Sunday Summary: A Wall Street Without Banks

By The Editors October 18, 2020 9:00 am

reprints

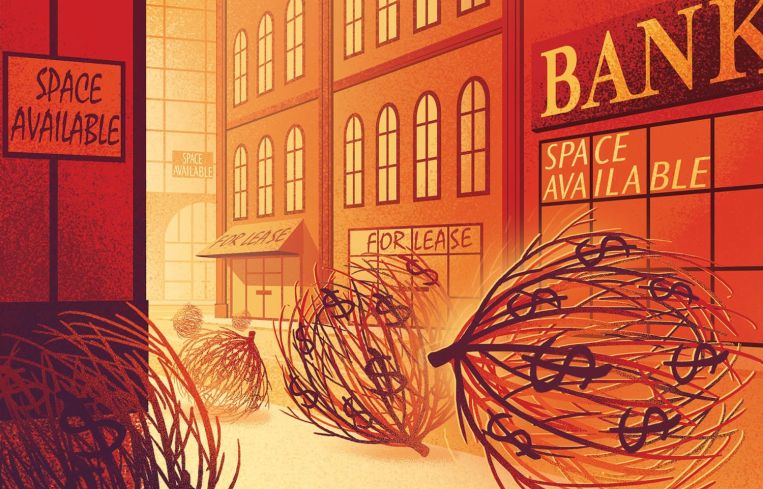

The words “Wall Street” mean nothing if they don’t mean high finance.

The less-than-a-mile long sliver of Downtown Manhattan was named after a small wooden defensive wall that the Dutch put up in 1653 to repel possible invaders, but it was the trading and banks that set down their roots centuries ago that gave the corridor its mystique. It is a place of bears and bulls; steak and martini lunches; pin-striped suits…

But not banks. At least not any more.

Two years ago the last of the heavies of Wall Street, Deutsche Bank, announced that it would be upping sticks and moving to the Time Warner Center in 2021; but COVID-19 has accelerated its departure. With a stunning lack of ceremony, Deutsche employees were informed in September that they weren’t expected to ever have to return to their offices at 60 Wall Street. An era has ended for the hallowed street.

But, then, that has to be expected. Everything’s different, and not for the better. The Financial District was in flux long before the coronavirus landed; there had been a great push to turn it into a live-work-play neighborhood. This vision for Lower Manhattan has only been hurt by the pandemic. “It’s all connected,” James Famularo of Meridian told Commercial Observer last week.

Those who are pushing for the neighborhood, however, have pushed boldly on. Nobody could ever accuse Silverstein Properties, for example, of not dedicating themselves to Downtown. The generalissimo leading the effort to nab some of the best tenants in the city is Jeremy Moss who explained to CO what a thoughtful landlord could do to staunch the bleeding and keep tenants happy.

Did you see that movie Tenet?

Neither did we. That’s the problem.

Tenet, for those still getting through Schitt’s Creek on Netflix, was the Christopher Nolan action picture that was supposed to lure moviegoers back into theaters. That didn’t happen. And this reaction is if not a death-knell for the industry, it’s at best a very, very bad sign.

Earlier this month Regal, the second largest theater chain, announced that it was closing 536 theaters nationwide without a reopening date. And industry leaders are begging Washington for some kind of federal aid.

Not only are the theaters hurting due to prolonged worry about being in an enclosed space for two hours, they’re also suffering from a big lack of product. Movie productions and releases were pushed back earlier this year and the industry hasn’t come close to recovering.

We should expect a lot more tumult in the industry before we see any happy endings.

Hello, Neumann…

If we say “Adam Neumann,” you say “WeWork”, right? Actually, no. The WeWork founder is back, baby, but his new project is not flex space or co-working. CO learned this week (by way of Bloomberg) that Neumann was investing $30 million in the residential management startup Alfred. (Also known as Hello Alfred.)

It was a good week for residential startups; Casai raised $48 million to build up their portfolio in Mexico City and to expand to other markets.

And it was a pretty good week for leases!

We should start with the big one: Centric Brands, which recently emerged from a bankruptcy, renewed a massive 212,154-square-foot lease at the Empire State Building.

A stone’s throw away, the asset manager Sanne took 20,865 square feet at 1333 Broadway.

Jeff Koons extended his 7,401-square-foot lease at 475 10th Avenue in Hudson Yards.

And Kreindler & Kreindler, a law firm that specializes in aviation injury suits, took 14,078 square feet at 485 Lexington Avenue.

There were interesting sales, too.

In L.A.’s South Bay, Nome Venture figured the time was right to purchase the 10-story 19191 South Vermont Avenue from Blackstone for $55.5 million.

And on the East Coast, Joe Sitt’s Thor Equities plunked down $27.1 million on a fully-leased life science facility at 7 Powder Horn Drive in Warren, N.J.

And hey, a big construction loan closed!

MaryAnne Gilmartin’s MAG Partners’ new project in West Chelsea is now off to the races, with a $173 million development financing from Madison Realty Capital.

See you next week!