repair the boilers, the Dursts and City Councilman Ritchie Torres charged that withdrawing the money would delay much-needed work on Astoria Houses’ boilers. But fisticuffs aside, the Durst cousins are eager to tackle the project.

“We’re in discussions with the city to find a way to move forward,” Douglas told Commercial Observer. The other six buildings in the planned 2,000-unit complex are stalled, but 10 Halletts Point, the first building, will open its doors with 405 rentals (including 81 affordable ones) this June.—Rebecca Baird-Remba

12. Bill de Blasio

Mayor of New York City

Last Year’s Rank: 35

Last year, it was difficult to organize a list like this without feeling like Mayor Bill de Blasio’s influence in the realm of New York City real estate was waning.

Real estate interests were at the heart of a corruption inquiry into his administration; de Blasio had seen himself relegated to the sideline while his best frenemy, Gov. Andrew Cuomo, dictated the terms of the political battle over the 421a tax abatement; hell, the mayor was even getting out-fundraised by a real estate executive, Paul Massey, who was gunning for his job.

In 2018, it’s a much brighter picture for hizzoner. Those corruption inquiries are now a distant memory, 421a has been replaced by the new Affordable New York Housing Program and de Blasio strolled to re-election this past November.

With those distractions set aside, the mayor and his administration have been able to get on with their ambitious housing policy aims; piece by piece—from East New York, Brooklyn, to East Harlem to the Jerome Avenue corridor in the Bronx—neighborhoods across the city are being rezoned to accommodate de Blasio’s Mandatory Inclusionary Housing affordable housing program.

Meanwhile, City Hall has seemingly shown more fortitude in its dealings with real estate interests, whether it’s sparring with The Durst Organization (and subsequently holding up the developer’s Halletts Point development in Astoria, Queens), hammering out a new deal with Related Companies and Sterling Equities on their long-planned redevelopment of Willets Point, or setting up a fight with the Real Estate Board of New York over de Blasio’s support of a floated “vacancy tax” on retail landlords.

It hasn’t always been an easy ride, but there’s evidence to suggest that this mayor has finally grown into his role.—Rey Mashayekhi

13. Barry Sternlicht

Chairman and CEO of Starwood Capital Group and Chairman of Starwood Property Trust

Last Year’s Rank: 12

Tallying Starwood’s titanic stature in American real estate, there’s just one head-scratching question: Where to start?

Founded in 1991 by Barry Sternlicht and Robert Faith—who left the company two years later—Starwood Capital today manages about $56 billion in real estate assets worldwide. Sternlicht, who still runs the company, oversees a sprawling empire: nearly 100,000 apartment units; the combined weight of the recently merged Starwood and Marriott hotel portfolios; a pair of its own luxury hotel brands, 1 Hotels and Baccarat; a home-building company; a mortgage servicer...The list goes on.

That’s because when scouring the market for new opportunities, Sternlicht has persistently expanded into new lines of the property business without regard for the narrowing silos of his own experience—or for reporters’ word counts. A full dossier would run pages.

“We’re all about risk and reward,” Sternlicht said. “I’m agnostic about geography and position in the capital stack.”

Starwood Capital’s unrelenting growth has benefited in the last 10 years from synergies with Starwood Property Trust, Sternlicht’s mortgage-lending arm.

“It’s been great,” Sternlicht said of the symbiosis between the two enterprises. “We cross-pollinate a lot.”

Last May, Starwood closed its $1.3 billion acquisition of Milestone Apartments REIT, a deal that added 78 properties totaling 24,000 apartments in 16 different cities to Starwood’s portfolio. It was a megadeal that was able, at least temporarily, to focus Sternlicht’s all-encompassing interests on the residential sector.

“I’m happy to have the multifamily footprint [that we do],” Sternlicht said. “We’re well positioned to be a creative player in this market.”—Matt Grossman

14. Adam Neumann and Miguel McKelvey

Co-Founder and CEO; Co-Founder and Chief Culture Officer of WeWork

Last Year’s Rank: 69

WeWork might not consider itself a real estate company, but it’s hard not to consider the coworking juggernaut a player in the space. (Consider, too, that the company has ventured into co-living with WeLive and fitness with Rise by We.)

WeWork invites a lot of divided opinions among real estate professionals. Skeptics say the company is hopelessly overvalued (its market valuation is $20 billion, Bloomberg Business reported). But the believers look at the deals the company has struck, the property it has converted, the workforce it has attracted and the imitators it has spawned and see a real estate unicorn. Last year, Commercial Observer was more dubious, assigning the company the 69th spot on the list. This year we’re taking the leap.

In 2017 alone, Chelsea-based WeWork opened 90 buildings, bringing the company to 200 locations across 64 cities worldwide, a company spokesman said. The member count is expected to double this year to 400,000, the spokesman said. The company’s revenue last year was $900 million.

WeWork’s most notable real estate deal of 2017 was purchasing the 676,000-square-foot Lord & Taylor building at 424 Fifth Avenue along with Rhône Capital for $850 million. (The deal has not yet closed.)

And it’s becoming even more global. Last August, SoftBank Group and its Vision Fund announced a $3 billion investment in WeWork and $1.4 billion toward its Asian expansion. To that end, WeWork is investing $500 million in Southeast Asia and South Korea precipitated by an acquisition of Singapore-based coworking company Spacemob.

WeWork has also launched a Chinese arm with a $500 million investment from SoftBank Group and Hony Capital and partnered with SoftBank to bring its first location to Japan. Finally, this April, WeWork said it’s buying Chinese rival Naked Hub for a reported $400 million.

