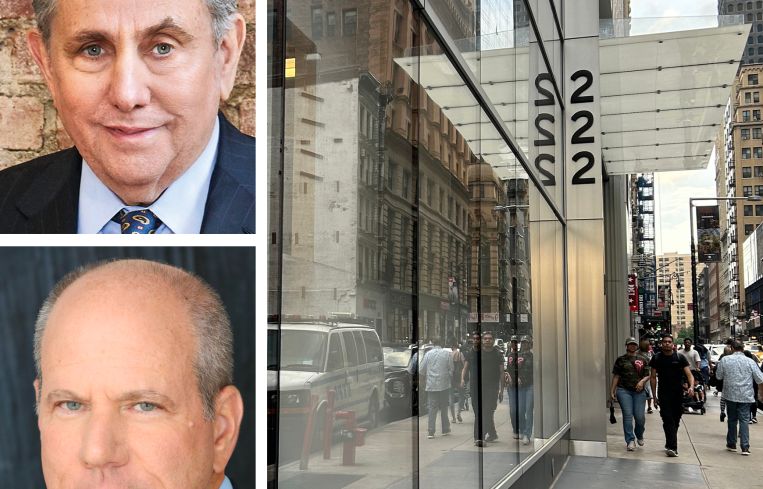

GFP and TPG Submit Plans for 800-Unit Office-to-Residential Conversion in FiDi

By Isabelle Durso August 12, 2024 3:36 pm

reprints

GFP Real Estate and TPG Real Estate’s plans for a major office-to-residential conversion at 222 Broadway in the Financial District just got a bit clearer.

The companies submitted an alteration application to the New York City Department of Buildings on Aug. 7, calling for the 31-story, 756,138-square-foot office building to be turned into 798 apartments, according to city records. The estimated job cost is approximately $43.6 million, the application shows.

GFP and TPG declined to comment. PincusCo first reported the filing.

Scott Beadle, head of development at GFP, filed the new plans for the building, while CetraRuddy Architecture was listed as the architect.

TPG, formerly known as Texas Pacific Group, partnered with GFP to buy 222 Broadway from DWS for $150 million in early June, with plans to turn the property into residential, Commercial Observer previously reported.

Office-to-residential conversions have been on the rise in New York recently as a way to both deal with the city’s housing shortage and its office surplus resulting from the pandemic.

New York City’s Office Conversion Accelerator Program found that the owners of 64 office buildings in the city have expressed interest in conversions, the Gothamist reported in May.

And this won’t be the only office-to-residential project in the pipeline for Jeff Gural’s GFP.

Just last year, GFP partnered with the Brodsky Organization and The Sorgente Group to transform the Flatiron Building into residential apartments and is in the market for $350 million to finance the work, CO previously reported. Plus, GFP teamed with Metro Loft Management and Rockwood Capital on the redevelopment of 25 Water Street into residential, landing a $535.8 million acquisition and construction loan for the project in December.

But office-to-residential conversions are much easier said than done. Developers have run into issues like outdated and incompatible infrastructure, tricky installations, and the feat of turning retail space into communal spaces.

On the plus side, construction costs for conversions are less costly than a ground-up development, and conversions take less time to complete than erecting new buildings.

Isabelle Durso can be reached at idurso@commercialobserver.com.