Sunday Summary: Thanks, Jane!

By The Editors February 16, 2025 9:00 am

reprints

The post-pandemic office recovery in Manhattan was real last year — except downtown.

While Midtown and Midtown South saw headline-grabbing deals and spikes in leasing, Lower Manhattan was a bit left out. Downtown ended the year with 2.3 million square feet of deals signed, a 9.3 percent year-over-year drop, according to Cushman & Wakefield. The fourth quarter only saw 382,744 square feet of leases, a 36.9 percent quarterly decline.

And the deals at the end of the year were small. The neighborhood didn’t see anything over 50,000 square feet in the fourth quarter, and the average deal size only came in at 5,530 square feet, the report found.

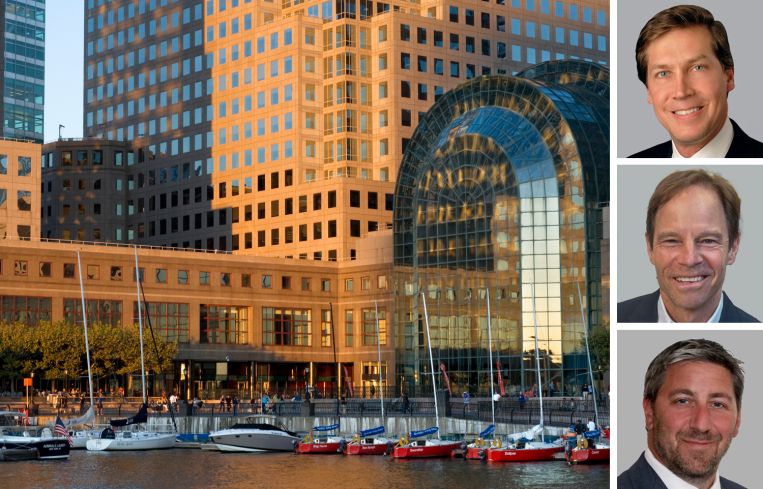

But all that changed Friday when Jane Street Capital gave the neighborhood a great Valentine’s Day gift by signing a “long-term” lease to stay put at 250 Vesey Street in Brookfield Place and grow to nearly 1 million square feet.

The trading firm has been in the building since 2014 and had nearly 600,000 square feet but was looking to grow and considered moving next door to 300 Vesey Street. But Brookfield decided to give up some of its own offices at 250 Vesey so Jane Street could have one address for its global headquarters.

And it wasn’t the only deal signed in the neighborhood last week (though the others were much, much smaller). The German American Chamber of Commerce in New York took 11,465 square feet at 120 Wall Street, the Municipal Art Society of New York inked a 7,010-square-foot deal at 111 Broadway, and Pickle1 signed on for 5,060 square feet to open a pickleball court at 100 Pearl Street (guess this trend will never die).

Lower Manhattan didn’t have all the leasing fun, though. WeWork signed on for 112,000 square feet at 5 Manhattan West (hey, another Brookfield property!) to manage an office space for Amazon, the second recent lease WeWork took on behalf of Amazon.

Meanwhile, Capital One inked a 96,606-square-foot expansion at 114 Fifth Avenue, where it already had 116,926 square feet.

Big money, no whammies

Some investors think property values have reached their low point, and they’re putting their money where their mouth is.

KKR announced a new $850 million credit fund to target high-quality properties in the U.S. and Europe and acquire commercial mortgage-backed securities loans.

And they’re not the only one splashing money on real estate purchases. Welltower reported it spent $2.4 billion in the fourth quarter alone to buy new senior and assisted living properties, thanks to distress from mortgage defaults providing big discounts.

The real estate investment trust also has $8.7 billion of available liquidity ready to go and plans to make more purchases in 2025.

Meanwhile, Brookfield reported a record high of more than $135 billion capital raised in 2024, deployed $48 billion of it last year, and announced an approximately $21 billion investment in infrastructure to support artificial intelligence in France (there’s a joke in there, but we won’t make it).

And it’s not just U.S. companies investing in Europe. Despite President Trump threatening tariffs around the world, plenty of foreign buyers are expected to pick up assets across the country this year as the U.S. remains a magnet for foreign capital.

“There’s more groups investing again, more groups on offense, and also some early green shoots from some of the core investors who have been on the sidelines the past couple of years,” Lauro Ferroni, JLL’s head of capital markets research for the Americas, told Commercial Observer.

People aren’t only planning to spend serious coin solely on hard assets in 2025. Thanks to macroeconomic conditions like clarity on borrowing costs and pent-up demand, experts expect mergers and acquisitions of real estate investment trusts to boom this year.

“The general sense in M&A across REITs and other sectors is that there’s going to be a lot of activity this year because regulations are decreasing under the new administration, and because the economy is performing well,” Robin Panovka, who co-chairs law firm Wachtell, Lipton, Rosen & Katz’s real estate and REIT M&A practice, told CO. “But the wild card is interest rates — that’s what’s been holding back a lot of transactions.”

It’s earnings season!

The fourth-quarter earnings kept rolling in last week. We had Newmark reporting it increased its capital markets transaction volume by 20 percent year-over-year with plans for more growth in 2025; and CBRE setting records in nearly every cash flow metric, including revenue jumping 16 percent quarter-over-quater to $10 billion.

And Steve Roth maintained his reputation for bold statements during Vornado’s earnings call, this time declaring the work-from-home “scare” dead.

“Work from home was a scare. But as we predicted, it would not last,” Roth said. “Most [workers] have left their kitchen tables and are back at the office.”

Roth had some data to back that up as Vornado Realty Trust saw 3.34 million square feet leased in its portfolio last year, with 2.65 million of that being New York City office leases. That’s an improvement from the 2.1 million square feet of office and 299,000 square feet of retail leases it signed last year.

Beg your pardon?

Perhaps nobody will be celebrating Presidents Day tomorrow more than Mayor Eric Adams. The Democrat has been mired in many, many months of scandal, and was hit with a five-count federal indictment in September over allegedly conspiring with Turkish nationals to funnel money into his 2021 mayoral campaign.

But the mayor’s troubles might be a thing of the past thanks to a new, unlikely ally: Queens’ own Donald Trump. Despite rocky relationships with New York City mayors past, Trump reportedly directed the U.S. Department of Justice to drop the indictment against Adams.

However, Adams isn’t fully in the clear, as the charges were dismissed “without prejudice of prosecution,” meaning the case against Adams could be reopened. A leaked memo from acting U.S. Deputy Attorney General Emil Bove said part of the reason to drop the charges was so that Adams could help the Trump administration’s efforts to detain and deport undocumented immigrants.

And, days later, Adams met with border czar Tom Homan to discuss how to work together on immigration enforcement in the future. The pair even went on “Fox & Friends” together to pledge cooperation with the federal government.

But Adams might be pushing back a bit against Trump as he’s planning to sue the Trump administration over it seizing $80 million from a city bank account.

Speaking of about-faces, CO looked at how some historic buildings avoided the fates of properties like the Helmsley Building, the McGraw-Hill Building and the Chrysler Building, and instead reinvented themselves to stay competitive with flashy newcomers like One Vanderbilt.

“They’re iconic,” Hilary Spann, executive vice president of BXP’s New York region whose portfolio includes the 56-year-old General Motors Building, told CO. “Some of them are really architectural gems that you probably could not afford to build today. There are really unique, era-defining designs that come along with these buildings, and I think the simplicity of a lot of those designs has really stood the test of time.”

With that, enjoy the long weekend!

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)