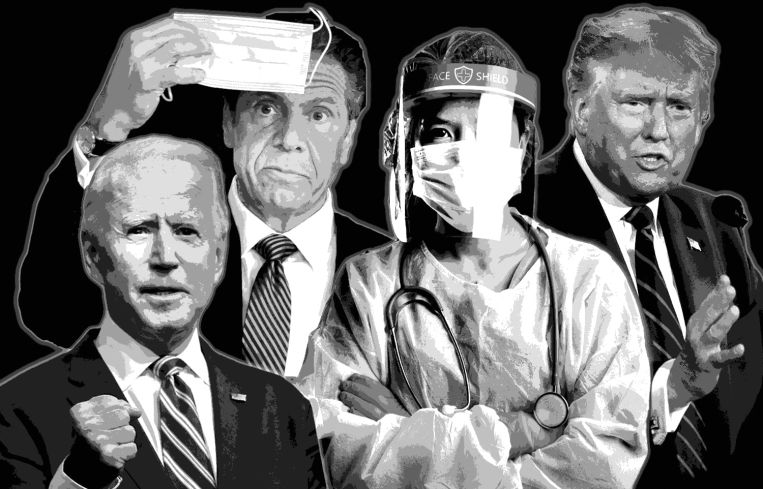

Making Sense of a Year When Everything Went Wrong

Roughly a year ago, as we were leaving behind a roller coaster-like decade of ups and downs, Commercial Observer surveyed the landscape and felt a healthy dollop of optimism about the future. (More or less.)

Apartments were selling on Billionaires’ Row for nearly a quarter of a billion dollars. (Well, one unit, anyway.) Hudson Yards saw a splashy opening, and Facebook, the most coveted tech tenant in the world (well, one of ‘em, anyway), inked a million-and-a-half-square-foot deal there.

There were problems, certainly. Retail continued its slow, steady decline at the hands of e-commerce. Amazon was wooed into promising a second headquarters in Long Island City, and then abandoned its plans in the face of public backlash and political scrutiny. And the biggest tenant in the city (WeWork) watched as its billions of dollars in valuation evaporated with a rapidity that would send many a CEO wading into the East River.

These issues seem very quaint today.

No living, sentient human being could look at 2020 as anything other than a disaster. (We would use saltier language, but this is a family publication.)

The worst thing, of course, was the part that had nothing to do with real estate; it was the 34,884 deaths and 749,204 cases of COVID-19 that New York State had endured as of Thursday, Dec. 11, as per The New York Times.

But the collateral desolations were difficult enough.

The list of retail bankruptcies since March reads like a who’s who of Americana in the 20th century: Modell’s Sporting Goods (March 11); J.Crew (May 4); Neiman Marcus and Aldo (May 7); JCPenney (May 15); Brooks Brothers (July 8); Lord & Taylor (Aug. 2) … there were so many more.

Hotels saw themselves suddenly turned into homeless shelters and temporary hospitals.

In May, CO convened a retail forum, where Steven Kamali, the founder of Hospitality House, predicted that half of New York restaurants would be forced to give their keys back before it was all over. It’s possible that Kamali was being optimistic. By September, CNN was reporting that, in the new year, it could be as much as two-thirds. Last month, the great restaurateur, Danny Meyer, suspended indoor and outdoor dining at his eateries.

And, while New York’s office owners always comforted themselves with the wisdom that, in the end, Manhattan couldn’t get any bigger and that real estate was always a safe haven, they were met with a reality that never would have occurred to them: What if offices, themselves, are no longer safe?

More than that, what if the big tenants realize that the money that they shovel out in rent every year might not actually be necessary if their workforce can better spend their time on Zoom and Slack?

Morgan Stanley CEO James Gorman sent a shiver down the backs of the entire New York City office market when he told a Bloomberg Television audience in April: “Clearly, we’ve figured out how to operate with much less real estate. Can I see a future where part of every week, certainly part of every month, a lot of our employees will be at home? Absolutely.”

All of which makes for a grim, nauseating year.

And, then, last month, the first ray of light shone. Pfizer announced a vaccine would be ready to be rolled out this year. Right on their heels, Moderna announced one too. By the end of the month, AstraZeneca announced a third. If ever there were welcome news, this would be it.

While the fears of tenants taking less real estate in the future haven’t been fully assuaged, the tenants themselves seem to want to return to the office. Over the summer, Cushman & Wakefield surveyed millennial workers and found 70 percent of them wished to return to the office.

CoreNet conducted a survey of its members, 73 percent of whom believed that continued work from home was hurting employee development.

Even the coworking and flex office sector seemed to take a deep breath and realize that all is not lost. In a recent Workthere survey, 76 percent of coworking and flex office providers said they are feeling good about the future of the sector in the next 12 months. (Maybe flex office will be a decent alternative to the more onerous 10-year lease.)

All in all, yes, it was a horrible year. But thanks to a little help from the pharmaceutical industry, we feel much, much better about 2021.