WeWork, which in 2017 launched operating system Powered by We, has been on a tear snapping up companies, including Meetup, a website for creating in-person events; The Wing, a women-only club and coworking space; Fieldlens, a mobile communication system for the construction industry; coding boot camp Flatiron School; and Unomy, an Israeli market intelligence provider.

Beyond offering coworking spaces, the company is looking to manage offices for institutional tenants. Big companies like Airbnb and Amazon have signed on. Last April, IBM inked a deal for all of WeWork’s 70,000 square feet in eight floors at 88 University Place just south of Union Square.—Lauren Elkies Schram

15. Mary Ann Tighe

CEO of the New York Tri-State Region for CBRE

Last Year’s Rank: 18

Mary Ann Tighe leased 4.7 million square feet of commercial space last year, but she feels like her biggest accomplishment was helping pass the Midtown East rezoning.

When she was chairman of the Real Estate Board of New York in 2012, she asked then-City Planning Chair Amanda Burden to consider upzoning the aging office neighborhood around Grand Central Terminal. Burden and the Bloomberg administration hammered out a plan for Midtown East, but the proposal ultimately died because the community boards and the City Council felt it didn’t include enough benefits for the neighborhood.

“I think there hadn’t been as much consensus built at the community level,” Tighe said. “As a result, [then-Councilman] Dan Garodnick couldn’t turn around to his fellow councilmembers and say, ‘This is what we need.’ ”

But the new Midtown East rezoning passed the City Council last August with flying colors. And it pushes developers to buy air rights from landmarked buildings in the area—including St. Patrick’s Cathedral, where Tighe sits on the board of trustees.

“Those of us at St. Patrick’s and St. Bart’s would prefer to hold on [to our air rights] because prices will continue to rise,” she said. “What this means for the not-for-profit [landmarks] is profound. We’ve endowed these buildings that need preservation and care forever.”

Tighe also won her ninth Ingenious Deal of the Year Award from REBNY, for arranging a 580,000-square-foot lease at 498 Seventh Avenue for 1199 SEIU’s health care workers union and its benefit funds. She was once again named CBRE’s top producer of the year for 2017. Her massive transactions included 21st Century Fox’s renewal and expansion for 784,000 square feet at 1211 Avenue of the Americas and Spotify’s 378,000-square-foot office lease at 4 World Trade Center.—Rebecca Baird-Remba

16. Owen Thomas and Douglas Linde

CEO; President of Boston Properties

Last Year’s Rank: 25

It has been a relatively quiet 12 months for the nation’s largest office landlord, which owns roughly 50 million square feet of real estate in its five core markets: Boston, New York, San Francisco, Washington, D.C., and Los Angeles. Nationally, Boston Properties is continuing to focus on existing projects like the 61-story, 1.4-million-square-foot Salesforce Tower in San Francisco, which at 1,070 feet in height is the tallest building west of Chicago; this past December, the company put the 97 percent–leased building partially in service.

In New York, the real estate investment trust is looking to compete with rivals like SL Green Realty Corp. and Vornado Realty Trust not through ambitious ground-up projects (like SL Green’s One Vanderbilt) but by reinvesting in its Midtown-heavy portfolio and upgrading assets like 601 Lexington Avenue and 399 Park Avenue.

The approach appears to be paying off with tenants like law firm Kirkland Ellis reportedly signing a 120,000-square-foot expansion at 601 Lexington Avenue to take its total footprint at the building to over half a million square feet. And in February, it was reported that NYU Langone Medical Center was close to taking all 200,000 square feet of office space at 159 East 53rd Street, the renovated atrium building at the base of 601 Lexington Avenue.

Elsewhere in Midtown, Boston Properties struck a massive $2.3 billion refinancing of its prized GM Building at 767 Fifth Avenue from a syndicate of banks led by Morgan Stanley, as Commercial Observer first reported last year and subsequently secured Estée Lauder to a 220,000-square-foot renewal at the property. And across the river in Brooklyn, the REIT is nearing completion on Dock72, the 675,000-square-foot ground-up office development in the Brooklyn Navy Yard that it is building in partnership with Rudin Management Company. But that doesn’t mean that loftier undertakings aren’t on the horizon.

Earlier this month, it emerged that Boston Properties has agreed to make a $500 million equity investment in the Moinian Group’s 3 Hudson Boulevard spec office tower in Hudson Yards—a move that would see the traditionally Midtown-focused REIT quite literally buy into the hype surrounding Manhattan’s Far West Side.—Rey Mashayekhi

17. Anthony Malkin

Chairman and CEO of Empire State Realty Trust

Last Year’s Rank: 13

Empire State Realty Trust continued its mission to upgrade its aged trophy properties and, as a result, last year nabbed “better and better tenants,” said Anthony Malkin.

Those included a 10,500-square-foot full-floor lease with MSG Sports & Entertainment at 111 West 33rd Street; Universal Music Group in 26,150 square feet at 250 West 57th Street; American Society of Composers, Authors and Publishers (ASCAP) in 85,400 square feet over four floors at 250 West 57th Street; and Priceline’s Agoda website expansion to a 27,000-square-foot, full-floor office space at the Empire State Building.

“There’s a huge amount of room for us where we continue to offer tremendous value for name-brand tenants,” Malkin said. “The millennial worker of today really wants the locations and the amenities and character of these buildings.”

