Sunday Summary: Some Pretty, Pretty, Pretty Good Deals

By The Editors April 21, 2024 9:00 am

reprints

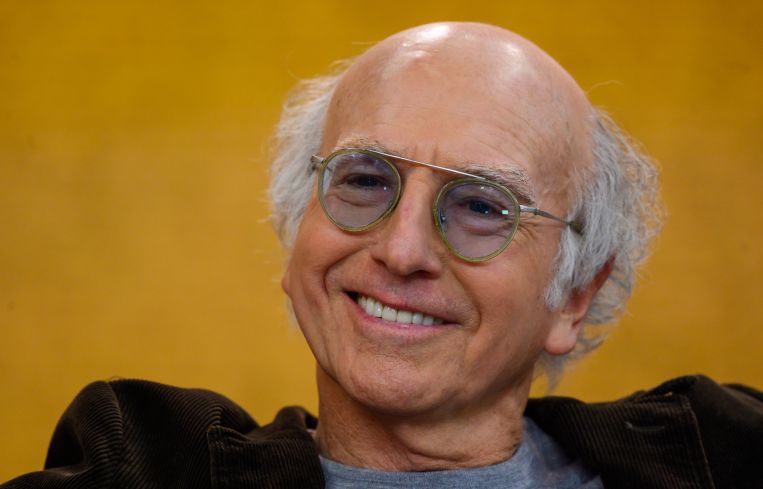

It’s been two full weeks since “Curb Your Enthusiasm” went off the air and we’re finally starting to go outside and talk to people again…

One of the things we most thrilled to about the obscenely wealthy New York transplant to California was his “pretty, pretty good” catchphrase. Nothing on television has ever captured both good things and bad things simply depending on a person’s cadence. (Although, let’s face it, the “pretty, pretty’s” were mostly bad.)

We had some pretty, pretty disappointing news from Federal Reserve chief Jerome Powell this week when he essentially told us to forget about the spring rate cut we had all been counting on.

“Recent data have clearly not given us greater confidence” that inflation is under control, Powell said on a panel discussion at the Wilson Center in Washington, D.C., last Tuesday. This “instead indicate[s] that it’s likely to take longer than expected to achieve that confidence” before cutting can begin.

When Commercial Observer followed up with the Fed, they declined to say anything else.

We imagine that CRE professionals were channeling their inner-Susie Essman. (Oh, and did we mention that the CRE CLO distress rate had reached above 10 percent? Cue Susie again.)

‘The Tivo guy was here!’

One thing that Larry was never very good at was cultivating long-term relationships (at least the romantic ones) but we concede that they’re difficult.

Sometimes even two legends of the industry will part ways, as happened this week when Andrew Farkas’s Island Capital Group apparently walked away from a partnership with Marty Burger’s new Infinity Global Real Estate.

“While discussions were held, a final deal was never formalized, but Marty and Andrew have tremendous respect for each other,” said a spokesperson for Infinity. “Infinity’s focus remains on building its three platforms: debt strategies, equity acquisitions, and development.”

However, that doesn’t mean that other relationships weren’t cultivated last week. Kristin Rebeck was just hired by Lee & Associates to grow their footprint in the Washington, D.C., area. Oh, and the Moinian Group just lured Nick Berger away from Newmark to head up commercial leasing for the real estate giant.

Social assassin

One of Larry’s greatest (and most terrible) traits was his honesty. He couldn’t keep a critique to himself. But honesty is often what’s needed.

And CO got a little injection of brute (but on-the-money) criticism of the New York real estate market when we sat down with Colliers’ Michael Cohen this week.

“I don’t really see us leasing our way back to 10 percent [availability], or anything near 10 percent,” Cohen said. “Improved leasing can reasonably be part of the equation, but it’s not the single factor… Job growth alone, which has historically been the way we lease ourselves out of the troughs of the market cycle, is not going to be sufficient. We’re going to have to look for other ways to reduce the oversupply to a more manageable number, closer to that 10 percent equilibrium.”

Although, heck, there were some pretty, pretty good leases this week. (For real!) Coinbase, Brian Armstrong and Fred Ehrsam’s cryptocurrency exchange, just took 67,000 square feet at SL Green’s One Madison. Over at SL Green and Vornado’s 280 Park Avenue, Antares Capital, the private equity firm, expanded its footprint from 55,000 square feet up to 76,000. (Speaking of 280 Park, the landlords just modified and extended a $1.075 billion mortgage. Pretty good!)

And it isn’t as though landlords aren’t trying. There are beautiful offices coming online, like Taconic Partners and Nuveen Real Estate’s 28-story One Grand that SHoP Architects designed, which features a 444-seat public school below a sleek, terraced office 100 feet in the sky.

But no office is being cheered louder than Ken Griffin’s Citadel project: a 62-story, 1.8 million-square-foot colossus at 350 Park Avenue being developed by Rudin and Vornado Realty Trust.

Plans were released last week at the Association for a Better New York’s power breakfast, which included a statement not only out of the elusive Vornado head Steve Roth (“350 Park Avenue … will reinforce New York City as the financial capital of the world and Park Avenue as the premier business boulevard”) but out of New York Mayor Eric Adams, too, who gushed that the tower will mean 6,000 jobs not to mention $36 million to the East Midtown Public Realm Improvement Fund. “Today, we are doubling down on our efforts to build a ‘new’ New York with a project that will help supercharge our economy and expand New York City’s iconic skyline,” Adams said.

Reciprocity pact

Larry was never against games of chance and neither is the New York City Council.

For a body that has its share of disagreements (to put it mildly!) they didn’t sit on their thumbs last week when it came to bringing a casino to Gotham; they swiftly passed a bill allowing for zoning changes for gaming facilities if New York does, indeed, get one of the casino licenses that Albany will be awarding.

More surprising, New York’s state government showed more glimmers of compromise than we’ve seen in months when the “parameters for a conceptual agreement” on the state budget were agreed to last Monday.

The plan would mean an incentive for mixed-income housing development and allowing residential development on state-owned land. Oh, yeah — and tenant protections.

“We’ve reached an agreement that will make this happen and extend protections to tenants in New York that have never been available before,” Hochul said in announcing the framework. “These new measures represent the most comprehensive new housing policy our state has seen in three generations. This is a landmark deal, and I’m really proud of it.”

Exciting stuff — if it happens. As of Friday evening the legislation had still not made its way to Hochul’s desk.

The navigation system!

Upon figuring out how to use his car’s GPS, Larry once triumphantly declared “I can’t wait to call my parents!”

No, Larry was not what you would call technologically savvy.

But, in all likelihood, that kind of fecklessness will probably be a thing of the past pretty soon.

As much of a shock as COVID threw into the office system, Generative AI is going to be even bigger and it’s coming soon.

CO took a look at what AI would do to the office market, and it’s the big looming problem few people are talking about.

Sorry if we just cast a cloud over your Sunday. But we’ve had a cloud over our Sunday since Larry David packed it in.

See you next week!