The Power 100

By The Editors April 26, 2017 1:15 pm

reprints

Whenever it comes time to rank the most powerful players in commercial real estate, the question to ask is: What was the story of the previous year?

Globally, 2016 was a year of topsy-turvy, in which voters decided to tell their respective leaders where to cram their best-laid plans. Great Britain decided that its unfulfilling union with the rest of Europe was over. Colombia saw peace with FARC guerillas within its grasp, only to find that voters had different ideas. And, of course, a wealthy real estate developer and political neophyte commandeered a train of aggrieved populism straight to 1600 Pennsylvania Avenue.

The most trusted minds responded with a collective “WTF?”

But many players in real estate could smell the disruption in the air. Unlike in 2015—when Blackstone made a $5.45 billion move to buy Stuyvesant Town-Peter Cooper Village the same year the firm picked up GE Capital’s sprawling real estate portfolio for $23 billion—you didn’t see too many blockbuster deals in 2016. (Blackstone moved down, slightly, to No. 3.) The name of the game was “prudence,” “holding pattern” and “wait and see.”

This might have been best exemplified by Related Companies. Back in 2010, the mandarins at Related planted the seeds of Hudson Yards, and they continued tending that 17-million-square-foot garden on the Far West Side of Manhattan. (Related’s Stephen Ross, Jeff Blau and Bruce Beal share the No. 1 spot this year.)

SL Green Realty Corp., New York City’s largest office landlord, didn’t make too many acquisitions in 2016 but spent a lot of time and money getting its own Midtown garden prepped at One Vanderbilt. (It’s in the No. 2 spot.)

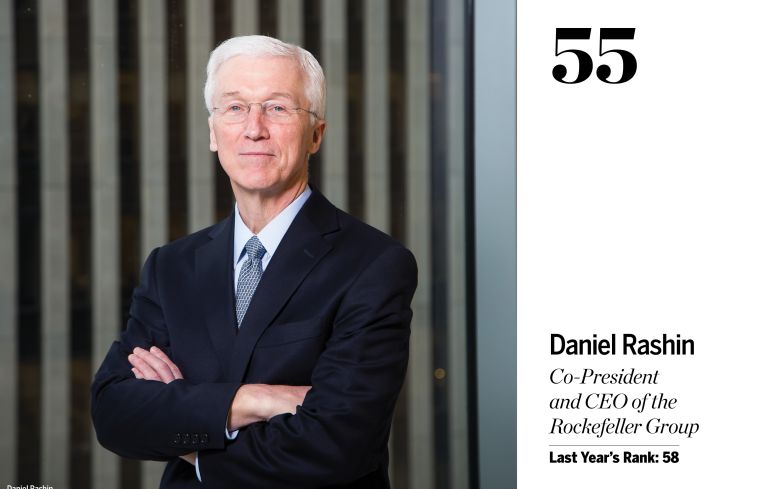

The Rockefeller Group (No. 55) spent $600 million not to buy a new building but to modernize an existing one: 1271 Avenue of the Americas. And even though construction is far from finished, the move has already begun to bear fruit with a major lease to Major League Baseball.

Of course, every rule has its exception. There were certainly a few bold buys, and deals continue to be made. RXR Realty spent $1.65 billion acquiring 1285 Avenue of the Americas from AXA Financial (RXR’s Scott Rechler is No. 4 on our list). And as global lines blur, several international real estate players rose in our estimation, including newbies like Masayoshi Son—the Japanese billionaire founder of SoftBank (and chairman of Sprint) who waded deep into real estate waters with his $3.3 billion acquisition of Fortress Investment Group (landing a respectable No. 30). And while Anbang’s multibillion-dollar redevelopment deal with Kushner Companies went south, there is little question that the Chinese insurer that owns the Waldorf-Astoria is a serious player in New York and U.S. real estate—after all, Anbang did pick up Strategic Hotels and Resorts from Blackstone for $6.5 billion (Anbang’s Wu Xiahui is No. 38).

The rest of these choices should speak for themselves.

Behold the great and powerful of commercial real estate.—Max Gross

The 2017 Power 100 Issue:

The First-Timers

The Highest Jumpers

The Shadow of Trump

Power of Attorneys

The Power Politicians

The Power Landowners

The Power Disruptors

The Power Data Players

The Power Architects and Designers

Power in Memoriam: Leonard Litwin

1. Stephen Ross, Jeff Blau and Bruce Beal

Chairman and Founder; Chief Executive Officer; President at Related Companies

Last Year’s Rank: 2

When you’re building a small city on the Far West Side of Manhattan, that endeavor tends to outshine all the others.

But Related Companies has many projects underway. Little things like, say, a modest $1.6 billion redevelopment project for which Related, along with Vornado Realty Trust, won the bid in September 2016 to mold the James A. Farley Post Office, also on the Far West Side, into the Moynihan Train Hall Station. Or the construction Related commenced on the 80,000-square-foot boutique office and retail building in the toniest part of Soho at 300 Lafayette in May. Or completed leasing at the 230-unit rental building called The Easton at 205 East 92nd Street on the Upper East Side and the 84-unit building at 456 Washington Street in Tribeca.

For its 47-unit Tribeca condominium 70 Vestry Street, Related managed to snag Robert A.M. Stern to design it. (Penthouse units are asking upward of $50 million). Oh, yeah, and Related acquired the 450-apartment Marine Terrace portfolio in Astoria, Queens, for $115 million last June, which they’ll redevelop with new units for veterans.

But we still haven’t talked about the 18-million-square-foot elephant in the room: Hudson Yards.

On just that complex alone, Related and its partner Oxford Properties Group closed more than $7 billion in financing last year, Jeff Blau said.

The company opened 10 Hudson Yards in May, a nearly 2-million-square-foot office building—the first completed tower at the Yards. It is now 100 percent leased with blue chip tenants such as Coach, L’Oréal and VaynerMedia.

At 15 Hudson Yards, the first residential condo building on the site, sales began in September and more than 30 percent of the 285 units have sold for a collective $500 million. In December, BlackRock was announced as an anchor tenant with about 1 million square feet at the planned 2.3-million-square-foot building at 50 Hudson Yards.

And the Shops and Restaurants at Hudson Yards, a planned 1-million-square-foot property retail property at 20 Hudson Yards that will be anchored by Neiman Marcus, is already 60 percent leased and should be open in 2018.

“Really the ability to execute and build and deliver on all of that at the same time is something that no one has ever done before,” Blau said about its activities.

Of course the size and scope of Hudson Yards alone is historic. But what really stands out about the project is that the city’s attention has undeniably shifted from prime Midtown to the west.

“When we started Hudson Yards it was about price point,” Blau said. “But we no longer have to compete by being the less expensive alternative. We are achieving some of the highest price points in the city. I think Hudson Yards has shifted the future growth of New York City to the west, where people want to live and work.”—Liam La Guerre

2. Marc Holliday and Andrew Mathias

CEO; President at SL Green Realty Corp.

Last Year’s Rank: 3

“We’re only 12 percent of the inventory,” Marc Holliday told Commercial Observer, when we stopped by his Grand Central Terminal office for a chat earlier this month and asked him about his 2016, “but we did 24 or 25 percent of the big leases.”

Wait a second. Only 12 percent of the inventory? Yes, Holliday meant precisely what he said: The real estate investment trust is Manhattan’s largest office owner, with stakes in 127 buildings totaling a gargantuan 47.8 million square feet. Was this a humble brag?

“I thought we’d be more by now!” Holliday protested. “I thought by ‘17 we’d be closer to 20 percent—or at least approaching 20 percent!”

Nevertheless, there are good reasons why SL Green Realty Corp. didn’t grow even larger than it did over the past year.

“It was a quiet year on the acquisition front,” Andrew Mathias said. “Intentionally we took a pause. We focused on leasing, focused on selling and taking advantage of repositioning the portfolio and bringing in an equity partner on One Vanderbilt.”

One Vanderbilt—the 1.7-million-square-foot tower only a couple of hundred feet away from their office—commanded most of the conversation. “National Pension Service of Korea came in as a 27 percent partner,” Mathias said of the $525 million equity commitment SL Green struck, which was announced this January. “Hines purchased a [1.4] percent interest as well—they’re our developer partner in the building.” (The gross asset valuation of the tower is $3.31 billion, according to SL Green.) And last week we learned that Daniel Boulud was going to be headlining the project’s restaurant space.

Plans for One Vanderbilt have been around the block before getting to this point. “I’d say it was between 2011 to 2012 when Andrew and I started to fully recognize the potential of the site as being a blueprint, if you will, for what this kind of large-scale, world-class development could be,” Holliday said. “It’s being built all over the world—but really not as much in Manhattan because the zoning doesn’t permit it, and sometimes the economics don’t permit it.”

