MSD, Apollo Close $536M Loan for 25 Water Street’s Office-to-Resi Conversion

Led by GFP, Metro Loft and Rockwood, the conversion is the largest ever in the U.S.

By Cathy Cunningham December 22, 2022 10:54 am

reprints

GFP Real Estate, Metro Loft Management and Rockwood Capital have landed a $535.8 million loan for the acquisition and redevelopment of 25 Water Street, with the plan to turn the Financial District office building into a residential tower, Commercial Observer can first report.

MSD Partners and Apollo provided the loan, and the deal closed Thursday morning.

Newmark’s Dustin Stolly and Jordan Roeschlaub, vice chairmen and co-heads of the brokerage’s debt and structured finance team, arranged the financing along with Chris Kramer, a senior managing director at the firm.

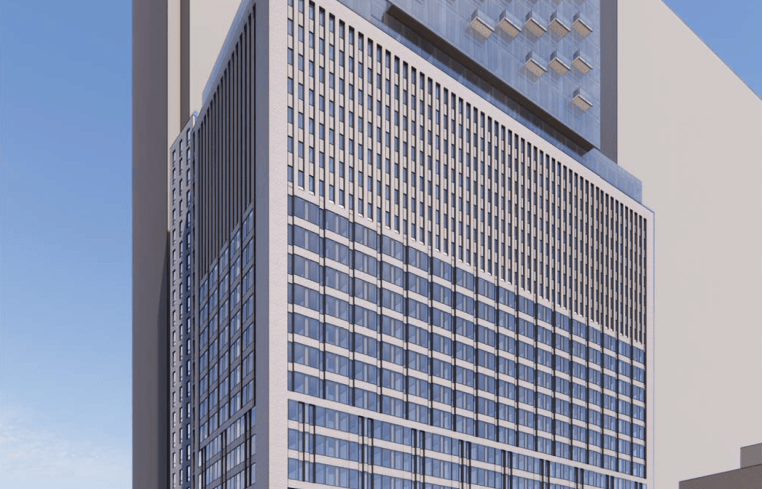

The deal — which will see the 22-story, 1.1 million-square-foot office building transformed into a 1,300-unit residential tower — represents the largest ever transaction of its kind in the U.S., according to Real Capital Analytics data cited by Newmark. Closing at a time when big loans, especially construction loans, are hard to come by, it’s also one of the biggest debt deals to close this quarter.

“We are pleased to join with Apollo in providing a $535.8 million loan to GFP Real Estate, Metro Loft Management and Rockwood Capital, the sponsors of 25 Water Street, for the acquisition and redevelopment of this special property,” Jason Kollander, MSD Partners’ co-head of real estate credit, said.

“The conversion of 25 Water Street will create a unique residential property in the fast-growing Financial District and we are excited to support this world-class sponsorship team in realizing this project,” Adam Piekarski, MSD Partners’ co-head of real estate credit, added.

Erected in 1969, 25 Water Street — formerly known as 4 New York Plaza — was designed by Carson Lundin & Shaw to house bank Manufacturers Hanover Trust. Over the years, it’s been home to high-profile tenants, including the New York Daily News and JPMorgan Chase.

Boasting views across Lower Manhattan and New York Harbor, the building also has floor plates ripe for multifamily conversion, positioning it well for its next chapter.

When its redevelopment is complete, the new 25 Water Street will feature units ranging from studios to four-bedroom apartments, and an amenity package that includes a basketball court, a steam room, indoor and outdoor pools and sports stimulators. The building is also expected to feature a sky lounge, rooftop terrace and coworking spaces.

“When complete, 25 Water Street will be the largest property ever to be converted from commercial to residential,” Brian Steinwurtzel, co-chief executive officer of GFP Real Estate, told CO. “GFP Real Estate and its partner, Metro Loft Management, are excited to bring some 1300 new rental units to New York’s burgeoning downtown, which has seen a number of successful conversions over the past two decades. We’d like to thank Newmark for their tireless work securing the financing for this incredible, visionary development.”

The Real Deal reported earlier this year that Jeffrey Gural’s GFP and Metro Loft were in contract to acquire the asset from its previous owner Edge Funds, which bought it for $270 million back in 2012 and, more recently, that MSD would lead a construction loan for its residential conversion.

The asset ultimately changed hands via a loan sale, which was led by Newmark’s Stolly and Roeschlaub, along with Brett Siegel and Evan Layne, vice chairmen and co-heads of New York capital markets investment sales at Newmark.

Nathan Berman’s Metro Loft is no stranger to office-to-resi conversions, having completed transactions spanning 5 million square feet over the past two decades. Those conversions include 180 Water Street, 67 Wall Street, 20 Broad Street, 20 Exchange Place and 116 John Street — acquired by Silverstein Properties a year ago — to name a few. Earlier this month, Bloomberg reported that the firm, together with Fortress Investment Group, is nearing a deal to acquire a stake in 85 Broad Street with conversion plans for the former Goldman Sachs headquarters building.

GFP, too, has plenty of experience up its sleeve, having recently purchased and redeveloped 13 buildings spanning 3.9 million square feet. The firm completed the $550 million renovation of David Geffen Hall at Lincoln Center for the Performing Arts, which reopened on Oct. 8 to much fanfare.

And, they’re certainly not alone in seeing the value in repositioning tired, vacancy-ridden office buildings into in-demand, luxury multifamily assets. In early December, Silverstein Properties announced a $1.5 billion fund targeting that exact strategy.

Apollo officials declined to comment. Officials at GFP didn’t immediately return requests for comment.

Cathy Cunningham can be reached at ccunningham@commercialobserver.com.