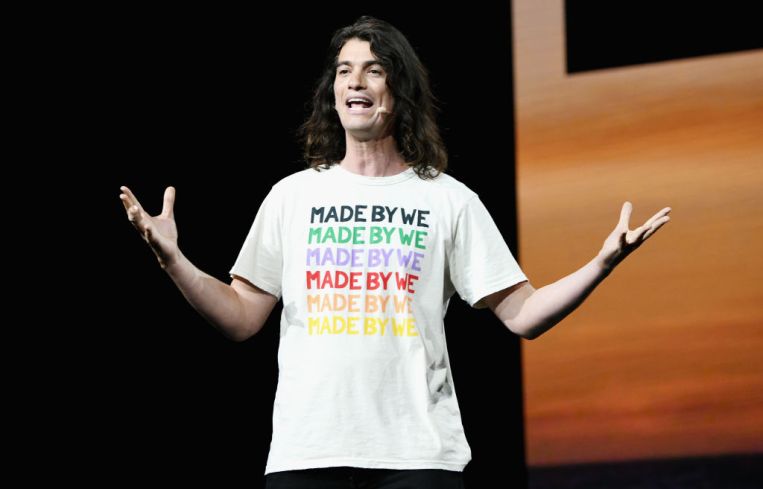

Adam Neumann Loses $185M Consulting Deal With WeWork

By Nicholas Rizzi October 20, 2020 10:28 am

reprints

Adam Neumann’s golden parachute keeps getting cut off.

SoftBank Group executive chairman Marcelo Claure said during a Wall Street Journal event yesterday that former WeWork CEO Neumann’s $185 million consulting deal with his former company was no longer in place.

“I don’t think that consulting agreement is still in force,” Claure said, according to the WSJ. “I think Adam may have violated some parts of the consulting agreement, so that’s no longer in effect.”

A spokesperson for WeWork did not immediately provide more details about the reasons and timing of the deal falling apart. A spokesman for Neumann declined to comment.

Despite ending Neumann’s consulting agreement, Claure told the WSJ that the WeWork co-founder was “incredibly helpful at the beginning” of SoftBank taking over WeWork but did admit the investor gave him too much free rein beforehand.

“We were probably a little too aggressive with WeWork,” Claure said about the nearly $9 billion SoftBank has pumped into WeWork over the years. “We probably allowed the entrepreneur to work too freely without having the right SoftBank involvement.”

Investors pushed Neumann out of his CEO position last year amid a troubled initial public offering and reports of his erratic behavior — including smuggling pot on a private jet to Israel. SoftBank agreed to buy nearly $1 billion in stock from Neumann and kept him on as a consultant for $185 million as part of his exit package.

His consulting fee isn’t the first cut to Neumann’s deal that SoftBank has made.

In April, SoftBank pulled out of its $3 billion buyback of WeWork shares, known as a tender offer, after it claimed WeWork failed to meet several conditions for the offer.

A special committee of the board of WeWork quickly shot back and sued SoftBank over the cancelation of the deal. In May, Neumann started his own legal battle against SoftBank claiming the Japanese bank “reneged on their promise to pay for the benefits they had already received” by pulling out of the tender offer.

The failed tender offer cut Neumann’s personal net worth by 97 percent to $450 million and kicked him out of the billionaire ranks, but it hasn’t kept him out of the real estate world. Last week, Neumann returned with a $30 million investment into management platform Alfred.

WeWork was already bracing for a rocky year after its troubled 2019 when the coronavirus pandemic hit and emptied its locations around the world. The company has laid off workers, and CEO Sandeep Mathrani told analysts it was looking to exit or restructure 20 percent of its leases.

The coworking giant has already ditched its 115,000 square foot space at 149 Madison Avenue and is closing three of its oldest locations in Washington, D.C. (WeWork told Commercial Observer getting out of the D.C. locations was in the works pre-pandemic.)

WeWork contends that flexible office space will be in much higher demand as companies will be wary to sign long-term deals post-COVID-19 and Claure told the WSJ he expects WeWork to become profitable by next year.