Of course, One Vanderbilt is still a long way off (aside from its anchor tenant of TD Bank, Mathias and Holliday said they don’t expect leasing to start until 2018.) While it was definitely the hot topic, there were plenty of other things to discuss—like SL Green’s 3.2 million square feet of leasing last year, or the $4 billion in gross asset value sales.

Most prominently, the company sold a 40 percent stake in 11 Madison Avenue to Prudential Financial for $480 million, and SL Green sold 388-390 Greenwich Street to Citigroup for $2 billion.

“Two-thousand-and-sixteen was a career year,” Holliday said.—M.G.

3. Jonathan Gray

Global Head of Real Estate at Blackstone Group

Last Year’s Rank: 1

Gray may be his name, but there have been nothing but sunny days over at Blackstone. “We had a very good 2016,” Jonathan Gray told Commercial Observer. “We think about our success in terms of investing capital, raising capital and returning capital, while simultaneously generating strong performance for investors along the way. On all of those metrics we had a great year.”

Blackstone currently manages a little over $100 billion of investor capital and oversees more than $200 billion in assets around the globe. Last year’s highlights include the investment firm’s $8 billion purchase of life science real estate investment trust BioMed Realty Trust, its $2 billion sale of its Chinese shopping center business to China Vanke, its €3.5 billion ($3.76 billion) acquisition of German office company OfficeFirst Immobilien and the $6.5 billion sale of a 25 percent stake in Hilton to Chinese conglomerate HNA Group.

“Even though we continue to be active sellers we’ve returned $60 billion of equity to investors over the past few years and at the same time we’ve continued to deploy capital,” Gray said. “The Blackstone platform has diversified from being a U.S. opportunistic business to a global opportunistic business, a global core-plus business and a global debt business.”

Closer to home, Blackstone’s largest New York City deal was its $620 million purchase of the eight-building, 894-unit Kips Bay Court multifamily property in December 2016. The acquisition complemented the firm’s $5.45 billion purchase of Stuyvesant Town-Peter Cooper Village in 2015 nicely, Gray said.

Blackstone used the same core-plus platform that it used to acquire Stuy Town to buy high-quality coastal real estate last year, including retail assets and logistics properties in California. Casting a wider net, the company snapped up over 330 million square feet in logistics properties globally, acquiring assets in Australia, China, Brazil and Japan and capitalizing on the shift to online retail.

Gray made global headlines last year when President Trump put him in the running for the Treasury Secretary role in his administration. Gray politely declined, telling reporters at the time that while it was an honor to be considered, “I still have much work to do at Blackstone.” So, what’s on his agenda for 2017?

“I would say our goal is firstly to continue to deliver for our investors through making smart investments but also to continue to expand and diversify the platform by moving into more geographies,” Gray said. “We want to build the biggest, most successful real estate platform around the globe and we want to be best in class in everything we do.”—Cathy Cunningham

4. Scott Rechler

CEO and Chairman of RXR Realty

Last Year’s Rank: 5

In 2016, RXR Realty reached a milestone: It closed the largest single-asset transaction in the company’s history. That was the $1.65 billion acquisition of 1285 Avenue of the Americas from AXA Financial. Simultaneously, RXR signed a lease renewal with UBS, which was nearing lease expiration, to keep its 900,000-square-foot North American headquarters in the 39-story, 1.8-million-square-foot office building. The renewal “really de-risked the transaction before we closed,” Scott Rechler said.

It was a banner year for RXR. Rechler made $3.72 billion of investments (acquisitions, developments and structured investments) in 2016 compared with $1.88 billion in 2015. But the company closed on $530.3 million of asset sales and recapitalizations versus $4.05 billion in 2015.

In 2016, RXR secured $225 million in financing from PNC Bank to fund its redevelopment of Pier 57, commenced construction on the pier and signed a 250,000-square-foot lease with Google at the complex.

RXR is also making a name for itself as a lender. Last year the firm loaned Extell Development Company $463 million for the construction of three Manhattan residential and mixed-use properties. The deal “was complex and had a lot of moving pieces,” Rechler said.

Finally, the company broke ground on about 2,500 multifamily units in Brooklyn and in the suburbs, Rechler said.

To “augment our team,” Rechler noted, RXR hired Joanne Minieri, the former president and chief operating officer of Forest City Ratner, as the new executive vice president and chief operating officer of its construction and development arm. And a month ago, David Garten started as senior vice president of infrastructure investment and emerging submarkets at RXR. He served as chief of staff to Rechler, while the latter was the vice chairman at the Port Authority of New York & New Jersey.—Lauren Elkies Schram

5. Steven Roth

Chairman of the Board and Chief Executive Officer at Vornado Realty Trust

Last Year’s Rank: 9

Steven Roth has been a power player in New York, Chicago, and Washington, D.C., real estate for decades. But when President Donald Trump tapped the Vornado Realty Trust head to co-chair his infrastructure council, the press began to take a harder look at Roth’s holdings and his links with the developer-in-chief.

The 75-year-old head of the real estate investment trust (which owns and operates more than 45 million square feet of office space and a staggering 2.5 million square feet of retail in Manhattan alone) made headlines earlier this month when he hinted that Vornado might sell its 49.5 percent stake in Kushner Companies’ 41-story, 1.4-million-square-foot office tower, 666 Fifth Avenue.

“This is an ongoing, complex, dynamic and unpredictable situation…It is the rare case when we may be sellers,” he wrote in his annual letter to investors. While Roth didn’t say why he wanted to sell his part of the property, Kushner Companies’ plan to redevelop the building into a 1,400-foot-tall, mixed-use skyscraper designed by Zaha Hadid probably has something to do with it.

Vornado also made waves in October when it spun off its Washington, D.C., properties and merged that new company with privately held D.C. landlord JBG Companies to form JBG Smith Properties. The powerful real estate investment trust will, once it closes, control 50 office properties spanning 11.8 million square feet, 18 multifamily properties with 4,451 residential units and 11 other properties totaling 700,000 square feet in D.C. and its immediate suburbs.

Despite the fact that Vornado earned more from retail year-over-year in 2016, according to their publicly disclosed data, Roth still had bleak predictions for retail in New York and nationwide.

“I believe the only fix for brick-and-mortar retailing is rightsizing by the closing and evaporation of, you pick the number, 10 percent, 20 percent, 30 percent of the weakest space,” he wrote in the letter to investors. “This very painful process will surely take more than five years. It will also create enormous opportunity for those with the capital and management platforms to feed on the carnage. For flagship retail (and for A+ malls), this is a pause, a cyclical bump. For everybody else, it is secular disruption.”—Rebecca Baird-Remba

6. Douglas Durst and Jody Durst

Chairman; President of Durst Organization

Last Year’s Rank: 6

If Douglas and Jody Durst, the chairman and president of the Durst Organization, respectively, had asked you to be involved in their “pyramid scheme” in 2016 it wasn’t what you thought.

Last year, they unveiled their Bjarke Ingels-designed 709-unit residential rental building called VIA 57 West at 625 West 57th Street—and it resembles a giant silver pyramid jutting out of the West Side Highway. Landmark Theatres, a brand co-owned by Mark Cuban and Todd Wagner, will open a location at the building.

And if that sounds like an impressive year in itself, they also opened a 375-unit apartment building at 100 West 31st Street called EŌS, where Nike leased 122,000 square feet of office space.

Douglas was apparently so enticed by VIA he took a pad there for himself (he currently has an apartment next door at the company’s Helena 57 West, which is named after his daughter).

“We are very proud of that accomplishment,” Durst said. “The biggest thing [last year] was being able to open both VIA and EŌS at the same time.”

In addition to completing buildings that had been in the works for years, Durst acquired a site in Long Island City, Queens, at 29-37 41st Avenue, in December 2016 for $175 million. Previously, Property Markets Group and Hakim Organization had plans at the site to build what could have been the largest building in Queens; Durst plans a residential building, but the plans aren’t yet solidified.

And in the summer, Durst purchased a 36,200-square-foot site at 1800 Park Avenue in Harlem from Continuum Company for $91 million.

Some of Durst’s older properties have also seen new life: At 4 Times Square, where Condé Nast left about 800,000 square feet empty, opting for 1 World Trade Center (another Durst Organization property), the landlord has been able to ink deals totaling about 500,000 square feet, including tenants RSM US, SS&C Technologies and ICAP.

Meanwhile, Durst continued construction on Hallets Point, its $1.5 billion, 2,400-apartment multi-building Astoria, Queens, mega-development.

The agreement reached between the Real Estate Board of New York and the Building and Construction Trades Council of New York over the 421a program last November will also help some Durst projects pencil out. (The program has since been revived in April 2017 as the Affordable New York Housing Program.)

