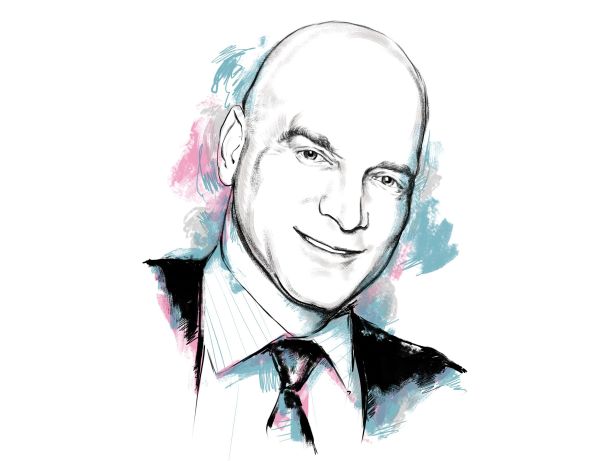

Nick Bienstock.

Nicholas Bienstock

Co-Managing Partner at Savanna

In 2021, will you buy or sell any real estate? What kind?

We will be buying and targeting distress up and down the capital stack in New York City. Whether we elect to sell anything in our portfolio depends on the state of the market. While we have several assets that are stabilized and ready to sell, we are well-capitalized and are under no pressure to sell.

New York has gone through multiple shocks over the past 30 years, and we believe the market will recover from this shock. So, we’ll only sell in 2021 if we believe that it is advantageous to do so.

How f@*$ed is retail?

F@*$ed up. There is no clearing price yet — in particular, for high street retail. It’s not prudent to catch a falling knife, so we are staying away from retail at the moment. At some point, when the bottom is visible, we may begin to look at deeply discounted, opportunistic retail buys.

How flexible are you with negotiating rents?

We don’t want to ever deny reality at the expense of our investments. Our buildings operate within the current market, and if rents across the market come down, we need our negotiating strategy to reflect that. We are dealmakers and owners of good buildings that we will rent at market rates. If that means we have to cut rental rates to reflect the current market and keep our buildings leased, we will do that.

One of the hardest decisions to make as an investor and owner is to sign a deal when the market rents fall below your original underwriting. But, if the market has changed and is unlikely to recover during the required holding period, then the right decision is to make a deal that is reflective of the market value. Putting your head in the sand and denying reality is not helpful or justifiable.

Has your “dead to me” list grown?

Generally, in business, we want to be tough but fair. We want to be trusted partners and reliable counterparties. Our “dead to me” list has always been very short. It hasn’t grown in 2020.

Are you in the market for financing?

We have very few upcoming debt maturities across our portfolio. But, we are going to market soon for construction financing on a 400,000-square-foot, ground-up office development we are building in the heart of downtown Brooklyn.

What would be the signs that things are NOT going to improve in 2021?

We are strong believers in the strength and resilience of New York City. We have lived through and managed our portfolios through multiple shocks in NYC in the past, and NYC has come back from each one with a stronger and more diversified business base.

That being said, because of New York’s density and reliance on public transportation, we believe the recovery from this pandemic will likely take longer in New York than other major markets. Our view is, this downturn is likely to get worse going into 2021 and will begin to recover in 2022. But we believe that will create some spectacular buying opportunities over the next two years.

Who do you like for mayor in 2021?

I will vote for anyone who is a practical problem-solver representing a balanced, middle-of-the-road view. We need a mayor that recognizes that profitable businesses and wealthy residents are not the enemy of New York; they are an integral part of the engine that provides the tax base and prosperity that facilitates all of the important social programs that the progressives in New York want to advance.

What do you think the city and/or state should do to help both real estate and the city?

The city should focus on providing basic services better. Safety and security are fundamental to every single resident and business. Clean the streets and fill the potholes. Focus on dealing more effectively with the homeless population that is growing on our streets every day. Quality-of-life issues matter to all New Yorkers.

The city was at the heart of the COVID-19 crisis and has emerged from it. But, even if we get a vaccine before the end of the year, it will be six to nine months before it is widely available. The city needs to figure out how to open our schools, restaurants, theaters, museums and stadiums in a way that is safe and responsible now. We can’t remain largely closed for another six to nine months.

How do you think the November election will affect real estate? How do you see a Trump win? How do you see a Biden win?

A Biden victory is more likely to lead to federal assistance to both states and cities, as well as to critical infrastructure projects — like the Gateway Tunnel. Those large-scale assistance programs will mean billions of dollars coming to New York in its time of need. Trump and the Republicans are not particularly fond of New York. So, a Biden victory would be better for New York City and the state would benefit the real estate business here.

LIGHTNING ROUND

Where’s your apocalypse bunker? Millbrook, N.Y.

Favorite at-home quarantine foods? Zabar’s bagels

Did you gain or lose weight during quarantine? While I put on the COVID 10, I exercised every day. So, I’m fat and fit!

Which TV show have you binged? Netflix’s “Sherlock Holmes”

Mayor de Blasio: Best Mayor or Best Mayor EVER? This administration increased the city workforce by 22,000 workers during this mayor’s term, and expanded the city budget by 40 percent. Have services improved for residents and businesses? Has the homeless situation improved? Is the city safer, cleaner and more efficiently run?

Biden, Trump or Kanye? Biden. Whatever Biden’s faults, we need to preserve our key democratic institutions, maintain separation of powers, and fight back against authoritarianism, racism, sexism, nativism and the demonization of the free press. There are such things as facts and truth.