Sunday Summary: Strap on Your Battery Belt

By The Editors January 28, 2024 9:00 am

reprints

Maybe it was the soggy, lukewarm weather, but those stuck in New York City last week were yearning for some sunshine. Or at least some Sunshine State.

So the good folks at Commercial Observer sat down with 13th Floor’s Arnaud Karsenti (himself an émigré from the damp regions of France) to talk about Miami, the Fed, distressed assets, and the $300 million fund that he’s currently deploying.

“We’re deeply invested in the residential mixed-use space in Florida and the Southeast,” Karsenti said — specifically, multifamily, SFRs and condos. “Within those three buckets, we are seeing a lot of different scale opportunities — some of them are entry-level workforce, some of them are higher-end luxury product projects. But, overall, they’re addressing a unanimous trend, which is the high demand from the population that wants more product in Florida that’s high quality and good value.”

Of course, some in South Florida are seeing opportunities in other asset classes, too. In Downtown Miami, Elysee Investment Company and Pan Am Equities purchased the 225,054-square-foot Time Century Jewelry Center, at 1 NE First Street for $27.5 million from Yair Levy (a few steps ahead of a foreclosure auction).

And, Bondi Sushi, the chichi Japanese eatery, just signed a lease for its first Broward County location at Oaklyn in Fort Lauderdale. All in all, it makes us want to head south.

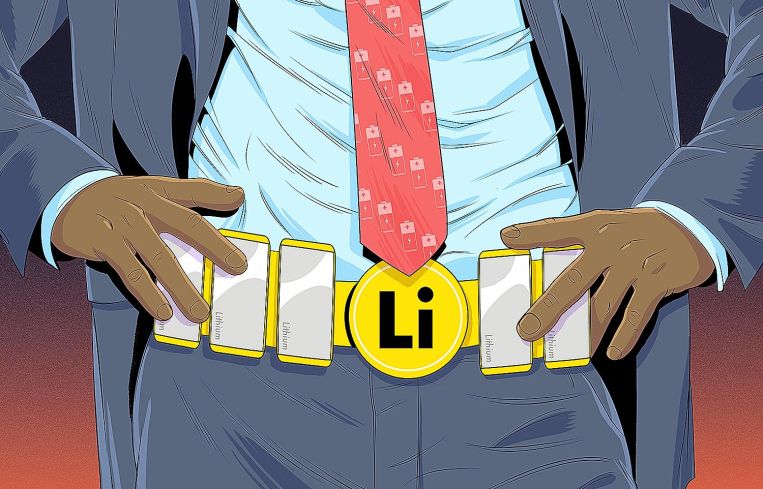

Strap on your belt

We don’t just mean Florida, per se. We can go to, say, Kentucky.

You’ve heard of the Rust Belt, and the Sun Belt. … Well, the newest belt that the real estate profession is promoting is the (ahem) “Battery Belt.”

By battery, they mean the centers where electric cars are being built.

Twin 4 million-square-foot battery manufacturing campuses are being built for Ford Motor Company and South Korean firm SK On in Glendale, Ky., which promise to be among the biggest in the world and are proving a boon to the local real estate.

“We’re already seeing the growth,” Margy Poorman, president and CEO at the Hardin County Chamber of Commerce, told CO. “We are seeing that farmland gets purchased with the anticipation of building single-family homes. They’re building apartments and luxury apartments in that area. Commercial and industrial property has also been snapped up very quickly in our area.”

The shuffle continues

There was another smattering of people moves in Gotham last week.

Sayo Kamara, one of CO’s top young professionals from 2019, left his perch at Cushman & Wakefield, where he was a senior associate, to go to the Durst Organization to be associate director on the commercial leasing team. And we, at CO, feel we brought the match about (albeit unintentionally) because apparently Kamara first met Durst’s David Neil at a CO event. (Cue “Matchmaker, matchmaker!” from “Fiddler on the Roof.”)

We also learned that Steven Rotter and Howard Hersch have left JLL and gone over to Newmark. Rotter and Hersch were superstars at JLL; their team had done more than 12 million square feet of leasing since 2018 and had some serious blue-chip clients like KKR and Rolls-Royce. (What the heck is Barry Gosin doing to lure brokers in? Whatever it is, it’s working. Speaking of Gosin, he was one of several esteemed names we interviewed on the red carpet for REBNY’s gala earlier this month — you can check out the video here.)