“Last year, we started Hallets 1, and that’s well underway,” Durst said. “And now that 421a has been enacted we are going to be jumping into the next two buildings.”—L.L.G.

7. Rob Speyer

President and CEO of Tishman Speyer

Last Year’s Rank: 8

In a city with its fair share of real estate scions who’ve inherited the fruits of the past generation’s labor, Rob Speyer stands alone. Since being appointed the sole CEO of Tishman Speyer following his father Jerry’s semi-retirement in late 2015, the younger Speyer has sought to raise the family firm’s profile to unprecedented heights.

Tishman Speyer currently has 8 million square feet in its New York City development pipeline and “has never been more active” in the city, Speyer said. “I’ve never been more optimistic about New York’s future,” he said, citing all-time highs in employment among the positive economic drivers that have “made New York the embodiment of a thriving metropolis.”

In addition to The Spiral—the 2.85-million-square-foot, Bjarke Ingels-designed Hudson Yards skyscraper currently in predevelopment—Tishman Speyer is seeking to accelerate the rapid transformation of Long Island City, Queens, via the company’s massive plans for Jackson Avenue. Right across the street from a three-building, 1,900-unit residential development along the thoroughfare, the company is working on a two-towered, 1.1-million-square-foot ground-up commercial office complex that’s virtually unprecedented for the neighborhood (whose office market is more known for loft-like warehouse repositionings than Class A towers).

“This is the largest and most important project in Long Island City since Citibank built its iconic headquarters [at One Court Square, 27] years ago,” Speyer said. “We’re transforming six acres of vacant land into a dynamic, 24/7 community, and it’s all a 15-minute subway ride from Midtown.”

But Tishman Speyer’s reach extends far beyond the five boroughs; globally, the company had nearly $46 billion in assets under management and operated 84.5 million square feet of commercial and residential real estate at the end of last year (the company has focused on core markets around the world, including London, Paris, Frankfurt, Berlin, Shanghai and São Paulo).

Speyer’s own reach has also grown beyond the family firm: Now in his fifth year as chairman of REBNY (the industry group has twice extended his three-year term by one year), he plays an immensely influential role within the city’s real estate industry at large. That influence was evident through the role Speyer played in the protracted negotiations with state legislators and the construction unions over the renewal of the 421a tax abatement.

“It wasn’t merely an extension of 421a: It was a reinvention of the program and one that will ensure we begin to address the housing shortage across all income levels in the city,” Speyer said of the new 421a, now known as Affordable New York. “It was of critical importance, so it deserved the time it took.”—Rey Mashayekhi

8. Ric Clark

Senior Managing Partner and Chairman of Brookfield Property Partners

Last Year’s Rank: 4

“We feel like 2016 was a very busy year for us,” Ric Clark told Commercial Observer. “We completed the repositioning of Brookfield Place. The retail center is essentially completed, and traffic is way up.”

With more than 95 percent of the retail occupied, including a newly opened Saks Fifth Avenue and one of the city’s most popular food halls, “busy” might understate the case.

In terms of office leasing, Brookfield signed a 403,000-square-foot lease renewal with the Royal Bank of Canada at 200 Vesey Street through 2032 and a 127,000-square-foot lease with Tullett Prebon.

Since work at the 8.5-million-square-foot complex (formerly known as the World Financial Center) is on track, Clark is turning his attention to the west—Manhattan West.

Brookfield is also cranking out its 7-million-square-foot development on Ninth Avenue between West 31st and West 33rd Streets.

It finished designing and redeveloping the “elephant foot,” a building at 450 West 33rd Street known now as 5 Manhattan West, and signed big-name new tenants there just last week.

“That building was formerly one of the ugliest in the city,” Clark said. “But we’ve transformed it, and we have had a feeding frenzy for tenants wanting space there.” That includes Whole Foods, which recently signed on for 60,000 square feet.

At 1 Manhattan West, a 2-million-square-foot building under construction, Skadden, Arps, Slate, Meagher & Flom signed a 550,000-square-foot space, and the National Hockey League took a 160,000-square-foot deal.

And Brookfield completed an 844-unit rental building at 3 Manhattan West, called the Eugene (after former Brookfield Chairman John Eugene Zuccotti), which opened to residents last month.

Besides Manhattan West, Brookfield and The Swig Company recently acquired a long-term ground lease for the 386,000-square-foot office building at 1100 Avenue of the Americas from the Nickerson family and is planning to erect a new building there.

And like many of its peers, Brookfield is also turning to Brooklyn. The developer began construction of two apartment towers with nearly 800 apartments at Greenpoint Landing with Park Tower Group. One is set to open in 2018 and the other the following year.—L.L.G.

9. Andrew Cuomo

Governor of New York

Last Year’s Rank: 15

As Andrew Cuomo casts his eye on the biggest prize in politics, he’s suddenly gotten serious about New York City’s aging infrastructure and its sweeping affordable housing crisis.

Earlier this month, he brought the 421a tax exemption back from the dead after a two-year-long stalemate that threatened to derail New York’s rental development pipeline. And while 421a’s return has been a big deal for the city’s real estate world, it hasn’t exactly grabbed headlines or helped further his chances at his widely rumored presidential run in 2020.

But Cuomo has been reinforcing his image as a second-coming-of-Robert-Moses-type master builder in other ways. “Right now we have the largest infrastructure investment in the history of the state of New York at $100 billion,” he said in his January State of the State address. “We’re doing roads and bridges all across the state. We’re also reimagining airports. Why? Because airports are the new front door to communities.”

Cuomo accelerated construction on—and ultimately finished—the three-stop Second Avenue subway, opening it on the last day of 2016. It is one of the world’s most expensive transit projects with two miles of tunnel that cost New Yorkers $4.45 billion. He announced an ambitious $1.6 billion plan to revamp Pennsylvania Station and to transform the Farley Post Office into a train hall that would host passenger facilities for Amtrak and Long Island Railroad last September. The governor is also pushing forward a proposal to build an AirTrain between Willets Point, in Corona, Queens, and LaGuardia Airport, as well as an $8 billion plan to modernize the airport and construct three new terminals. Also on the table is an $8 billion proposal to renovate John F. Kennedy International Airport and $2 billion to ease traffic and upgrade the roads surrounding it.

But, he’s thinking on the local level, too. Last month, he announced a $1.4 billion investment to build 3,000 units of housing and improve access to health care and recreation space in central Brooklyn.—R.B.R.

10. Jeff Sutton

Founder and President of Wharton Properties

Last Year’s Rank: 11

There are few people in real estate who would question just how bad the last 12 months has been for retail—except, perhaps, if your name is Jeff Sutton.

While landlords throughout the city (check that, throughout the country) have been hemorrhaging tenants left and right, the sphinx-like head of Wharton Properties inked a 15-year deal to get Nike into a 69,214-square-foot space at 650 Fifth Avenue (which Sutton owns with SL Green Realty Corp.) where the 7,000 square feet of ground floor space traded at $4,000 per square foot. The 15-year deal is worth a jaw-dropping $700 million in total.

And while prime Fifth Avenue storefronts have been sitting empty, somehow Bulgari and Ermenegildo Zegna are parading their wares at 730 Fifth Avenue, a.k.a., the Crown Building, which Sutton owns with GGP (Zegna’s lease was for approximately $150 million for 15 years, as The New York Post reported, and Bulgari is paying a record $5,500 per foot); or, there’s the lease that Sutton signed in Times Square to bring a Swarovski to the old Roxy Deli space at 1565 Broadway, which the Post also reported (the exact prices on that deal remain unknown).

Of course, Sutton’s reach extends well beyond Times Square and the tony parts of Fifth Avenue; Wharton opened a massive, 200,000-square-foot chunk of retail at 100 West 125th Street along Lenox Avenue, which is home to a Burlington Coat Factory, an Olive Garden, a Raymour & Flanigan and an American Eagle with (most enticing of all) a Whole Foods set to open later this year.

Moreover, Sutton tapped the Israeli bond market, raising $245 million on the Tel Aviv Stock Exchange (at a 3.9 percent interest rate—a record low for an American company) in an issuance backed by 18 assets.

All in all, while many of his peers struggle, Sutton hustles. He’s the one guy in the fraught cauldron of retail we’re not particularly worried about.—M.G.

11. William Rudin

Vice Chairman and CEO of Rudin Management Company

Last Year’s Rank: 12

Family has always been important to the Rudins, who have passed down their real estate business through five generations. But it’s something that has taken outsized importance since Jack Rudin, the former chairman of Rudin Management Company, died this past December at the age of 92.

“He trained us very well, as did my dad [Lewis Rudin],” William Rudin said of his late uncle’s influence on him, his siblings and his cousins. “I know he’s looking down very proudly on what we’ve accomplished, just as I look upon my kids and am thrilled that they’re involved [in the company].”

