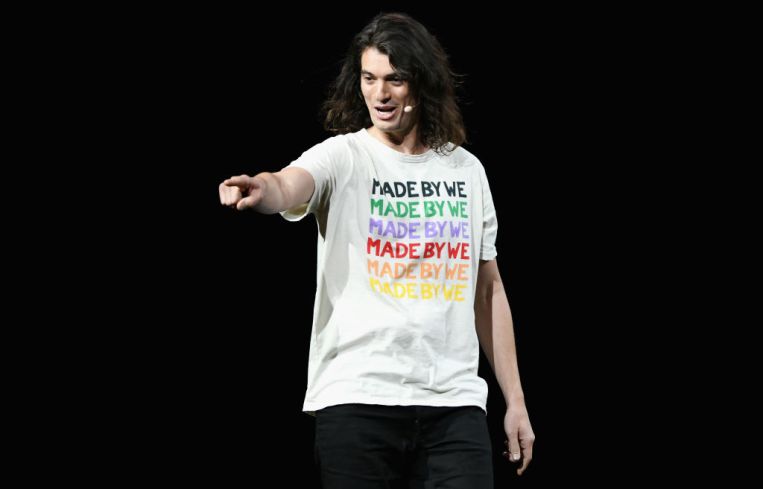

Adam Neumann Sues SoftBank Over Canceled $3B Tender Offer

By Nicholas Rizzi May 4, 2020 7:01 pm

reprints

Former WeWork CEO Adam Neumann filed a suit against SoftBank (SFTBY) Group over the cancelation of the Japanese bank’s deal to buy $3 billion worth of shares in WeWork from stockholders, which included Neumann’s nearly $1 billion golden parachute.

Neumann claims SoftBank abused its power by pulling out of the deal — known as a tender offer — and “reneged on their promise to pay for the benefits they had already received,” according to the suit filed yesterday in Delaware court.

In the suit, Neumann accused SoftBank of a breach of contract and a breach of “fiduciary obligations” over canceling the tender offer and said he never would have relinquished control of WeWork to the bank without the deal.

Neumann did not provide comment through a spokesman.

“SoftBank will vigorously defend itself against these meritless claims,” Rob Townsend, SoftBank’s chief legal officer, said in a statement. “Under the terms of our agreement, which Adam Neumann signed, SoftBank had no obligation to complete the tender offer in which Mr. Neumann — the biggest beneficiary — sought to sell nearly $1 billion in stock.”

The suit pits Neumann against SoftBank’s head Masayoshi Son — Neumann’s biggest cheerleader who pumped about $14.25 billion into WeWork since its inception — and is the first time the two publicly sparred since Neumann was ousted from WeWork last year. In an interview with Forbes last month, Son admitted he spent too much money on WeWork and put too much faith in Neumann.

“We paid too much valuation for WeWork, and we did too much believe in the entrepreneur,” Son told Forbes. “But I think even with WeWork, we’re now confident that we put in new management, a new plan, and we’re going to turn it around and make a decent return.”

Neumann’s suit is also the second legal fight SoftBank faces after it pulled out of the tender offer earlier this month. On April 7, the special committee of the board of WeWork sued SoftBank over the cancelation of the deal.

SoftBank previously tried to have the special committee’s suit thrown out, arguing it did not have the authority because Neumann was planning a suit. In Neumann’s filing, his lawyers argued that the special committee’s legal action is “meritorious” and asked that the two lawsuits be consolidated.

On April 1, SoftBank announced it canceled the tender offer — a huge chunk of its multibillion-dollar bailout for the troubled coworking giant — citing that WeWork failed to meet several conditions, including not getting antitrust approvals or closing joint ventures in Asia. It also cited several investigations into WeWork that started after its botched initial public offering last summer and impacts from the coronavirus pandemic as reasons.

SoftBank previously said halting the deal will mostly impact Neumann, his family and institutional investors like venture capital firm Benchmark while WeWork employees only had about 10 percent of the shares in the offer. The special committee said that $450 million from the deal was allocated to current and former WeWork employees — with Bloomberg reporting some planned their lives around the money they’d receive. But a source with knowledge of the deal told Commercial Observer the number was less than $300 million.

Neumann claims in his suit that, by December 2019, SoftBank “secretly” took action “to undermine” the tender offer and blamed the failure to close the joint ventures in Asia on SoftBank itself. His suit — filed by Morris, Nichols, Arsht and Tunnell, Friedman Kaplan Seiler and Adelman and Susman Godfrey — also takes shots at SoftBank’s financial health, claiming that it’s “deteriorating, which no doubt influenced its decision to renege on its obligations to WeWork.”

The cancelation of the tender offer cut Neumann’s net worth by 97 percent to $450 million and kicked the bombastic WeWork co-founder off of the billionaire ranks, Bloomberg reported.

WeWork was facing a rough year after its disastrous 2019 — which included the failed IPO, Neumann’s ouster, laying off thousands of workers and nearly running out of cash — before the coronavirus pandemic rendered most of its locations empty. Last week, WeWork started another round of layoffs, with more likely on the way.