And there was even some CEO news. M&T Realty Capital Corporation (the off-balance-sheet lending practice of M&T) named Michael Edelman to take over as CEO from Michael Berman. Edelman has been president of M&T RCC for two years, and has done stints at Capital One and Freddie Mac.

The NYC leasing continues

The burst of Midtown office leasing at the beginning of the year hasn’t seemed to have abated in the least.

Evercore, the financial firm, took an impressive 95,000 square feet at Fisher Brothers’ 55 East 52nd Street. RXR’s 530 Fifth Avenue scored two leases with the recruiting firm Major, Lindsey & Africa taking 12,293 square feet and the software firm Operative taking 9,751 square feet. SL Green Realty racked up three leases at 1185 Avenue of the Americas with ICBC Standard Resources (an arm of ICBC) taking 14,728 square feet, Slatebook taking 14,428 square feet (we don’t know what Slatebook exactly does, either) and Ryan Specialty taking 12,803 square feet. And Greater New York Mutual Insurance took 52,2116 square feet at the Empire State Building. Oh, and Silverstein got the YMCA Retirement Fund into space at 1177 Avenue of the Americas.

Of course, it wasn’t all Midtown. In the Flatiron District, EmblemHealth renewed its lease at 21 East 22nd Street, but we can’t say that Midtown hasn’t been on a roll.

Speaking of which….

Super owner Jeff Sutton has been on something of a roll in Midtown himself.

Sutton’s Wharton Properties and SL Green sold a 115,000-square-foot retail condo to Gucci’s parent company Kering at 715-717 Fifth Avenue for an eye-popping $963 million!

This was Sutton’s third major deal since December. Prada purchased not one but two Fifth Avenue properties from Wharton, at 724 and 720 Fifth Avenue, for a combined $825 million!

Let’s get back to multifamily

Of course, office and retail have had their struggles, and that’s one of the big question marks lingering over the NYC market, but residential and multifamily is its own story.

And it looks like there is at least one Midtown property that the city considers ripe for conversion: 850 Third Avenue.

Along with Downtown’s 175 Water Street, the New York City Industrial Development Agency is planning to give the two properties a combined $100 million in tax breaks as a part of Eric Adams’s M-CORE (Manhattan Commercial Revitalization) program, with the idea being that they would be converted into residential.

We saw another big housing push with the City Planning Commission deciding to certify a rezoning plan to build some 7,000 new units of housing along 46 blocks in the Bronx near future transit hubs.

We wouldn’t be surprised if this Bronx plan isn’t the first such housing initiative near transit. Part of the Biden administration’s $1.2 trillion infrastructure legislation from 2021 included billions for the Department of Transportation, and in October the administration said it would support using some of that money to convert vacant offices into housing.

Hopefully, the market can get some real clarity on values, which has been one of the biggest stumbling blocks to multifamily development. Financing fundamentals are starting to stabilize, according to a new report from CBRE

Props to that!

Before you take off for the rest of your Sunday, we would just like to note that last week CO published its proptech issue.

There were raises like PredictAP (which uses machine learning to automate real estate functions) generating some $8 million from RET Ventures among others; there was a Q&A with the Brooklyn-based tech accelerator Newlab’s new CEO Cameron Lawrence; but the story we thought most of you should read was about the crashes and consolidations that proptech as a whole is currently enduring.

“In a maturing industry like proptech there’s always a natural attrition,” said investment bank Baird’s Joshua Butler. “As the industry matures and becomes less fragmented, you’re going to see more consolidation of duplicate non-differentiated solutions. Those former high-value startups that aren’t really battle tested from their business models perspective, they’re going to be the ones that get acquired at a lower valuation than their historical 2021 unicorn valuations.”

Which sounds somewhat alarming.

However, Butler quickly tempered with this:

“But I think there’s still a significant amount of opportunity, optimism and growth there for those companies that have resilient and differentiated solutions. They’re absolutely going to capture that additional growth-market share and, frankly, upside valuations.”

On that happy note, have a lovely Sunday — and we’ll see you next week!