As far as business is concerned, the Rudins are looking in only one direction: forward. On top of its considerable Manhattan portfolio (16 office properties spanning 10 million square feet and 20 residential buildings comprising more than 4 million square feet), the firm is finishing up work on its 199-unit condominium development on the former site of St. Vincent’s Hospital in the West Village. The Greenwich Lane, as the development is known, is more than 95 percent sold with only “a few apartments and three townhouses” left on the market, Rudin said.

But Rudin’s most notable recent move is Dock 72—the 16-story, 675,000-square-foot ground-up office development it is building at the Brooklyn Navy Yard with partner Boston Properties. The project, which represents the company’s first development outside of Manhattan, is also a collaboration with WeWork, which will anchor the property with 222,000 square feet of space and “worked with us on designing the project and curating the amenities,” according to Rudin.

The developers expect to top out Dock 72 this summer, with tenants able to begin building out their spaces this fall and move-ins likely to start in the first quarter of next year. While WeWork is the only current tenant signed on, Rudin has high hopes that the building will become a destination for the young, creative, entrepreneurial companies that are increasingly driving the city’s economy.

“It’s a different model from how we’ve looked at office buildings before,” he said, citing Dock 72’s 35,000 square feet of amenities (including a 13,000-square-foot food hall, plus a wellness center, rooftop gardens, outdoor basketball court and bike valets). “It’s following the residential model of being fully amenitized, and allows small- and medium-sized companies who are competing for talent to offer those amenities to their employees.”—R.M.

12. Barry Sternlicht

Chairman and CEO of Starwood Capital Group and Chairman of Starwood Property Trust

Last Year’s Rank: 17

If you want to take a look at Barry Sternlicht’s handiwork, all you need to do is take a stroll along the Brooklyn waterfront.

There you will find 1 Hotel Brooklyn Bridge, Sternlicht’s eco-luxury lodging, which opened earlier this year, where the beams were recycled from the Domino Sugar Factory, the floors from an old distillery in Kentucky, the power is 100 percent wind, much of the water comes from a rain reclamation system and one can nary find a single plastic bottle in the whole 194-room joint.

“It’s not a brand—it’s a cause,” Sternlicht told Commercial Observer last year, proclaiming it his favorite among the many hotel ventures in his storied career. (Since 2015, Starwood has opened two other 1 Hotels, one each in Midtown and South Beach.)

Of course, hotels are only part of Sternlicht’s real estate career. Starwood Property Trust closed a whopping $6.4 billion in transactions in 2016—a jump from $600 million in 2015. And it also took on a $5.8 billion portfolio of apartments from Equity Residential.

Still, it keeps coming back to hotels with Sternlicht. In October 2016, Starwood sold a $2 billion stake to China Life Insurance Company (China’s largest insurance company) to invest in 280 select-service hotels expanding over 40 states.—M.G.

13. Anthony Malkin

Chairman and CEO of Empire State Realty Trust

Last Year’s Rank: 7

In 2016, Empire State Realty Trust leased just under 1 million square feet of space. That compares to a little over 1.2 million square feet leased the year prior. The reason for the disparity?

“[In 2016] we didn’t have as much space to lease,” said Anthony Malkin. “We’d done so much leasing the prior year and in 2016 we were busy redeveloping intentionally vacated space for lease-up this year.”

As the biggest landlord in the Garment District, ESRT boasted some high-profile retail deals last year including stationery retailer Papyrus signing a lease at 1359 Broadway between West 36th and West 37th Streets and Maison Kayser taking space at 1400 Broadway between West 38th and West 39th Streets. At ESRT’s 12-story 1333 Broadway between West 35th and West 36th Streets, Dr. Martens also signed a deal.

Malkin said the company last year “did some tremendous office leasing.” That included The Michael J. Fox Foundation signing an 86,000-square-foot lease at ESRT’s 111 West 33rd Street; JCDecaux taking 46,537 square feet over the entire 73rd and 74th floors at the Empire State Building at 350 Fifth Avenue between West 33rd and West 34th Streets; and GuildNet taking 37,680 square feet at 250 West 57th Street between Broadway and Eighth Avenue.

In 2016, the Qatar Investment Authority acquired a 9.9 percent stake in ESRT on a fully diluted basis, which gave the company a $622 million infusion. And Empire State Building Observatory achieved a record revenue of $124.8 million in 2016, an 11.2 percent increase from $112.2 million in 2015.

Malkin highlighted the company’s 50 percent rent spreads between new and expired rents.

“We’ve been doing well on that,” he said. “It’s pretty consistent. We are repositioning these properties for new tenants with better credit, longer-term leases and the tenants are generally larger.”

The company, public since 2013, is on a mission to modernize its aged trophy properties, spending between $80 and $120 per square foot to do so. “You can’t just put lipstick on a pig,” he said.—L.E.S.

14. Robert Stuckey

Managing Director and Head of U.S. Real Estate Group for The Carlyle Group

Last Year’s Rank: New

“It’s no secret that we’re later in the cycle,” Robert Stuckey, who runs the real estate division for The Carlyle Group, said last week, “so we had to be selective.”

But Carlyle’s selections over the past year have proven pretty fascinating.

For one thing, there’s 866 United Nations Plaza, where Carlyle just picked up 330,000 square feet of office condominium space for $217.5 million from Meadow Partners. This works out to less than $700 per square foot—a pretty good figure when you consider that area comps are roughly $1,000 per square foot. (Carlyle plans to sell off the condos.)

Then there’s Glasshouses, the Far West Side project at 660 12th Avenue (in a space that’s currently occupied by Federal Express) that is going to be turned into an event space with Jack Guttman and will feature a 50,000-square-foot roof and promises all the lighting, the high ceilings and the cachet for 2,000-person soirées. Carlyle is hoping to have that project finished by the end of 2018.

And, like every other serious New York real estate player, Carlyle extended its reach into the outer boroughs; it recently sold its stake in the Brooklyn Hilton at 140 Schermerhorn Street for $88 million according to The Real Deal, and it has closed on about 115 condos as part of the same project at 265 State Street. (The residential portion is called The Boerum.) Of course, that’s just some of the company’s recent projects in New York. On the national scene, Carlyle is pretty much everywhere, and this January the firm announced that it was embarking on its eighth U.S. real estate fund where it’s hoping to raise a modest $5 billion.—M.G.

15. Larry Silverstein and Marty Burger

Chairman; CEO of Silverstein Properties

Last Year’s Rank: 13

Last September was the 15th anniversary of the 9/11 tower attacks—and ever since that terrible day, Larry Silverstein has dedicated himself to rebuilding the area anew. Two-thousand-and-sixteen was the year the end looked in sight.

Silverstein Properties, led by Silverstein and Chief Executive Officer Marty Burger, completed 7 and 4 World Trade Center (in 2006 and 2013, respectively) and last year topped out 3 World Trade Center. Once 2 World Trade Center, his planned 2.8-million-square-foot mega-tower, finds a suitable anchor tenant, his work will be complete. One World Trade Center (which is owned by the Port Authority of New York & New Jersey and the Durst Organization) premiered in 2014.

“We haven’t rebuilt everything, but we’ve come very close,” Silverstein said. “We’ve been going at it for about 15 years, and I’d say it’s going to be another five years. I’m 86 now—by that time I’ll be 91. Tower 2, that’s the last building. Just stay tuned, because one of these days we are going to be able to talk about Tower 2.”

In the meantime, Silverstein Properties has been securing big leases at the rest of the complex. It completed a deal with media company GroupM to expand its 520,000-square-foot lease at the 80-story, 1.8-million-square-foot 3 World Trade Center by another 170,000 square feet. Music streaming company Spotify took 378,000 square feet at 4 World Trade Center at the start of 2017.

Last June, billionaire Ronald Perelman made a $75 million gift to Silverstein Properties’ free-standing performing arts center at the World Trade Center. The 90,000-square-foot, three-auditorium building is set to break ground at the site in early 2018 and is scheduled to open in 2020. And the one-acre Liberty Park opened to the public.

Of course, it’s easy to forget that not everything Silverstein Properties is working on is at the World Trade Center; it has approximately $10 billion of projects under development right now. The company is planning its development of two towers on a site at 514 11th Avenue on the Far West Side, which it purchased in January 2015 for $115 million.

It completed the Robert A.M. Stern-designed 30 Park Place, an 82-story condominium and Four Seasons hotel (80 percent of the units have been sold thus far). The luxury tower even lured Silverstein and his wife from their pad at Park Avenue and East 59th Street.

“I think the World Trade Center has emerged as the commercial heart of the city’s hottest residential neighborhood. Twenty percent of the people that work Downtown, live Downtown,” Silverstein said. “To me, Uptown there are a lot of old people…We’ve decided it’s time to be where the young and dynamic people are.”—L.L.G.