All those deals contributed to the leasing of a record 1.3 million square feet in 2017. Malkin touted the company’s balance sheet. “We are approximately 20 percent net debt to enterprise value, and we have a $1.1 billion line, which can be expanded to $1.75 billion. We have no money drawn against it.”

The company CEO is “excited” about the first phase of the Empire State Building observatory opening after a $150 million redevelopment. The observatory revenue grew in 2017 1.8 percent to $127.1 million from $124.8 million a year prior.

Looking ahead, the company is “most interested in merging our company with other private or public companies,” Malkin said.

“Here’s the thing—when we went public [in 2013] we didn’t call it the Malkin REIT. Before we went public, it was Malkin Properties. We didn’t do it for a reason. This is not a family business. This is a public company.”—Lauren Elkies Schram

18. Jed Walentas

CEO of Two Trees Management

Last Year’s Rank: 21

The big news for Jed Walentas in 2017 was the continued redevelopment of the Domino Sugar Factory site in Williamsburg, including the opening last summer of the project’s first residential building, the 16-story, 522-unit, SHoP Architect-designed 325 Kent.

“As the first building in the Domino ensemble of buildings, it was really important that we set a high-quality standard with the architecture, the finishes, the amenities, the retail and also how we interact with the neighborhood,” Walentas said. “With big projects like this, it’s important that the first phase goes incredibly well, and I’m infinitely pleased. We really met all of our objectives there.”

Two Trees also spent considerable time in 2017 drawing prestigious retail outlets to its Brooklyn properties, including the openings of the Apple store and Whole Foods at 300 Ashland Place in Fort Greene, the women-only club and coworking space The Wing at 1 Main Street in Dumbo and a new, as-yet-unnamed restaurant from Lilia chef Missy Robbins, which is scheduled to open this summer at 325 Kent.

The year ahead will see continued development of Domino’s 260 Kent Avenue, a COOKFOX-designed, 462,000-square-foot, 42-story mixed-use building that will include 330 rental apartments, 150,000 square feet of office space and 13,000 square feet of retail. (They also scooped up a 400,000-square-foot leasehold in Gowanus, which currently houses a Lowe’s and offers 800,000 buildable square feet.)

The Domino project will also see the opening this summer of the six-acre Domino Park. Designed by High Line architect James Corner Field Operations, the park will include bocce courts, a dog run, a skate park, a volleyball court, a Danny Meyer taco and margarita stand and a children’s play area, bringing a quarter mile of much-needed open space to Williamsburg.

“We’ve built one of the great parks in New York City,” Walentas said. “To be able to add six acres of open space to the community and the city, with this quality, this will possibly be my proudest professional moment. I couldn’t be more excited about it.”—Larry Getlen

19. Jeff Sutton

Founder and President of Wharton Properties

Last Year’s Rank: 10

Retail king Jeff Sutton is branching out into the residential world.

After decades of amassing some of Manhattan’s priciest street retail, Sutton’s Wharton Properties is co-developing a 300-unit affordable mixed-use project with BRP Companies at 90-02 168th Street in Jamaica. The developer’s first foray into Queens will include 70,000 square feet of retail spread across three buildings, and 10 percent of the units will be set aside for artists at affordable prices.

The residential division of the company, led by Sutton’s son Joseph, also acquired several small apartment buildings throughout the West Village, Washington Heights and Brooklyn’s Williamsburg and Bushwick last year.

Up in Harlem, Sutton is focused on development on West 125th Street. He opened his 160,000-square-foot retail project at 100 West 125th Street, which hosts the neighborhood’s first Whole Foods, last July. He’s also building a two-story, 23,000-square-foot retail property a couple blocks west at 288 St. Nicholas Avenue, on the corner of West 125th Street.

The mysterious and somewhat superstitious Brooklyn native, who declined to comment, also did a handful of smaller deals in his home borough, including the purchase of a single-story commercial building at 2250 Nostrand Avenue in Flatbush for $14.6 million last month.

His firm also completed $1.2 billion in refinancings for seven properties. In the largest of those transactions, Wharton and co-owner SL Green Realty Corp. refinanced the retail space at 650 Fifth Avenue with a $225 million loan from German lender Aareal Bank last October. Nike’s new flagship store in the building is under construction and set to open later this year. And last month, The Real Deal reported that Wharton is taking over SL Green’s $100 million investment in a pair of 11-story commercial buildings at 530-536 Broadway in Soho.—Rebecca Baird-Remba

20. Gary Barnett

Founder and President of Extell Development Company

Last Year’s Rank: 16

Manhattan native Gary Barnett has brought a lot of things to New York City: diamond money, technology CEO Michael Dell and now a Nordstrom. Barnett is known for quality buildings, among them the 60-story Orion at 350 West 42nd Street and the 90-story One57, where Dell was just identified as the buyer of a $100.5 million penthouse, Gotham’s priciest crib.

But Barnett is also known for his patience, assembling parcels like a collector who can wait years for a fill-in piece he covets. Earlier this year he bought 1637 First Avenue from the Hakim Organization for $16 million, acquiring air rights that will allow him to build a higher tower at 350 East 86th Street. Further south on First Avenue, near East 79th Street, Barnett is pulling together several parcels as well.

“These two projects are still in the early stages,” noted Barnett, who said that Extell is looking into mixed-use developments for both.

And in the Two Bridges area of the Lower East Side, Extell is erecting One Manhattan Square, where closings are slated for late 2018.

Barnett can be patient waiting for money, too. With volatile global markets, the financing climate is getting trickier, but he said Extell has “no trouble with financing so there is no need to consider going public.” One of 2017’s achievements was to bring in more than a billion dollars in financing for Central Park Tower, a 95-story space needle to be built at 217 West 57th Street.

