Sunday Summary: It’s a Great Day For Life Sciences

By The Editors October 16, 2022 9:00 am

reprints

In late August, we started to feel that maybe — just maybe — this whole inflation thing was under control. It was just possible that we got past the worst of it in one piece.

Nope.

The Consumer Price Index report came out on Thursday (people: never release these things on a date with a 13 in it!) and it looks like prices exploded again in September.

That means that the additional rate hikes that real estate professionals fear are almost certain when the Fed next meets in November. And with it a lot more strangeness. (Did you know that office leasing in Brooklyn dipped 30 percent last quarter and rents … went up? Yeah, we’re scratching our heads, too.)

All that being said, there was still activity this week. Loads of it.

Vanbarton Group just sold the former AIG headquarters, 175 Water Street, for $252 million to 99c LLC in an all-cash deal.

An entity tied to the San Francisco-based Chartres Lodging Group purchased the Theater District hotel The Muse at 130 West 46th Street for $49.5 million from asset manager Barings.

And there were lots of leases: The Jewish Board of Family and Children’s Services took 12,230 square feet at 463 Seventh Avenue; at 1441 Broadway the Berkshire Hathaway-owned HH Brown Shoe Company renewed its 22,516 square foot lease and advertising firm Spot and Company of Manhattan took 11,033 square feet; the legendary Chicago improv outfit, Second City, announced plans to open its first-ever New York City location at 64 North Ninth Street in Williamsburg next summer; Timberland will feel anything but snug in its new 5,600-square-foot location at 550 Broadway in SoHo; and a block away GFP Real Estate secured two new tenants — Chaloner Associates and Levine/Leavitt — at 594 Broadway.

There was even some lending: Chess Builders secured $135 million of construction financing from Valley National Bank to build a 218-unit multifamily development at 218 Front Street in Brooklyn.

All of which points to a simple truth: As bad as things might look to some, there are pretty good opportunities if one is savvy about it.

For those looking for interesting ways to structure deals, there is always the ground lease.

“If there’s a recession, liquidity will be even more constrained, which will mean real estate investors will have to be that much more efficient in order to navigate the market,” Safehold’s Jay Sugarman told Commercial Observer. “That only strengthens the value proposition for modern, well-structured ground leases.”

And then there’s simple, old-fashioned good management practices.

“We definitely target underperforming assets; not necessarily sectors or asset classes,” Angelo Gordon’s Adam Schwartz told CO in our cover story last week. “We’re looking to buy assets from people who lack the capital or the expertise or the time to maximize the value. We’re not trying to predict the future. Rather, we’re trying to be good managers of the real estate, good executors. Even better if we can do both.”

That’s pretty sage advice, but we would offer one caveat. There are sectors and asset classes that are doing pretty well.

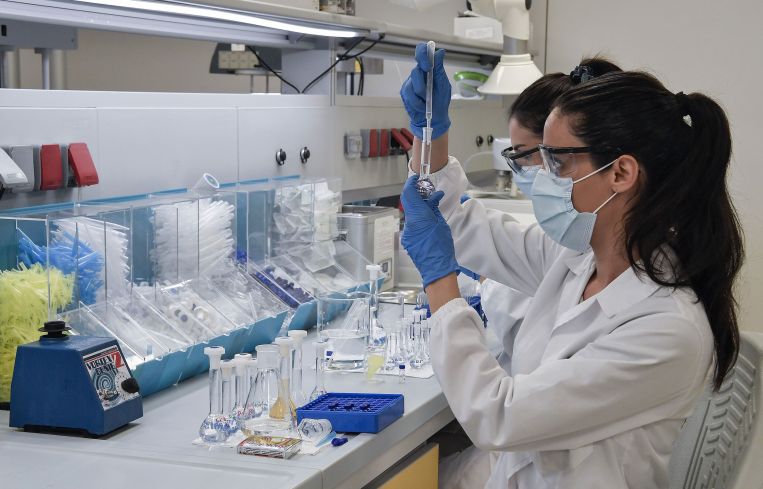

Life sciences seems to never have been healthier.

Money tight? Not if you’re Gemdale USA which secured a $575 million construction loan from Invesco Real Estate for its 15.7-acre life sciences and technology campus north of San Diego called Aperture Del Mar.

Indeed, job availability in the sector is double what it was pre-pandemic, as per a report from Cushman & Wakefield, and there’s a 19.9 million-square-foot pipeline of life sciences construction scheduled for 2023.

To wit, on Oct. 13 Gov. Kathy Hochul and Mayor Eric Adams announced a 5-acre, 1.5 million-square-foot life sciences development to be known as Science Park and Research Campus Kips Bay, or SPARC Kips Bay, along First Avenue and East 25th Street, that will include space for the City University of New York’s nursing school, the New York City Department of Education and a forensic pathology center run by NYC Health + Hospitals.

Don’t get cocky, NYC

If you thought 1.5 million square feet sounded big, the day before Gov. Hochul’s announcement the North Bay Village Council voted to greenlight the Ansin family’s 7.3 million-square-foot development plan on Treasure Island’s 79th Street Causeway just outside of Miami Beach. The development will constitute 1,936 residential units, 200,000 square feet of office space, 670,000 square feet of additional commercial space, a hotel, a marina, and 84,366 square feet of public space. (Why are you trying to make New York look bad, Florida? You also got a new Contessa restaurant announced last week from the Carbone guys. Oh, and did we mention that the Fontainebleau is adding a 50,000-square-foot event venue?)

And, while it wasn’t exactly a new deal, per se, Washington, D.C., showed a little glam this week, too, with the $3.6 billion development known as The Wharf finally finishing construction five years after its grand opening.

Plus, D.C. got some of the runoff glam from one of NYC’s most prestigious law firms. (Check that — one of the world’s most prestigious law firms.) Cravath, Swaine & Moore signed a 21,065-square-foot lease at 1601 K Street NW for its first Washington office.

And then there was the big move that reverberates everywhere, like when one major real estate company decides to acquire a massive piece of one of its peers. That happened last week when Simon Property Group purchased a 50 percent stake in Jamestown.

No word yet on what Simon is paying, but with Jamestown’s assets under management currently valued at $13 billion, let the speculation run rampant!

Don’t forget LA!

Los Angeles started the week with a pretty big shock wave, when City Council President Nury Martinez was caught on tape disparaging fellow council members like Mike Bonin, who is white but who has a Black son, saying in Spanish that his child was “like a monkey” and that Bonin used his son as an “accessory.” Fellow council member Kevin De León derided Bonin as the City Council’s “fourth Black member” and compared his son to a luxury handbag. The audio recording led to Nury’s resignation on Thursday.

But even amid that firestorm it shouldn’t distract from the other major news hitting the City of Angels.

Hackman Capital Partners, for one, just closed a whopping $1.6 billion fund to acquire, develop and manage studio space — although Hackman has set its sights not just in L.A. but globally, with deals like the Kaufman Astoria Studios in New York, and the Eastbrook & The Wharf Studios in London.

And in the world of leasing, Quest Diagnostics just completed a doozy when it renewed its 199,535-square-foot office lease at Kennedy Wilson’s 8401 and 8403 Fallbrook Avenue in West Hills.

Have a good weekend!