Silverstein Properties' entry on this list has been updated to include CEO Marty Burger, who was initially absent from the entry due to an editorial oversight.

16. Gary Barnett

Founder and President of Extell Development Company

Last Year’s Rank: 14

Having met a fair number of ambitious young people who are either looking to get into the development game or have just started their careers, they virtually all speak of Gary Barnett in the sort of reverential tones usually reserved for deities. Can you blame them? Barnett is an icon in New York City real estate, the self-made man who rose from Lower East Side beginnings and an early career in the diamond trade to assemble an enviable portfolio of privately-held assets across the city. As a builder, he’s already left an indelible mark on the city—erecting modern-day, floating palaces for the global elite.

Of course, it hasn’t all been strawberries and cream. One57, the 1,000-foot-tall luxury condominium skyscraper that basically invented Billionaires’ Row, has yet to sell out more than five years after sales launched. Barnett’s exposure in the luxury condo space has meant that his foray into the Israeli bond market, where he’s issued hundreds of millions of dollars in debt since 2015, has been rife with shareholder concerns over whether he’ll be able to pay back what he owes. And even when he tried to fly in a more reasonably priced market via One Manhattan Square—the under-construction Lower East Side condo tower where most of the units are priced “only” up to $3 million—Barnett had to pull teeth to finance the thing, ultimately relying on Scott Rechler’s RXR Realty for the mezzanine lending necessary.

But if there’s one truism in New York City real estate that has actually held up through the years, it’s that you’d be unwise to bet against Barnett. The man's influence on the Manhattan skyline shows no sign of abating; he’s only building what will become the tallest residential building in the Western Hemisphere at 217 West 57th Street, the behemoth known as Central Park Tower. Meanwhile, Extell continues to make moves in retail (signing Target last summer to its new 500 East 14th Street development) and hotels (reportedly inking a deal to build a new Hard Rock Hotel in Times Square). All things considered, it looks like the kids are onto something.—R.M.

17. Sam Zell

Chairman of Equity International

Last Year’s Rank: New

For an outfit that’s run by a Chicagoan, Equity Residential—the real estate arm of Sam Zell’s Equity Group Investments—sure owns a lot of New York City. Equity Residential controls 40 properties and 10,632 apartments in the Big Apple.

Last month, Zell told Bloomberg that rent prices in the city are “flattening out,” and the outpouring in new apartments is beginning to taper off, even as demand remains high. “The surge in supply is starting to slow down as banks and investors become concerned about the impact of supply and demand,” he said.

Of course, Gotham is only one piece of Zell’s real estate empire. Nationwide, the company owns 300 properties and 76,513 apartments, and its revenue grew 3.7 percent between 2015 and 2016, according to its annual earnings report released in January.

But in New York City, Equity saw the number of new leases drop 3.5 percent and revenues dip 1.5 percent. A growing supply of new apartments and a slowdown in high-paying jobs were to blame.

“Financial services are contracting and tech job growth has stalled,” the company’s COO, David Santee, said in its fourth-quarter 2016 earnings call this February.

In 2017, the real estate investment trust expects that trend to continue with a 1.8 percent drop in revenues here in the city. It has also budgeted $4 million in rent concessions for 2017—which far exceeds the rent concessions it has set aside for residential leasing in any other city.—R.B.R.

18. Mary Ann Tighe

CEO of the New York Tri-State Region at CBRE

Last Year’s Rank: 19

There is no other broker whose name is as instantly recognizable (and instantly identified with success) as that of “Mary Ann”—the Tighe isn’t really necessary.

Mary Ann Tighe, the chief executive officer of CBRE’s New York Tri-State Region since 2002, dominated 2016 office leasing. The former Real Estate Board of New York chair took the global firm’s top spot with 122 transactions, covering 4.6 million square feet and valued at $3.1 billion.

It’s an accolade she has hit before—in 2008, 2011 and 2014. But, unlike in previous years, she said there wasn’t a single deal that was revolutionary.

“I didn’t do what I would call a transformative deal [in 2016],” Tighe said. “I didn’t even submit anything for [REBNY’s] Deal of the Year Award. It wasn’t like the neighborhood changed because of what we did. We didn’t make New York different because of my 2016 deals, which is different from many of my deals in the past.” (For the record, Tighe has won the Deal of the Year Award eight times.)

However, she grinded out a lot of singles and doubles that were run out flawlessly.

“What I would say is 2016 was hugely productive for me,” Tighe said. “Of all of the teams that we put together for the deals, I can’t think of a hiccup that happened. Each of these deals had the right team members.”

Tighe led a CBRE team that represented the landlord of 55 Water Street, the Retirement Systems of Alabama, in a 900,027-square-foot renewal for McGraw Hill Financial’s office space. It was the largest office lease in New York City since 2014.

She also helmed another CBRE team that represented L&L Holding Company in the 200,000-square-foot anchor lease for hedge fund Citadel at L&L’s building under construction at 425 Park Avenue. The lease comes with the penthouse of the new luxury 900-foot tower, which Citadel will rent for $300 per square foot, the most expensive office rent in the city’s history.

And she has already kicked off 2017 in prime form. She and a CBRE team represented landlord Silverstein Properties in a 378,000-square-foot deal for Spotify on floors 62 to 72 of the 2.3-million-square-foot 4 World Trade Center, which was announced in January.

Plus, Tighe worked on a 784,000-square-foot renewal and expansion of 21st Century Fox’s headquarters at 1211 Avenue of the Americas and a 440,000-square-foot lease for News Corp’s headquarters there. Tighe might just be modest, but any other broker would call that one a home run.—L.L.G.

19. Donald Bren

Chairman of Irvine Company

Last Year’s Rank: New

Donald Bren is most closely identified with Southern California—he started building homes there in 1958, and his Newport Beach-headquartered Irvine Company owns a substantial portion of Orange County, including office buildings, shopping centers and acres of still-undeveloped land. Yet, the empire of the nonpresidential billionaire named Donald also reaches east, notably to 200 Park Avenue in New York City. He owns 97 percent of 200 Park, which is better known as the MetLife building (Tishman Speyer owns the rest).

The 84-year-old, who declined to be interviewed, quietly took control of 200 Park and has been building his stake at the 58-story tower since 2005. It’s a replication of how he built Irvine Company, buying out one stakeholder after another over the course of nearly two decades. The slow and patient approach has made him the richest developer in America, with a net worth of $15.2 billion, according to the Forbes 2016 400 list, a ranking of the country’s richest billionaires.

Bren’s disciplined long-range planning reflects his experience in the United States Marine Corps, yet he’s also an expert skier (which earned him scholarship funds in college; an unlucky ankle break kept him from the 1956 Olympics). But one thing that distinguishes him from many of his real estate brethren is his avoidance of the spotlight. Bren would be completely under the radar were it not for his outsized philanthropy, with education, conservation and medical research being focuses. (At one awards ceremony, it was estimated that he’s given away $1.3 billion.)

Now at an age when many would retire, Bren is still climbing his mountains—methodically. “We cannot predict the future,” he said a few years ago in an interview at the Urban Land Institute, “but we can plan for it.”—Alison Rogers

20. David Simon

Chairman and CEO of Simon Property Group

Last Year’s Rank: New

Simon says...never mind jumping in the air or sticking out your tongue, but follow his lead and maybe you’ll have a shot at becoming the largest shopping mall operator in the U.S.

“Here we go again,” David Simon wrote in a letter to stockholders in the company’s 2016 annual report. “No, I’m not talking about the constant narrative that retail real estate and the mall are becoming disenfranchised given the growth in internet retailing. I am referring to our record financial performance.”

During a year when retail was the ugly duckling of asset classes, with bankruptcies and store closures dominating headlines, Indianapolis-based Simon Property Group boasted record results. Its consolidated revenues increased 3.2 percent year-over-year to $5.4 billion, its net income reached $1.84 billion, and occupancy for its U.S. malls and Premium Outlets reached an all-time high of 96.8 percent.

Through the years, Simon has recycled $10 billion of real estate through the sale of non-core assets and the spinoff of smaller malls and strip centers. When the firm was founded in 1993 its focus was on small malls in small markets. Today, that focus has shifted to big and vibrant retail centers in major markets that encompass dining and entertainment options.

For example, last year Simon Property Group added The Shops at Crystals on the Las Vegas strip to its portfolio, paying $1.1 billion for the asset along with Invesco Real Estate.

The company isn’t budging from its long-term strategy of owning high-quality retail assets and is paying no mind to the naysayers. “I don’t see any reason why well-located, high-quality retail real estate that has a diverse product mix, that is well leased and managed, provides services and looks and feels good, won’t continue to increase in value. Don’t fall for the edicts,” Simon wrote. We won’t; Simon said so.—C.C.

