FPA Multifamily Buys Two Baltimore Apartment Buildings for $73M

Investment activity across Baltimore has ratcheted up amid the city’s post-pandemic rebound

By Nick Trombola September 25, 2025 7:10 pm

reprints

Although Baltimore’s massive mixed-use developments are the talk of the town, midsize multifamily assets are also trading hands as investors eye rising rents and increasing public safety across Charm City.

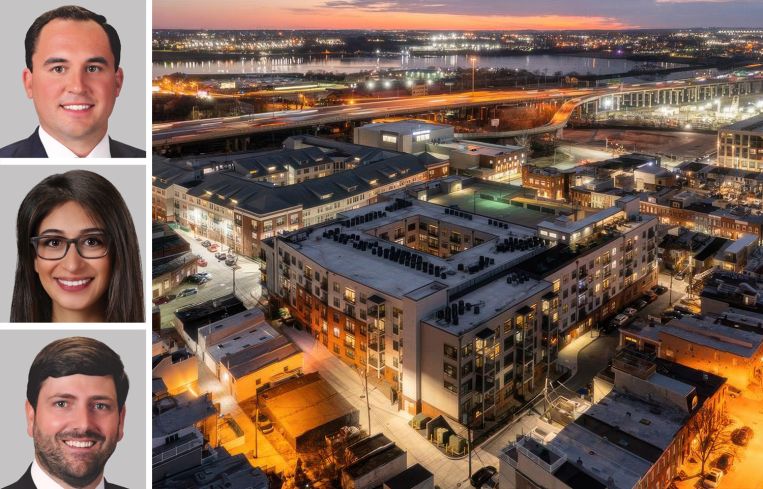

Real estate investment firm FPA Multifamily put down $73 million for The Lofts and The Flats, which combine for 345 units. Benefit Street Partners sold the 16-story, 95 percent occupied properties, at 1901 South Charles Street and 2 East Wells Street in South Baltimore. The buildings are just north of Interstate 95 from the $5.5 billion Baltimore Peninsula district development.

Berkadia’s Drew White, Brian Crivella, Carter Wood, Bill Gribbin, Yalda Ghamarian and Cole Carns represented the seller in the deal. The Business Journals first reported the news.

“These properties are in an excellent position to capture additional upside through a focused value-add program that will deliver curated amenities and units catering to renters’ needs and preferences today,” White said in a statement.

Long overlooked as an investment target, Baltimore has come into its own in recent years largely thanks to reductions in violent crime and its burgeoning status as a biotech hub. Two sprawling, mixed-use projects on the banks of the Patapsco River, the 14 million square-foot Baltimore Peninsula and MCB Real Estate’s Harborplace redevelopment, also contribute to the city’s resurgence.

Local authorities are likewise in the midst of reconstructing the Francis Scott Key Bridge, a 1.6-mile bridge spanning the Patapsco River that collapsed after being struck by a malfunctioning ship in early 2024. The new bridge is expected to open in 2028.

Nick Trombola can be reached at ntrombola@commercialobserver.com.