In Brooklyn, he’s working on Brooklyn Point, a 68-story tower that will include more than 40,000 square feet of indoor and outdoor amenities. The project, Barnett said, “is ushering in a new era of luxury living and high design within one of Brooklyn’s most exciting burgeoning neighborhoods.”

His vision is that “in 10 years, Downtown Brooklyn will be similar to Downtown Manhattan, only with more residential than office.”—Alison Rogers

21. Blake Hutcheson and Andrew Trickett

President and CEO; Senior Managing Director of Investments at Oxford Properties Group

Last Year’s Rank: 24

Oxford Properties Group is a gigantic real estate investor, deploying the assets of OMERS, one of Canada’s largest pension funds, around the globe. Trickett, a Canadian who is based in New York City, spearheads the firm’s activity here.

The megaproject is Oxford’s partnership with the Related Companies in the development of Hudson Yards, the Far West Side parcel that Oxford notes is “the largest undeveloped single piece of property in Manhattan.”

In addition to the usual office buildings, condominiums, restaurants and shops, the firms are bringing in a medical clinic as an amenity. Announced in March, the 18,000-square-foot health center on the second floor of 55 Hudson Yards, at 11th Avenue and 34th Street, is being developed in partnership with the Mount Sinai Health System.

Further South, in January, Oxford, in partnership with the Canada Pension Plan Investment Board, acquired a part of the St. John’s Terminal site, built as the terminus of the High Line in its rail freight days. The two companies bought the portion of the site that is south of Houston Street, paying $700 million to sellers Westbrook Partners and Atlas Capital Group. Oxford will own a 52.5 percent interest in the project, and manage the development on behalf of the partnership, according to a CPPIB statement. The 3.25-acre site in the Midtown South submarket includes 600 square feet of Hudson River frontage.

Oxford Properties, since it is working in the service of retirees, has a long time horizon that can work to its advantage, but creativity counts, too. As Blake Hutcheson, the firm’s President and CEO said at a Columbia University gala honoring him last year, “By the way, there aren’t always answers. So why not throw spaghetti against the wall and try sometimes? Because we have the confidence to know that nobody else has a better idea.”—Alison Rogers

CORRECTION: Through an editing error text from Hutcheson and Trickett's 2017 Power 100 entry appeared in the print edition of Commercial Observer. This has been corrected online. CO apologizes for the error.

22. Christopher Kahl, Matt Bronfman and Michael Phillips

Chairman; CEO; President of Jamestown

Last Year’s Rank: 28

Jamestown Properties made a splash last month by selling Chelsea Market at 75 Ninth Avenue to Google for $2.4 billion.

The all-cash deal ranks as the third-largest sale of an individual building in New York City history.

The national real estate investment firm has also been busy at Industry City, its 5.3-million-square-foot industrial and office complex in Sunset Park, Brooklyn. (It owns the property with Belvedere Capital, Angelo Gordon & Co., Cammeby’s International and FBE Limited .) It refinanced the development with a $647 million loan and leased 550,000 square feet to new commercial tenants there last year. And it aims to grow: Jamestown applied for a massive rezoning last October to build 3.3 million square feet of new commercial space at Industry City.

The firm also purchased a 280,000-square-foot office property at 260 East 161st Street in the South Bronx for $115 million. The 10-story building is home to the Legal Aid Society and Montefiore Medical Center, as well as Walgreens, Starbucks and Chipotle.

In Manhattan, Jamestown secured city approvals for a new observation deck, Times Square history museum and visitor center at 1 Times Square, which it co-owns with Sherwood Equities. Work on the museum is set to begin later this year. The 25-story building was originally built in 1904 to serve as the headquarters of The New York Times, but in recent years the mostly vacant property is known for its massive billboards and for hosting the New Year’s Eve ball drop every year.

In terms of both the market and their business, Phillips felt that “there was less transaction volume in 2017 than 2016. I think it’s harder to buy things, and there were fewer things for sale. It’s been slow on that front. But I think we had a good year last year.”—Rebecca Baird-Remba

23. Peter Riguardi

Chairman and President of the Tri-State Region at JLL

Last Year’s Rank: 33

Any discussion of JLL’s Peter Riguardi and his 2017 must begin with a deal that was struck in 2016 but didn’t close until May of the following year, and that was the BlackRock deal.

Riguardi and his team brought the world’s largest asset manager to the Far West Side, landing it a home as the anchor tenant for Related Companies and Oxford Property Group’s 50 Hudson Yards. BlackRock signed a 20-year lease and the company agreed to pay $1.25 billion for 850,000 square feet.

If ever there was a moment to drop the mic, the BlackRock deal is it. However, Riguardi and his team have kept going, hitting the Far West Side, Midtown and Downtown Manhattan with additional showstoppers.

At the beginning of the year, Spotify, the music streaming service, grabbed a hefty 378,000 square feet at Silverstein Properties’ 4 World Trade Center thanks to the efforts of Riguardi and his team (consisting of Ken Siegel, Alexander Chudnoff and James Wenk). But midway through 2017 Spotify decided to take another 100,000 square feet.

A few blocks away Riguardi and his crew have been doing big deals at Fosun International’s 28 Liberty Street, including a 345,000-square-foot lease with the New York State Attorney General’s office that closed in January 2017.

Riguardi represented J.P. Morgan Chase when it took a 15-year, 305,000-square-foot lease at Brookfield Property Partners’ 5 Manhattan West on the Far West Side to house the bank’s expansive tech team.