21. Jed Walentas

Principal at Two Trees Management

Last Year’s Rank: 25

Two Trees’ Jed Walentas already transformed one waterfront Brooklyn neighborhood, and he’s on his way to building another. The first one, Dumbo, is legend, and the next is the redevelopment of the Domino Sugar Factory in Williamsburg. The 4-million-square-foot, $3 billion complex near the Williamsburg Bridge is poised to become a mini-neighborhood, complete with office space, retail, apartments and a public park.

Last week, Two Trees revealed images of Domino’s six-acre park along the East River and announced it would open in the summer of 2018. The $100 million green space will feature a 450-foot-long elevated walkway called the Artifact Walk, 30 historical pieces salvaged from the factory and a pair of 80-foot-tall cranes. Ultimately, the 11-acre industrial site will produce 2,800 apartments, a quarter of which will be affordable, 380,000 square feet of office space in the historic former factory building and four new residential buildings. At the moment, the first 16-story rental building is inching toward the finish line at 325 Kent Avenue. In June 2017, it will open its doors with 522 apartments, 105 of which will rent for below-market rates.

In the past few months, the 49-year-old Brooklyn firm also wrapped up 379 rentals at the 300 Ashland Place, the angular 35-story tower designed by TEN Arquitectos in Fort Greene. The ground floor retail space, which will house Whole Foods and an Apple store, is still under construction.

Between 300 Ashland and Domino, the developer is working on roughly $3.3 billion worth of projects. Its current portfolio is valued at $4 billion and includes 2,000 apartments and 3 million square feet of commercial and industrial real estate.—R.B.R.

22. Brett White, John Santora and Bruce Mosler

CEO and Chairman; Vice Chairman and Tri-State Region President; Chairman of Global Brokerage at Cushman & Wakefield

Last Year’s Rank: 30

When you look at the moves that Cushman & Wakefield has undertaken in the last two years, it’s obvious that the brokerage’s ambition is limitless. Under the leadership of Brett White, John Santora and Bruce Mosler, C&W played a game of musical chairs with its leadership and went on a hiring spree, nabbing top executives from rival brokerages as whispers of a public offering got louder.

Tod Lickerman, the firm’s global president, became the chief executive of the Americas, and Santora, a 40-year veteran at C&W, replaced Ron Lo Russo, who returned to a brokerage role.

C&W also snatched Mark Weiss from Newmark Grubb Knight Frank in January 2016, Glenn Isaacson of CBRE that May, Douglas Harmon and Adam Spies of Eastdil Secured in October and Ed Wartels and Justin Halpern of Cresa New York in December. Most recently, in March 2017, 36-year veteran Patrick Murphy joined C&W from CBRE.

“It’s really about building strength in New York,” Santora said. “Not that we got weak, but [we wanted] to take that jump forward.”

C&W, which has more than 43,000 employees, is trying to bolster its New York office because doing big deals here will trickle into transactions in other markets around the world as C&W makes closer relationships with global investors in the city, Santora said.

C&W’s capital markets team, now led by Spies, Harmon and Robert Knakal (who came aboard in 2014 when the firm bought Massey Knakal Realty Services), have been responsible for 78 percent of office property sales above $50 million since 2010.

The company advised landlord Paramount Group on a $850 million refinancing of 1301 Avenue of the Americas from AXA Equitable Life Insurance Company, MetLife and New York Life in October.

And C&W was involved in eight of the top 14 retail deals in Manhattan by square footage. This included Nike’s nearly 70,000-square-foot store at 650 Fifth Avenue, Under Armour’s lease at 767 Fifth Avenue for 53,000 square feet and American Girl’s 40,000-square-foot shop at 75 Rockefeller Plaza.—L.L.G.

23. Darcy Stacom and William Shanahan

Chairwoman and Head of NYC Capital Markets; Chairman, NYC Capital Markets at CBRE

Last Year’s Rank: 26

When the sale of 245 Park Avenue closes for $2.2 billion (a transaction that CBRE confirms but won’t comment on), Darcy Stacom and William Shanahan will have brokered three of the four New York City office building sales that topped $2 billion. The CBRE sales team claimed a whopping $8.3 billion in transactions over the past year. They also set a pricing record with 693 Fifth Avenue, the former Takashimaya building, which sold for $525 million, the highest price per square foot for an office building in New York City—ever.

Other notable deals include the largest multifamily sale of 2016, 894 units at Kips Bay Court, for $620 million; the $330 million sale of 441 Ninth Avenue; and the creation of a ground lease at 1100 Avenue of the Americas, which will lose its current tenant, HBO, to Hudson Yards, in two years.

CBRE also navigated delicate partial interest sales, such as PGIM’s $1.04 billion purchase—with around $480 million in cash and assumption of debt—of a 40 percent stake in 11 Madison Avenue and China Investment Corporation’s $683.5 million purchase of a 49 percent stake in One New York Plaza.

“With global economic forces in opposition, investors are looking closely to the fundamentals of each transaction,” Stacom said. “This is the time when our firm and our team excel.”—A.R.

24. Blake Hutcheson and Andrew Trickett

President and CEO; Senior Managing Director of Investments at Oxford Properties Group

Last Year’s Rank: 27

As an investor on behalf of OMERS, one of Canada’s largest pension funds, Oxford Properties Group has both access to capital and time on its side. “We think in decades on behalf of OMERS, and this continues to serve us well,” Blake Hutcheson said.

Oxford has concentrated much of its advantage on development in global cities—or “city-states” if you will—and hit milestones in Boston (where it is now the second-largest landlord) and Washington, D.C., (where its first development is 91 percent leased). In Canada, it unloaded a 50 percent interest in an office portfolio in Toronto and Calgary for $1.18 billion and, in the U.S., has set its sights on San Francisco.

But it’s the firm’s activity at Hudson Yards that has made it a New York City name. Alongside its partner Related Companies, Oxford opened 10 Hudson Yards, a 1.8-million-square-foot office building that is the first office tower to open in the massive West Side “newborhood.” The developers also launched residential sales at 15 Hudson Yards (with asking price points north of $2,300 per square foot), announced a Thomas Heatherwick public art piece, which resembles a honeycomb with 16 stories of stairs, and signed 2 million square feet of leases.

“The thriving megacities in our future,” said Andrew Trickett, “will understand that civic, cultural and commercial interests are interconnected.”—A.R.

25. Owen Thomas and Douglas Linde

CEO; President of Boston Properties

Last Year’s Rank: 29

Owen Thomas and Doug Linde form the brain trust behind the largest office REIT in the U.S., which owns nearly 48 million square feet across a portfolio that’s heavily focused on Class A office space in core, gateway urban markets—namely New York, Boston, San Francisco and Washington, D.C.

The pair is pursuing a strategy that has seen Boston Properties fund new developments and acquisitions by offloading “non-core assets that the market values more dearly than we do,” Thomas told CO. In turn, the company has deployed that capital via a variety of ambitious projects.

In April, Boston Properties topped off Salesforce Tower in San Francisco—the 1,070-foot-tall, 1.4-million-square-foot office property that on completion will become the tallest building in the country west of Chicago. In New York, the REIT is teaming up with Rudin Management Company and WeWork on Dock 72, the 675,000-square-foot Brooklyn Navy Yard office development that will be delivered next year.

“Most of our new investments today are in developments rather than acquisitions,” Thomas explained. “The reason for that is we’re building brand-new buildings at higher yields and a lower price per square foot than where existing, stabilized assets are trading.” He pegged Boston Properties’ current development pipeline at “a little over” $2.2 billion.

Meanwhile, the company has set its sights on what will become its fifth core market: Los Angeles, where it acquired Blackstone Group’s 50 percent stake in the six-building Colorado Center office complex in Santa Monica for more than $500 million last year. Thomas noted that the complex was only 68 percent leased at the time of the purchase, giving Boston Properties a “value-added angle” that it has already begun to realize.

“We’ve done well with [Colorado Center]; we’ve signed a handful of significant leases and brought [occupancy] up significantly,” he said. “We identified Los Angeles as another core market that we want to have, and our intent over time is to grow our presence there.”—R.M.

