Sunday Summary: When Is This Going to F@*$kin’ End?

By The Editors October 25, 2020 9:00 am

reprints

One of the crushingly depressing stories that has been popping up in the last couple of weeks has been the state of the coronavirus pandemic.

It’s not getting better. On Thursday there were 75,000 reported cases of COVID-19 in these United States. That was a single-day record for eight states, as per the New York Times. It was the second worst day, as far as infections go, since the pandemic began. As of Friday morning, 223,000 Americans have perished in this endless nightmare.

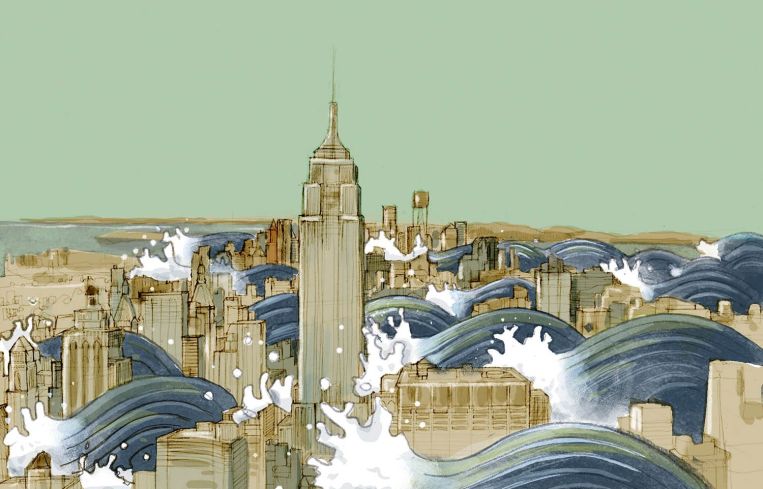

As we ready ourselves for what promises to be a painful winter, Commercial Observer looked at what a second wave and another round of shutdowns would mean for New York City.

“The implications would be horrendous,” Jeffrey Citron, a real estate lawyer at Davidoff Hutcher & Citron, told CO. “It would set us back months. People would be afraid to come into offices, afraid to come into the city.”

It would be difficult to imagine how some of the more fragile industries, like, say, hospitality could hold on. Hotel occupancy is down almost 79 percent from last year. What does this portend for New York’s chichi neighborhoods like, say, Nomad, which have some of the city’s most sought-after boutique hotels?

What about the city’s stable of department stores? They were already hurting, pre-pandemic. They could limp along, but some are already thinking about how to revamp them, as Amazon is attempting to do with the old Lord & Taylor flagship.

Bad stuff is happening already

Of course, it’s not in some far off future that the bad stuff awaits. This week we saw an Upper West Side apartment building at 60 West 91st Street head into bankruptcy auction; as did 753 Ninth Avenue.

But the numbers for these properties are smallish in comparison to the amount of money it was revealed that Adam Neumann lost when his consulting gig with WeWork ($185 million) went poof. “I don’t think that consulting agreement is still in force,” SoftBank’s Marcelo Claure said, according to the WSJ. “I think Adam may have violated some parts of the consulting agreement, so that’s no longer in effect.” (Not to rub it in, but this week another book came out detailing Neumann’s precipitous fall. It’s called “Billion Dollar Loser,” which should tell you that it was not positive.)

And yet…

The deals keep coming. In Los Angeles, the Hakim family picked up a Beverly Hills office for $36 million. In New York, SL Green sold a $100 million B-Note on One Court Square to Davidson Kempner Capital Group.

And there were leases! The BBC and Quantcast each took space at the Hippodrome Building. Prime Clerk, a legal services firm, expanded their space at Liberty Bklyn in Sunset Park. And the advertising tech firm VideoAmp is taking 13,000 square feet at 33 East 33rd Street.

Back in L.A., production firm, gnet, signed a long-term lease for 16,790 square feet at Jamison’s Miracle Mile Tower, and the law firm Thompson Coburn LLC took 25,000 square feet at 10100 Santa Monica Boulevard.

Until next week!