And an even bigger monster lease was HSBC’s 548,000-square-foot renewal at PBC USA’s Midtown building at 452 Fifth Avenue.

O.K., now you can drop the mic.—Max Gross

24. Darcy Stacom and William Shanahan

Chairmen of NYC Capital Markets at CBRE

Last Year’s Rank: 23

“We had a really good success ratio last year,” Darcy Stacom said. “Last year, we were very successful in keeping the market active and getting the major transactions done.”

Highlights include the closing of 245 Park Avenue last May. HNA Group paid $2.23 billion for the building between East 46th and East 47th Streets from Brookfield Property Partners and the New York State Teachers’ Retirement System, one of the highest prices ever paid for a Manhattan office tower. Stacom and Shanahan represented the sellers.

“We brought that to market in the beginning of the year when people were uncertain how the market would act,” Stacom said. “We had a strong bidding war for that property.”

They represented NY REIT in the sale of a 48.7 percent interest in Worldwide Plaza at 825 Eighth Avenue to SL Green and RXR Realty for $840.1 million, Shanahan said. And for TH Real Estate, an affiliate of financial planning firm Nuveen, and Future Fund of Australia, they sold 685 Third Avenue to Unizo Holdings for $467.5 million.

“We’ve seen lost of strength across most property types,” Stacom said, “and much depth of bidders.”

Stacom said that if you remove deals of $50 million and below, she and Shanahan “had the No. 1 market share in the investment sales market.”

The pair is off to a very strong start this year. For example, they represented Google in its purchase of the Chelsea Market building—the former Nabisco factory at 75 Ninth Avenue—from Jamestown for $2.4 billion in March.

And they sold Aalto57—a 163-unit mixed-use property at 1065 Second Avenue—to Oxford Properties Group for $277.5 million on behalf of its developers, World Wide Group, J.P. Morgan Chase and Rose Associates, in what was the highest price ever paid per unit for a residential leasehold ($1.63 million per unit).—Lauren Elkies Schram

25. Masayoshi Son

Chairman and CEO of SoftBank Group

Last Year’s Rank: 30

In February 2017, Masayoshi Son became a powerful U.S. real estate player with SoftBank Group’s announcement of a $3.3 billion acquisition of Fortress Investment Group. (The deal closed in December.)

But apparently, that was just the beginning of power moves in the real estate industry for Japan’s richest individual, whose wealth recently clocked in at over $21 billion, according to Forbes. Last year, SoftBank invested nearly $6 billion in real estate companies via its $100 billion Vision Fund.

SoftBank, a mobile telecom and investment firm, and coworking giant WeWork joined forces in July 2017 when the companies announced a 50-50 partnership—WeWork Japan—so the Chelsea-based company could expand into the Land of the Rising Sun.

But then just a month later in August, SoftBank announced it invested $4.4 billion in WeWork, $1.4 billion of which will be used to expand the coworking provider’s efforts throughout Asia with three subsidiary companies: WeWork China, WeWork Japan and WeWork Pacific. The remaining $3 billion is for the stateside parent company. (This February, WeWork opened its first location in Japan in Tokyo’s Roppongi district. And it opened three more in Tokyo soon thereafter.)

And SoftBank poured $450 million into residential brokerage Compass in December 2017 and just two weeks later led a $120 million investment in Lemonade, a startup that provides insurance for renters and homeowners. And this January, Softbank led an $865 million round of funding in construction startup Katerra, which designs and erects buildings. And there’s a good chance that Son is not done.—Liam La Guerre

26. MaryAnne Gilmartin, Robert Lapidus and David Levinson

Co-Founder and CEO; Co-Founders of L&L MAG

Last Year’s Rank: 41

MaryAnne Gilmartin shook up the real estate world in January when she departed her longtime perch at Forest City Realty Trust for a new, joint venture called L&L MAG with L&L Holdings’ David Levinson and Robert Lapidus.

“For the last year, we worked on putting a transaction together that will allow us to build a development company and platform here in New York like no other,” said Gilmartin, who was ranked No. 67 last year. L&L MAG will aim to develop residential, hotel and office properties in New York City and elsewhere, and it will keep its eye out for opportunities like distressed properties and public-private partnerships.

In the final year of her 23 years at Forest City, Gilmartin helped restructure Pacific Park (formerly Atlantic Yards) in Prospect Heights, Brooklyn. Partner Greenland USA now controls 95 percent of the 22-acre megaproject, and Forest City has just 5 percent.

She was also involved in helping find a buyer for 461 Dean Street within Pacific Park, the 32-story modular tower that Forest City sold to Principal Global Investors for $156 million last month. It was a fitting end to her time at the company, after she spent more than a decade pushing Atlantic Yards through a byzantine public approval process.

Outside of her real estate work, Gilmartin helped craft a plan to close Rikers Island as part of the Lippman Commission, headed by Jonathan Lippmann, a former chief judge of the State of New York.

L&L had its own bang-up year, sealing huge leasing deals with Mastercard at 150 Fifth Avenue and J.P. Morgan Chase at 390 Madison Avenue. The firm is wrapping up work on the redevelopment of the 32-story 390 Madison Avenue, and it’s building a full-block, 670,000-square-foot office tower designed by Norman Foster at 425 Park Avenue. The 18-year-old outfit also formed a $500 million joint venture with J.P. Morgan Chase Asset Management with the aim of acquiring and developing $4 billion worth of property.—Rebecca Baird-Remba

27. Andrew Cuomo

Governor of New York

Last Year’s Rank: 9

Gov. Andrew Cuomo has been slowly drifting leftward with an eye toward a 2020 presidential run, but he had to kick it up another level in response to a challenge from actress Cynthia Nixon, who hopes to unseat him in the Democratic primary for the fall governor’s race.