26. Jeffrey Gural, Jimmy Kuhn, Barry Gosin and David Falk

Chairman; President; CEO; President of New York Tri-State Region of Newmark Grubb Knight Frank

Last Year’s Rank: 21

Sure, there are the leases. Newmark Grubb Knight Frank did plenty of those in the last 16 months. There was, for instance, the 175,000-square-foot one that NGKF’s Neil Goldmacher arranged for Point72 Asset Management (Steven A. Cohen’s investment fund) at 55 Hudson Yards. Or there was Kramer Levin’s 265,000-square-foot renewal at 1177 Avenue of the Americas, which was the handiwork of Moshe Sukenik, Chris Mongeluzo and Brian Cohen of NGKF. Or, the law firm Hogan Lovells, which grabbed 206,720 square feet at 390 Madison Avenue, thanks to NGKF’s Sukenik. And the company even subleased 160,000 square feet of Time Inc.’s old space at 1271 Avenue of the Americas to The New York Times courtesy of NGKF’s Andrew Sachs.

But that’s not the kind of thing that seems to get Barry Gosin excited.

“We bought about [30] companies around the country in the last three years,” Gosin said, “and we have eight LOIs [or letters of intent] out to buy companies.” Among its recent purchases were the San Francisco-based real estate advisory company Regency Capital Partners; the Ohio-based brokerage Continental Realty; and Jacksonville Beach, Fla.-based multifamily investment sales brokerage Walchle Lear.

“We just opened up in Minneapolis last week,” Gosin said. “We’re basically doing it from scratch. We continue to open in new markets and explore…invest in technology, and we continue to acquire. We’re very aggressive.” (Once you get Gosin going, he can rattle off the statics as fast as gunslinger: “We hired [500] brokers in the last [three years]; we quintupled the size of the company in the last four-and-a-half years.”)

Perhaps the most significant recent move that NGKF made (at least internally) was the fact that its parent BGC Partners submitted a draft registration on Form S-1 to the S.E.C. for an initial public offering of Class A stock. Nothing is set in stone, and Gosin can’t say much about the move other than, “It should tell you we’re ready to go on another wind of growth.”—M.G.

27. Douglas Harmon and Adam Spies

Co-Chairmen of Capital Markets at Cushman & Wakefield

Last Year’s Rank: 16

Over the course of the current real estate cycle, which has seen property values for core New York City commercial assets hit astronomic heights, only a few dozen deals have broken the $1 billion barrier. Somehow, two men have had their fingerprints on an overwhelming majority of those transactions, serving as gatekeepers for anyone seeking to tap the market for high-priced Manhattan office towers.

In October, Doug Harmon and Adam Spies left their cushy jobs at Eastdil Secured to head the new capital markets group at Cushman & Wakefield. The pair are now charged with bringing their big-deal know-how to the brokerage giant, which undoubtedly has an enormous presence both in New York and nationally but has lagged significantly behind rivals Eastdil and CBRE on the investment sales front.

Harmon, Spies and their team now handle every transaction listed at $75 million and up at Cushman—a barrier that they’ve had absolutely no trouble hopping in recent years. After helping to arrange Blackstone Group’s record $5.4 billion acquisition of the Stuyvesant Town-Peter Cooper Village residential complex in 2015, Harmon and Spies followed up with a cadre of major $1 billion-plus deals last year—an impressive swansong for their time at Eastdil.

They guided AXA Financial’s enormous disposition of two Midtown office towers—the $1.9 billion sale of 787 Seventh Avenue to California-based pension fund CalPERS and the $1.7 billion purchase of 1285 Avenue of the Americas (which CalPERS co-owned with J.P. Morgan Chase) by a partnership led by Scott Rechler’s RXR Realty.

Harmon and Spies also brokered Chetrit Group and Clipper Equity’s $1.4 billion sale of the former Sony Building at 550 Madison Avenue to Saudi conglomerate Olayan Group. And in a testament to the stratospheric level of Manhattan property values, they handled two minority-stake acquisitions by foreign buyers that surpassed the $1 billion mark—the Hong Kong Monetary Authority’s $1.15 billion purchase of a 49 percent interest in 3 Bryant Park and China Investment Corporation’s $1.03 billion deal for a 45 percent stake in 1221 Avenue of the Americas.

While it’s been said that the Manhattan commercial property market can’t sustain this activity forever (and signs of a slowdown have already reared their head in places), Harmon and Spies have built a résumé suggesting that whatever direction the market goes, they’ll be able to cope just fine. Now, they have the resources of one of the world’s largest brokerages at their disposal; competitors would be wise to pay heed.—R.M.

28. Christopher Kahl, Matt Bronfman and Michael Phillips

Chairman; CEO; President of Jamestown

Last Year’s Rank: 22

Christopher Kahl was long the lone principal at Jamestown, but as of last year, there are three.

“Matt [Bronfman] and I bought part of the company, so now we are principals,” Michael Phillips said. When asked how much, Phillips responded, “We bought significant interest in the company.”

Beyond the inner workings at Jamestown, the company bought and sold a serious sum of real estate last year. Indeed, in 2016, Jamestown sold $2.45 billion worth of real estate—a company record but for 2006—and that was all concluded in the last four months of the year. The company also purchased $1.7 billion in real estate in 2016. Those figures compare with $1.5 billion in acquisitions in 2015 and $175 million in sales.

Some of the firm’s mega-sales last year included 1250 Broadway to Global Holdings Management Group for $565 million and The Falchi Building in Long Island City, Queens, to Savanna for $257 million, as well as the four-building Lantana TV production campus in the Santa Monica area of Los Angeles for $408 million to Brightstone Capital Partners and Artisan Realty Advisors.

“There were a lot of people buying,” Phillips said. “They were candidly paying up for assets.” In New York in particular, the strategy was to sell off some assets in 2016, “because we thought the market had peaked in New York. We felt it was a good time.”

On the acquisition front, Jamestown partnered with Clarion Partners to buy Westside Provisions District in Atlanta for $128 million, Phillips said.—L.E.S.

29. Sandeep Mathrani

CEO of GGP

Last Year’s Rank: 18

It’s no secret that retail had a difficult 2016, and the year did not start particularly well for GGP, either. In January alone, Barclays downgraded the Chicago-based mall giant and predicted “formidable headwinds in the mall space,” while Reuters reported that Brookfield Property Partners was considering a takeover of GGP (forcing Brookfield executives to subsequently dispel the report).

In New York, GGP—the company officially changed its name from General Growth Properties this year—had to deal with not one but two failed transactions to sell the office component of 685 Fifth Avenue, which it owns with Joe Sitt’s Thor Equities. After a deal with developer Michael Shvo fell through, the landlords struck an agreement with Turkish jewelry firm Gulaylar Group for the property last April—only for that deal to collapse, as well (Gulaylar is reportedly suing GGP and Thor for breach of contract).

Yet, despite difficult circumstances, CEO Sandeep Mathrani has continued to steer GGP clear of the considerable hazards that face a retail player of the company’s size (127 properties in 40 states). The REIT has not sat back passively in the face of market challenges, continuing to make acquisitions and plot its way forward.

Partnerships are one way the company has made life easier for itself as it navigates the current environment for retail. GGP and longtime partner Thor finally closed on the retail property at 218-222 West 57th Street for $81.5 million last June, after the deal had been held up in contract for more than two years due to litigation. The two companies also secured luxury handbag brand Coach to a 23,400-square-foot lease for a flagship store at the retail portion of 685 Fifth Avenue.

Meanwhile, GGP and Jeff Sutton’s Wharton Properties are reportedly planning to convert the third and fourth floors of the Crown Building at 730 Fifth Avenue from offices into retail space, while GGP teamed with fellow mall REIT Simon Property Group to acquire bankrupt clothing retailer Aeropostale for $243 million in September—a deal that kept the brand afloat and saved it from liquidation.—R.M.

30. Masayoshi Son, Constantine Dakolias and Ben Michelson

CEO and Founder of Softbank; Co-Chief Investment Officer; Managing Director for the Credit & Real Estate Business at Fortress Investment Group

Last Year’s Rank: 43

“In tennis, you strike a ball just after the rebound for the fastest return. It’s the same with investment,” Masayoshi Son once said. And, it’s safe to say that Son may very well be the Roger Federer of the business world…only much richer and with bigger balls in play. The Japanese billionaire’s name may not have been one that crossed your lips until recently but with his $3.3 billion purchase of private equity firm Fortress Investment Group, he’s poised to make a huge splash in U.S. commercial real estate.

“Fortress’ excellent track record speaks for itself,” Son said in a press release at the time of acquisition.

Indeed, Fortress didn’t let the grass grow under its feet in 2016 and was busy executing deals all over the U.S. Perhaps the most buzzed-about deal was the $2 billion in financing that Fortress is providing to Maefield Development and the Nederlander Organization for the redevelopment (and literal elevation) of Broadway’s Palace Theatre.

Other transactions included a $225 million construction loan for the Zaha Hadid-designed One Thousand Museum condo tower in Miami; the $122 million sale of two Cisco Systems buildings in San Jose, Calif. (along with TMG Partners); the $53.4 million sale of the 28-story, Class A Riverplace Tower office building in Jacksonville, Fla.; the $2 billion sale of coastal freight operator Florida East Coast Railway Corp and the $577 million purchase of a portfolio of (U.K. retailer) Marks & Spencer stores from Topland.

