Manhattan Office Leasing Picks Up in 2021, But Availability Rate at Record High

By Tom Acitelli April 1, 2021 10:27 am

reprints

Office leasing picked up in Manhattan during the first three months of 2021, but the market remains nowhere near where it was pre-COVID.

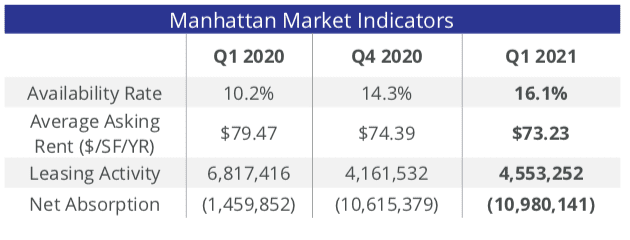

Leasing volume increased 9.4 percent in the first quarter compared with the fourth quarter of 2020, according to new figures from Colliers International. Still, the total volume of 4.55 million square feet was one-third lower than the 6.82 million square feet leased in the first quarter of 2020, just before the coronavirus pandemic swept New York.

What’s more, Manhattan’s availability rate increased to 16.1 percent during the first quarter, the highest that Colliers International has ever recorded and well ahead of the previous zenith of 13.9 percent set in the third quarter of 2003, at the tail-end of the dot-com bust and in the twin wakes of a recession and the 9/11 terrorist attacks.

The Manhattan office market has now had seven consecutive quarters of expanding availability.

Asking rent for office space also continues to take a hit. Manhattan’s average asking rent decreased 1.6 percent in the first quarter, to $73.23 a square foot, the lowest since 2018. The average was down, in fact, in 13 of the 18 submarkets that Colliers tracks; and the average for top-shelf Class A space was down 1.2 percent, to $80.39 a square foot.

“One year into the pandemic, Manhattan’s available supply continued to outpace tenant demand with measurable downward pressure on pricing,” Franklin Wallach, Colliers’ senior managing director of research, said in a release about the figures.

“However,” Wallach said, “two critical events took place during this period that will be paramount to Manhattan’s long-term recovery as more than one-fourth of New York City’s residents have been at least partially vaccinated and the Metropolitan Transportation Authority received $6.5 billion in funding from the American Rescue Plan.”

Also, recent statistics have shown that more tenants are kicking the proverbial tires in Manhattan’s market as those vaccines roll out and companies trickle back to the office.

The average number of new tenant tours of Midtown office space was 64 percent higher year to date in 2021 through the first week of March, for instance, compared with the average from early July to late November 2020, according to VTS, a proptech firm that tracks new tenant demand for non-Class C space.

Still, the fundamentals just aren’t there yet for a return to pre-COVID leasing levels.

For one thing, there is still a ton of available sublease space on the Manhattan market. Net sublet availability increased by 2.91 million square feet in the first quarter. Such space now represents nearly one-fourth of all available office space in Manhattan, about the same share as it did at the end of 2020. JPMorgan Chase, Manhattan’s biggest private occupier of office space, is still planning to sublet some 800,000 square feet at two addresses.

At the same time, major office users continue to waver on just how much space they’ll need post-COVID. Last week, Citigroup said it was switching to a hybrid model, wherein most employees will work remotely at least part of the week. And numerous surveys show employers big and small mulling similar moves (and also show that workers are just fine with that).

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)