Recently, Cuomo came out in favor of repealing vacancy decontrol, a policy that allows landlords to charge market-rate rents for a stabilized apartment if the stabilized tenants move out and the unit’s legal rent exceeds $2,500 a month. The policy position—part of a larger progressive agenda set to be unveiled later this month—is also an effort to try and force rogue Democrat State Senator Simcha Felder to caucus with the Democrats rather than the Republicans in the State Senate, the New York Daily News reported. Otherwise, the Brooklyn Dem would be blamed for blocking a liberal agenda that could finally be passed if, for the first time in many years, Democrats control New York’s senate.

While scrapping vacancy decontrol is probably a pipe dream, Cuomo has made progress on some housing policies over the past year. In April 2017, he signed into law the revamped 421a tax exemption program (called Affordable Housing New York), which requires rental developers to set aside at least a quarter of their units as affordable housing in exchange for a property tax break.

The bill also came equipped with wage requirements for larger projects in Manhattan, Brooklyn and Queens, in a nod to demands from construction labor unions. Cuomo also pushed forward with his $20 billion plan to create or preserve more than 100,000 units of affordable housing and 6,000 units of supportive housing statewide.

In another act of political theater, Cuomo recently visited various New York City Housing Authority developments, pledged $250 million to the cash-strapped agency and declared a state of emergency. He also promised to appoint an independent monitor to oversee how NYCHA spends that $250 million, along with an additional $350 million the state has committed since 2015 but not yet released.—Rebecca Baird-Remba

28. Sam Zell and David Neithercut

Chairman; President and CEO of Equity Residential

Last Year’s Rank: 17

It’s hard to believe that the country’s ninth-largest apartment manager and third-largest apartment owner—Equity Residential—was formed in Ann Arbor, Mich., first managing student housing.

Such is the case, according to the National Multifamily Housing Council. Today, the Chicago-based real estate investment trust owns 305 properties with 78,611 apartments across the country, over 10,000 of which are in New York City, according to its annual earnings report released in February.

And thanks to its 96 percent portfolio-wide occupancy level its rental revenues and average rental rates last year rose 2.2 and 2.3 percent, respectively. Those figures are down slightly from 2016 as its rental revenues and average rents each climbed 3.7 percent that year.

“In the New York market, elevated deliveries of new luxury supply both in established residential areas and newer residential areas like Long Island City [Queens] are having an impact on our ability to raise rents,” the REIT wrote in its annual earnings report.

In New York, Equity’s revenues for its currently held properties increased 0.1 percent in 2017. The company wrote in its February annual earnings report that its primary goal in 2017 was to focus on retaining existing residents in order to drive renewal rate growth, which came in at 4.6 percent for 2017. The firm also said it expects to see a slight improvement in the rate of new leases obtained in 2018, but it’s also anticipating lower occupancy and renewal rates.

For 2018, it echoed that same goal, and although the company pledged to continue to seek out quality opportunities for acquisitions, Zell may think otherwise.

When Bloomberg Daybreak: Americas asked Zell in November 2017 what he liked in real estate, he replied, “Not a lot. I’m a seller rather than a buyer. It’s a lot harder [to sell a commercial property now] than two years ago.”—Mack Burke

29. Douglas Harmon and Adam Spies

Co-Chairmen of Capital Markets at Cushman & Wakefield

Last Year’s Rank: 27

It has been a year and a half since the dynamic duo of Douglas Harmon and Adam Spies left Eastdil Secured for Cushman & Wakefield. The pair, and its team, has been going strong.

Harmon and Spies are brokering the sale of Pfizer’s Midtown office buildings on East 42nd Street to David Werner for $360 million. The pharmaceutical giant is selling 219 and 235 West 42nd Street as it finalizes a new lease (negotiated by other C&W brokers) at Tishman Speyer’s tower at 66 Hudson Boulevard called The Spiral.

In March they worked on the highly publicized deal between Google and Jamestown that is one for the books. Google, a unit of Alphabet Inc., purchased the 1.2-million-square-foot home to Chelsea Market from Jamestown for $2.4 billion—the third-highest price ever paid in a single-building transaction in New York City. Spies and Harmon were on Jamestown’s side of the deal.

The Spies-Harmon team negotiated Blackstone Group’s purchase of a 49 percent stake in One Liberty Plaza from Brookfield Property Partners, which valued the famous black steel tower at slightly over $1.5 billion.

Harmon and Spies were charged by SL Green Realty Corp., the city’s largest commercial landlord, to market a 43 percent stake in 1515 Broadway in Times Square. They successfully brokered the sale to Allianz Real Estate in a deal valued at $1.95 billion.

Among other transactions, the pair brokered the sale of the 1.6-million-square-foot former St. John’s Terminal at 550 Washington Street for $700 million between Westbrook Partners and Atlas Capital, the sellers, and Oxford Properties Group, the buyer. Oxford, with Harmon and Spies as negotiators, later brought on Canada Pension Plan as an equity partner for the office and retail portion of the mixed-use complex. All in, the implied development cost of the project is $1.4 billion.