And 2017 isn’t off to too shabby a start either, with Fortress selling mountain resort operator Intrawest Resort Holdings to Aspen Skiing Company for $1.5 billion. Well worth a celebratory après-ski tipple, if you ask us.

All eyes are now on Son to see where he (and his balance sheet) takes Fortress next. Son is most widely known for his investments in telecommunication companies—Son’s SoftBank is the owner of the Japanese arm of Vodafone and acquired Sprint in a $20 billion deal—but recent investment decisions point toward a distinct interest in the U.S. generally, and real estate specifically.

In December, Son pledged that that he would invest $50 billion in the U.S. and create 50,000 new jobs, after a meeting with President Trump. And in February, around the same time of the Fortress acquisition news, it was widely reported that Softbank was close to making a $3 billion investment in WeWork. So, it seems that the “Bill Gates of Japan” is a man of his word.—C.C.

31. Richard LeFrak

Chairman and CEO of LeFrak

Last Year’s Rank: 35

In January, President Donald Trump tapped Richard LeFrak to head up a nationwide infrastructure council that will monitor a proposed $1 trillion in spending on roads, bridges, water systems, cable lines and electrical grids. But LeFrak—who heads his family’s century-old real estate business—will still remain involved in private real estate development. LeFrak had a busy 2016 and expects an even more productive 2017.

LeFrak controls 40 million square feet of residential, commercial, retail and office space across the country. He pegs his firm’s new development nationwide last year at half a billion dollars, and he expects to break ground on 1,000 more apartments this year. His biggest new construction project is in Newport, a 600-acre swath of former rail yards in Jersey City that LeFrak and his father Samuel purchased in 1985.

“I have enough sites [in Newport] for 23 more high-rise buildings,” he said. In that fast-growing waterfront neighborhood, the company finished work last year on a seven-story, 163-unit rental building called Embankment House. And it’s wrapping up construction on a 43-story, 376-unit rental tower called the Ellipse, which juts out into the Hudson River and is easy to see from Lower Manhattan. Tenants are expected to move in in July.

Here in New York City, the firm recently entered contract to buy the Dumont Hotel, a 37-story, 252-key property at 150 East 34th Street in Kips Bay. After the sale closes in June, the firm plans to convert the building to 280 condos, according to LeFrak.

The developer also hopes to break ground this year on a $4 billion mixed-use project called Sole Mia in Miami. He’ll start work on the first two rental buildings, totaling 400 units, in the next six weeks. By the time the master-planned community is complete in a decade or two, it will encompass 4,300 apartments and 1.5 million square feet of commercial space.

Ultimately, LeFrak notes, he owns so much property that he can wait out a slow real estate market. “Between New Jersey, California and Florida, I have sites that could support up to 9,000 units,” he explained. “They could be done in five years, 10 years, 15 years—depends on the market. I’ve been in the business 50 years; I’ll be in it for another 50 years. If [the market] is a little soft right now, it’s not a tragedy.”—R.B.R.

32. Christopher Schlank and Nicholas Bienstock

Founders and Co-Managing Partners of Savanna

Last Year’s Rank: 33

For Nicholas Bienstock and Christopher Schlank, last year was mostly about constructing or renovating properties that their firm had acquired in previous years.

Savanna completed the office conversion of its two industrial properties in the outer boroughs: the 170,000-square-foot former Schlitz Brewery at 95 Evergreen Avenue in Bushwick, Brooklyn, and the 172,000-square-foot Bruckner Building at 2417 Third Avenue in the South Bronx. Now, it’s working on leasing both projects.

Savanna also topped out 540 West 26th Street in Manhattan, a 166,000-square-foot office building, and leased half of the property to Avenues: The World School. Last year, the developer also began constructing Vandewater, a ground-up 32-story, 250,000-square-foot condominium at 543 West 122nd Street. The building will comprise 170 units and is just a block from Columbia University, Schlank and Bienstock’s alma mater.

To top it all off, Savanna started building a new 80,000-square-foot office building at 106 West 56th Street in the Plaza District.

“The market has been a little bit up and down, and the uncertainty around the election kind of stalled the market,” Schlank said. “What we are focused on now is redeveloping the assets that we have [acquired] over the past two years. So we are in transition.”

Currently, the company has 7.3 million square feet in its portfolio. Following its model to buy, redevelop, lease up and then sell within five to seven years, Savanna is counting on the fact that its efforts to build today will eventually reap big rewards.

“We like to buy it, love it, kiss it and see it grow up a little bit,” Schlank said. “I think what is very important is that we are not flippers: We are value-add people. Really the money we make is on the repositions and the transition.”

While construction and redevelopment took much of the team’s attention, it wasn’t the only thing Savanna did last year.

The developer added to its Queens holdings by purchasing the 711,000-square-foot Falchi Building in Long Island City, Queens, from Jamestown in October for $255 million. (Savanna also owns the 50-story One Court Square in LIC, which is currently the tallest building in New York City outside of Manhattan.)

And the company recently sold its 20,619-square-foot retail condo at 10 Madison Square West to TH Real Estate for $97.5 million, after leasing nearly the entire space to PetSmart.

In Brooklyn, Savanna is earlier in the cycle, completing a rezoning process of a development site at 141 Willoughby Street, in Downtown Brooklyn, that brought its buildable square footage to 400,000 square feet from just 167,000 square feet. Bienstock and Schlank said they are planning a mixed-use office and retail building at the site.—L.L.G.

33. Peter Riguardi

Chairman and President of the Tri-State Region at JLL

Last Year’s Rank: 36

Early this year Peter Riguardi took home the Real Estate Board of New York’s Louis Smadbeck Broker Recognition Award, which “celebrates a commercial broker with exceptional personal and professional integrity, leadership and prominence in the brokerage community.”

He definitely has the leadership part down: Riguardi oversees more than 2,000 people (brokers and staff), he said. And he leads by example, as he was involved in many of the most-talked-about deals that have recently closed.

Most notably, at the end of last year, Riguardi led a JLL team that represented private equity firm BlackRock in its 850,000-square-foot lease at Related Companies’ and Oxford Properties Group’s 50 Hudson Yards.

“I think Hudson Yards has really answered a lot of questions for companies,” Riguardi said. “Companies are really excited about new space, and it’s more efficient [space]. There are more modern amenities, and companies are more concerned about having a work-life balance. I think [Hudson Yards] has created a great solution, and [that’s] why BlackRock and others felt it was the best place in the future to retain and attract top talent.”

Of course, there are not many whales like the BlackRock deal, but Riguardi managed a steady diet of transactions, like a 78,000-square-foot deal for WeWork at Metropolitan Tower at 142 West 57th Street.

Riguardi has already started 2017 with a bang, leading a JLL team to represent landlord Fosun Property Holdings at 28 Liberty Street in signing the New York State attorney general’s office to a 345,000-square-foot space. He also led another set of JLL brokers in negotiations for Spotify, which inked a 378,000-square-foot lease at 4 World Trade Center this February.

And, only a few weeks ago, his team brokered a 548,000-square-foot renewal at 452 Fifth Avenue for HSBC.—L.L.G.

34. Mitchell Steir and Michael Colacino

Chairman and CEO; President of Savills Studley

Last Year’s Rank: 23

Savills Studley had a busy year brokering deals for notable tenants, including representing Canada’s U.N. Mission and Consulate General in a 15-year lease for 97,000-square-feet at 237 Park Avenue; securing a 706,000-square-foot facility for Fabuwood Cabinetry in Newark, N.J., for what the company says is the largest industrial facility in the state’s history; and 95,000 square feet for RSM US LLP, in a 15-year deal that closed earlier this year, for two floors and part of a third at 4 Times Square.

Michael Colacino said the company’s primary focus for 2016 was further growth.

“We’re part of a public company, and the way public companies work is, standing still is going backward. So we’ve got a mandate to grow,” Colacino said. “We have a specific focus on what the platform needs to be and how it needs to expand, and that includes geography, with tenant rep talent across the country, and a big focus in 2016 on the capital markets business.”

As such, Savills Studley effected growth in all areas of its business. The company opened three new offices—in Baltimore, Charlotte, N.C., and Atlanta—in 2016, while acquiring several offices from other companies, including Cresa. These include Cresa’s Orange County office of 40 tenant representatives and offices in Durham and Charlotte in North Carolina that will bring 22 more brokers aboard.

Savills Studley also brought on several top performers including Melissa Marsh, who has more than doubled the size of its workplace strategy team since joining in early 2016. And the company has created a retail services group in New York and launched Savills Studley Academy, for training the next generation of company leaders.