Life Sciences Continues to Roll as Other Real Estate Sectors Buckle

By Tom Acitelli October 16, 2020 6:00 am

reprints

It’s not news that the life sciences industry is weathering the pandemic particularly well. A new report shows just how well it’s doing, however.

Even before the coronavirus swept into the U.S. toward the start of 2020, the pharmaceutical, medical, telemedical, biomanufacturing and biotechnology companies that comprise the bulk of the life sciences industry were hiring in droves and building hundreds of thousands of square feet of new lab and office space. Projects such as Deerfield’s nearly 327,000-square-foot redevelopment of 345 Park Avenue South and Janus Property’s 350,000-square-foot conversion of a former bakery at 450 West 126th Street, both in New York City, are transforming streetscapes and submarket dynamics.

In the San Francisco and Boston regions, the industry was and remains one of the animating forces in the local real estate and jobs markets (never mind pretty sweet for the local tax bases).

These trends have largely held through the pandemic, a new CBRE report finds.

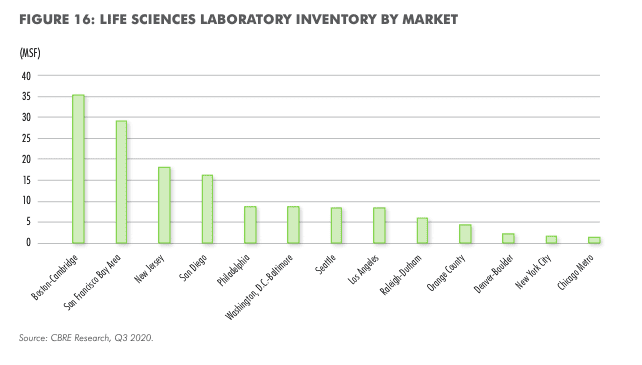

Pick a stat. The amount of total commercial laboratory space has grow 12 percent nationally in 2020, to 95 million square feet, with another 11 million square feet under construction (see chart below for where life sciences already commands quite a bit of inventory). The number of life sciences jobs is slightly higher than it was a year ago, with employment in biotechnology research and development particularly robust. It’s up 4.9 percent annually—and outpacing employment growth in the almighty tech sector.

Meanwhile, investment keeps pouring in. Total venture capital funding for life sciences for the 12 months ended June 30 was $17.8 billion, a yearly record. And federal funding for major universities and health care institutions for life sciences research is expected to increase 6 percent this year, to $42 billion, according to CBRE.

Even the bad news isn’t so bad. The $9.6 billion in sales of lab and R&D properties over the 12 months ended June 30 represented an 18 percent drop from the 12 months before. Pricing remains competitive for life sciences properties, though, CBRE said.

There are a few reasons for this strength. Call them pre-existing conditions. Before COVID, it was demand from a fast-aging U.S. population. An estimated 10,000 people were turning 65 every day by 2019, according to census data, and 21 percent of the U.S. population is expected to be at least that age by 2030. Plus, new technologies and discoveries in gene and cell therapies as well as artificial intelligence furthered research and investment in those fields.

Now, of course, the big driver is COVID and the race to find therapeutics and a vaccine for it.

“Interest in the life sciences sector from developers, investors and financial backers already was strong in recent years, and the unfortunate arrival of COVID-19 brought even more attention and capital into the sector,” Steve Purpura, a CBRE vice chairman in charge of the brokerage’s life sciences practice in the Northeast, said in statement.

The Boston area and the San Francisco Bay Area remain the top life sciences hubs in the U.S., with New Jersey, the Washington-Baltimore corridor, and the San Diego metro also heavily represented in terms of employment and R&D investment.

Life sciences’ endurance comes, of course, as other commercial real estate sectors struggle mightily amid the pandemic. Hospitality continues to tank, office leasing and sales remain anemic in major markets such as New York and Los Angeles, and retail — well, retail had weaknesses pre-pandemic like life sciences had strengths; and, like with those, the pandemic has only accentuated things. Only industrial has really held up comparable to life sciences, and that helps explain a lot about retail’s travails.