Finally, the C&W team is representing Starrett City Associates in the sale of the Brooklyn rental complex Starrett City—the largest federally subsidized housing complex in the U.S.—for $850 million from a group of owners. That deal is slated to close soon.—Lauren Elkies Schram

30. Jimmy Kuhn, Barry Gosin and David Falk

President; CEO; President of New York Tri-State Region at Newmark Knight Frank

Last Year’s Rank: 26

Twenty-seventeen was a year of change for Newmark Knight Frank, which dropped the “Grubb” from its name to return to its pre-2012 Newmark Knight Frank moniker.

While NKF generated 18 percent revenue growth in 2017, leading to a record $1.6 billion in revenue for the company, its December IPO was a mixed bag. Initially hoping to sell 30 million shares at between $19 and $22 per share, the company shifted expectations in the days prior to the IPO, instead selling 20 million shares at $14 a stock.

The company also took a hit thanks to Hurricanes Harvey and Irma, as sister company Berkeley Point Capital, owned by Newmark parent BGC Partners, saw a 30.5 percent drop in mortgage revenue gains during the third quarter, which company executives attributed to a hurricane-related overall decline in multifamily lending, according to The Real Deal.

But the positive news was very positive. The company made several key acquisitions, including the assets of San Francisco-based real estate finance firm Regency Capital Partners; taking on Spring11, a New-York based commercial real estate due diligence, consulting and advisory service firm; six former offices of the valuations network Integra Realty Resources; and the biggest acquisition in the company’s history, Berkeley Point Financial for $875 million.

NKF also, with The Sapir Organization, completed a $70 million Series B round of financing for flexible workspace provider Knotel.

The company made numerous key hires in 2017, including Craig Robinson as CEO of global corporate services; Helene Jacobson and Stephen DuPlantis as executive vice presidents and co-leads of national valuation and advisory; and Dustin Stolly as vice chairman and co-head of capital markets debt and structured finance (who made CO’s list of the 50 most powerful people in commercial real estate finance).

And NFK’s leasing and sales were strong nationwide. NKF took home third place in Real Estate Board of New York’s Ingenious Deal of the Year Awards, for Geoffrey Newman’s securing of a series of complex air rights deals so that Bruce Eichner’s Continuum Company could develop a 64-story condominium tower at 45 East 22nd Street.—Larry Getlen

31. Ron Moelis, Lisa Gomez and David Dishy

CEO; COO; President of Development and Acquisitions at L+M Development Partners

Last Year’s Rank: 45

Few real estate firms in New York are as synonymous with affordable housing and culture as L+M Development Partners.

Founding Partner Ron Moelis and his team have had their hands in some of the most consequential projects in the de Blasio era, in which the city plans to create or preserve 300,000 units of below-market-rate housing over the next decade.

The sites that catch the company’s eye often have a partnership with an existing institution, such as a medical center or an arts organization that expands its footprint while incorporating hundreds of units of new housing stock.

That’s what drew them to working with St. Barnabas, a hospital in the Belmont section of the Bronx, to convert two vacant parcels of adjacent land to 314 units of housing with a new medical clinic onsite. The clinic includes a teaching kitchen that will help patients learn about nutrition and how they can live a healthy lifestyle.

“In a way we think of it as a demonstration project,” Lisa Gomez said. “This is in a very poor neighborhood with high emergency needs, and we hope safe and secure housing can decrease emergency room usage.”

L+M is also working with the Universal Hip Hop Museum on one of the largest city-owned parcels in the South Bronx to build 1,045 units of housing, a new multiplex theater, park space and a permanent home for the museum.

And the company is helping the National Black Theater redevelop its home at 2031 Fifth Avenue between East 125th and East 126th Streets into a state-of-the-art venue with a 30,000-square-foot theater space below 240 units of housing.

“We want to get to the intersection of where people live, work and play as an underpinning of urban development,” Gomez said.—Aaron Short

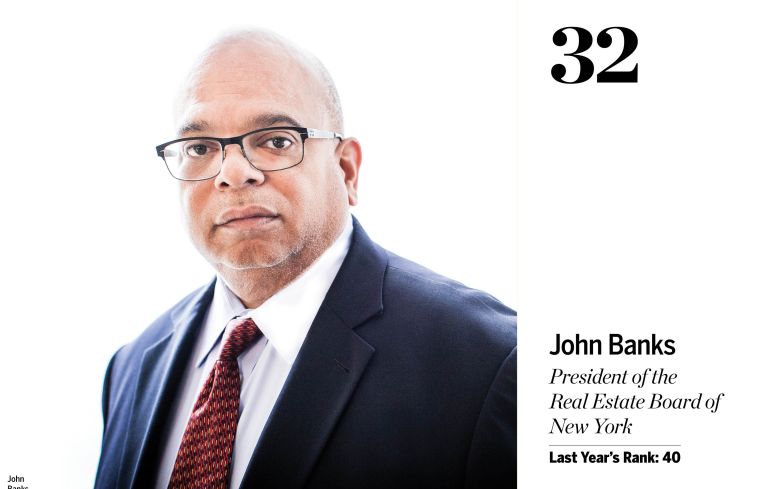

32. John Banks

President of the Real Estate Board of New York

Last Year’s Rank: 40

The Real Estate Board of New York backed two efforts last year that were game-changers for the real estate industry.

One was the passage of Affordable New York, the replacement program for the expired 421a tax break—which Commercial Observer covered in its write-up on Banks in last year’s Power 100.The other was the rollout of REBNY’s Residential Listing Service (RLS). According to REBNY, more than 100 consumer-facing websites are receiving a listing feed from the RLS, including Homes.com and The New York Times.

