Sunday Summary: Loosen the Belt, the Restaurants Are Coming!

By The Editors August 27, 2023 9:00 am

reprints

Summer is nearly over, and that means that our diet can be forgotten until June 20, 2024.

That’s very good, because South Florida has been on a restaurant kick the last week or so.

Mid-month we learned that the guys behind Dante’s HiFi, the popular Wynwood bar, were taking over Navé in Coconut Grove.

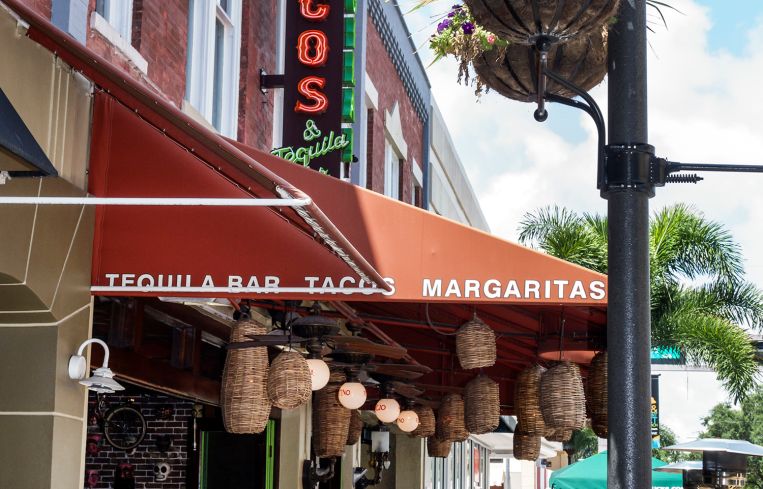

Then, last Tuesday, we heard that Rocco’s Tacos was renewing its 4,800-square-foot taqueria space at 224 Clematis Street in West Palm Beach.

And we heard another Northerner was headed south: Tutto il Giorno, the Southern Italian restaurant from Donna Karan’s daughter Gabby and her husband Gianpaolo de Felice, which has three outposts in the Hamptons, is opening a branch at the ritzy Royal Poinciana Plaza mall.

Of course, there are always alternatives to the fancy-schmancy restaurants.

While retail has by and large been keeping its head down and trying not to be talked about too much, discount grocery stores are having a moment. Aldi, the German-based grocery chain, has opened or leased 117 spots in the U.S. over the course of the last year, with plans to lease another 120. Fellow grocer Lidl has bagged about 19 leases.

In fact, grocery stores are such an alluring prospect that some companies that were never traditional grocery brands, such as Dollar General, are expanding their offerings into the space.

And, beyond grocers, there’s always the simple cup of coffee. Starbucks, for instance, just signed a lease in Brooklyn’s Midwood neighborhood next to the legendary Di Fara pizzeria.

Brother, can you spare $193 million?

All that is fine and dandy, but it was difficult to get excited when we saw this new report from Newmark saying that commercial real estate lending is down by 52 percent year-over-year.

CMBS and collateral loan obligation originations are down 79 percent. Originations by debt funds are down 73 percent. And banks are putting out 48 percent fewer deals than last year.

“I think you’d have to go back to 2009 for a similar contraction in activity, though the current environment proves more optimistic,” said David Bitner, executive managing director of global research at Newmark. “I predict that banks will be less active as a source of credit in CRE in the coming years.”

It’s no wonder when you see some of the misery in the office sector. Charles Schwab issued a filing last week which solidified plans to close offices in Atlanta, San Antonio, San Diego, St. Louis and Tampa while at the same time reducing its real estate presence in Boston, Chicago, San Francisco, Jersey City and Nevada.

And after going broke, Vice Media says it will continue without its Williamsburg office.

Having said that, Berkadia would like a word.

An analysis of Federal Reserve and Real Capital Analytics data found that multifamily lending has actually been fairly steady since the regional banking meltdown this spring.

“My initial hypothesis was we’d see a supreme dry-up in bank lending, and that just didn’t materialize,” said Josh Bodin, senior vice president of securities trading at Berkadia, who co-authored the study. “While we’re seeing caution in bank lending, the second quarter supported the idea that there wasn’t nearly as much pullback as we thought there’d be.”

Indeed, money is out there for the right project.

Panepinto Properties just landed $193 million of construction financing from Pacific Life to build Pathside, a 605-unit luxury high rise in Jersey City.

Pacific Life also put out another $94 million to LCOR for its 28-story tower in New Rochelle, N.Y.

And Estate Companies secured $170.8 million in financing for two projects in North Miami Beach and Hollywood, Fla.

Beyond just finishing projects that have been in the works for a long time, there is still an appetite for trades. Avalon Bay Communities sold the 269-unit Jasper Columbia Pike in Arlington, Va., for $105 million to Penzance. (And, while plenty of firms are taking a haircut on their properties, Avalon Bay got out of it reasonably well — it purchased it in 2016 for $102 million.)

Plus, Related Companies laid out $194.6 million for a site in West Palm Beach that starchitect Robert A.M. Stern will design.

As for industrial…

Money is certainly there for industrial. AEW Capital Management just loaned Blackstone $51 million to build a new warehouse on an 8-acre lot in Miami-Dade County. (Of course, Blackstone is always busy. Did we mention that it just sold a stake in the Bellagio in Las Vegas to Realty Income in a deal that valued the hotel at $1 billion more than Blackstone paid for it? Just another sleepy August week for what may be the world’s biggest private landlord…)

Birtcher Development scored $75 million to build a Class A, 492,631-square-foot logistics facility in the Inland Empire.

Taurus Investment Holdings just picked up a portfolio of 12 Class B industrial buildings in Dallas and Atlanta for $124 million.

And Rexford Industrial Realty acquired two fully leased properties in Southern California’s Santa Clarita Valley for $38 million.

Sunday reading

There’s been a lot of talk about AI lately. It could be good. It could be bad. It could take over the world in some sort of Terminator scenario.

But it’s a reality in CRE. To wit, JLL this month rolled out JLL GPT, which it claims is the industry’s first bespoke AI.

Some of this will be used to improve building efficiencies, generate 3D models for prospective clients, do some risk analysis, and more.

“It has a chat-like interface which is enabling the entire JLL workforce to use that interface to actually ask questions and to do different kinds of work that they need for their day-to-day operations,” said Yao Morin, chief technology officer at JLL.

We just hope JLL GPT co-opts Pest Share, the newest and perhaps most important property technology out there.

See you next week!