Matt Kelly

Matt Kelly

CEO at JBG SMITH

JBG SMITH continues to strengthen its position as a market-leading real estate investment trust shaping the D.C. region’s most exciting projects and attractive neighborhoods.

“The challenges of this past year have done nothing to dampen our enthusiasm or in any way slow our progress in National Landing,” Matt Kelly said, referring to the neighborhood comprising the Crystal City and Pentagon City areas of Arlington County and the Potomac Yard neighborhood in Alexandria. “Construction is moving full-steam ahead on Amazon’s headquarters and Virginia Tech’s new Innovation Campus.”

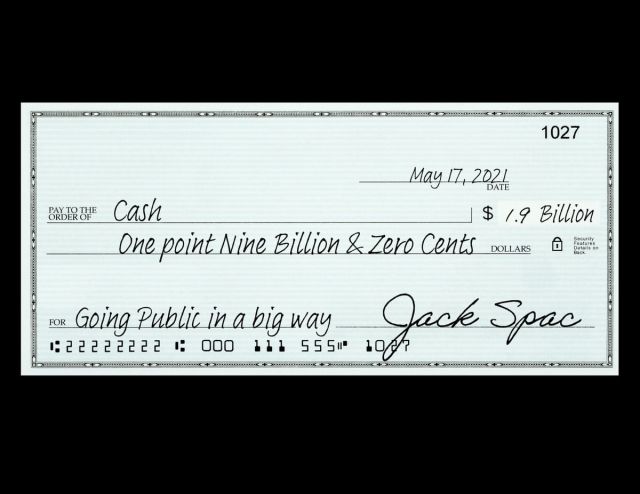

The company also recently entered a strategic joint venture with J.P. Morgan Global Alternatives to design, develop, manage, and own approximately 2 million square feet of new, mixed-use development in Potomac Yard, adjacent to that Innovation Campus.

“Just around the corner, along Crystal Drive, we completed development of a dynamic new retail and entertainment district, which is already 83 percent leased, along with the redevelopment of 1770 Crystal Drive, which is fully leased to Amazon,” Kelly said.

JBG SMITH is currently on track to deliver the first phase of Amazon’s headquarters — which will include 2.1 million square feet of office, 65,000 square feet of retail and 1.1 acres of open space — in 2023.

In spite of the pandemic, JBG SMITH completed more than 800,000 square feet of office leases in 2020, too.

JBG SMITH remains active on its own portfolio of developments as well. It began construction on two residential towers at 1900 Crystal Drive this past March; completed the redevelopment of 1770 Crystal Drive, an office tower fully leased to Amazon, in December; and acquired a prime site directly across the street from Amazon’s future headquarters at the end of 2020.

In December, too, JBG SMITH and its Washington Housing Initiative partnered with Amazon’s new $2 billion housing fund to facilitate the acquisition of the 825-unit Crystal House with a 99-year affordability covenant for working-class families.

“We have put ourselves in a strong position to take advantage of the substantial tailwinds from Amazon’s new headquarters, Virginia Tech’s $1 billion Innovation Campus, and our own connectivity investments in National Landing,” Kelly said. “Our active portfolio recycling efforts, substantial development pipeline and potential acquisition opportunities will enable us to accelerate our ongoing transition to a majority multifamily portfolio concentrated in high-growth submarkets.”—K.L.