John Banks said that 95 percent of REBNY members’ listings are on the RLS, far above the 80 percent it was using as the benchmark for success.

REBNY, which has a new chairman in Rudin Management Company CEO William Rudin, has been upping its tech game. Last March the 122-year-old organization launched a tech committee, and as CO reported this month, REBNY is hosting a global proptech contest—the organization’s second real estate technology contest, following its “hackathon” event last year.

In 2017, REBNY got heavily involved in the Building Skills New York program, which makes entry-level job placements for city residents on construction sites. Working with other development and affordable housing partners, Building Skills hired a new executive director, Banks became the organization’s chairman, and the program increased the number of job placements it made from 41 in 2016 to 125 in 2017. Banks noted that the increase came even “in an environment when there’s 4 percent unemployment in New York City.” The goal for this year is 250 placements, he added.

REBNY also turned over 35 boxes of archived historical materials to the LaGuardia and Wagner Archives at the City University of New York’s LaGuardia Community College in Long Island City, Queens, last September.

Banks said that is an “example of something the public might not know, but it’s a big deal for us to preserve the records maintained since [REBNY’s] inception.”—Lauren Elkies Schram

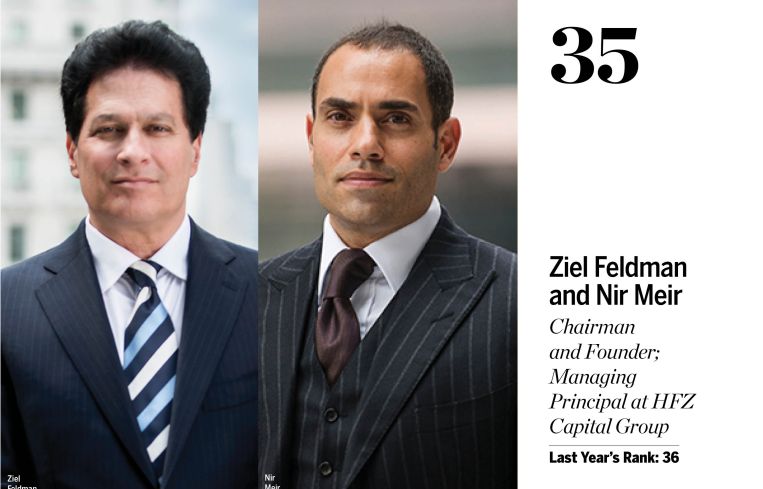

33. Brett White, John Santora and Bruce Mosler

CEO and Chairman; Vice Chairman and Tri-State Region President; Chairman of Global Brokerage at Cushman & Wakefield

Last Year’s Rank: 22

Cushman & Wakefield, which celebrated its 100th birthday last year, has grown to more than 45,000 employees in more than 70 countries and is currently led by CEO and Chairman Brett White.

John Santora oversees the tri-state region as president and vice chairman, and Chairman of Global Brokerage Bruce Mosler (who was the CEO and president of C&W until 2010) is a leading force in many of the company’s top leasing deals.

Together, the three men are keeping the C&W machine purring. Earlier this month, C&W’s brokerage team handled an 800,000-square-foot lease for Pfizer’s new headquarters at Tishman Speyer’s 2.8-million-square-foot 66 Hudson Boulevard office development in Hudson Yards.

Concurrently, its capital markets team sold Pfizer’s Midtown headquarters buildings at 219 and 235 East 42nd Street for $360 million to real estate investor David Werner.

“The way our teams are [working] together, that’s what makes us proud,” Santora said. In March, C&W completed the $2.4 billion sale of Chelsea Market at 75 Ninth Avenue to Google. The company also handled the sale of a 43 percent stake in 1515 Broadway, valued at $838.5 million, to Allianz Real Estate in November 2017 as well as the $742.4 million sale of a 49 percent interest in One Liberty Plaza to Blackstone Group a month later.

In terms of leasing, Mosler’s team was behind EY’s lease at Brookfield Property Partners’ 1 Manhattan West, which now totals 707,900 square feet after the tenant expanded its initial footprint. And other C&W brokers (together with a team from CBRE) worked on 1199SEIU Healthcare Workers East and Retirement Fund’s 580,000-square-foot lease at 498 Seventh Avenue, which earned the brokerages first place in the Real Estate Board of New York’s Ingenious Deal of the Year Awards.

“[Last year was an] incredible year from a leasing perspective. It was one of the biggest in recent years,” Santora said. “These were all monster deals in any given year. [And] we saw at the second half of [2017], our capital markets team really started to ramp up.”

At some point in the future, C&W will become a public company. In preparation for that, Santora has brought in a lot of talent in the past few years.

But the early part of 2018 has been rough from a personnel standpoint with a number of noteworthy departures. James Nelson, a vice chairman in the capital markets division, jumped ship for Avison Young in January while the company parted ways with Executive Vice Chairman Peter Hennessy (under acrimonious terms) in March. Most recently, Paul Massey, the president of New York investment sales and former mayoral candidate, resigned in April.—Liam La Guerre

34. Yoel Goldman

Founder of All Year Management

Last Year’s Rank: New

You may not be able to find a photo of Yoel Goldman, a member of Brooklyn’s insular Satmar Hasidic Jewish community and a notoriously private man who shies away from any press whatsoever. But that doesn’t mean you can’t see his work; you only have to look as far as Williamsburg, Brooklyn’s ever-developing skyline, where you’ll find the ivory-hued, 22-story William Vale hotel, towering over all that surrounds it.