Empire State Realty Trust Reports Q2 Improvements in Earnings Call

By Mark Hallum July 24, 2025 1:08 pm

reprints

Empire State Realty Trust (ESRT) is proving to be a steady Eddie, reporting similar but improved results in its leasing and tourism in the second quarter of 2025 compared to the previous quarter.

The real estate investment trust which owns the famed Empire State Building said that in the last three months it had leased 232,108 square feet of office and retail in Manhattan compared to 230,548 square feet in the first quarter of 2025.

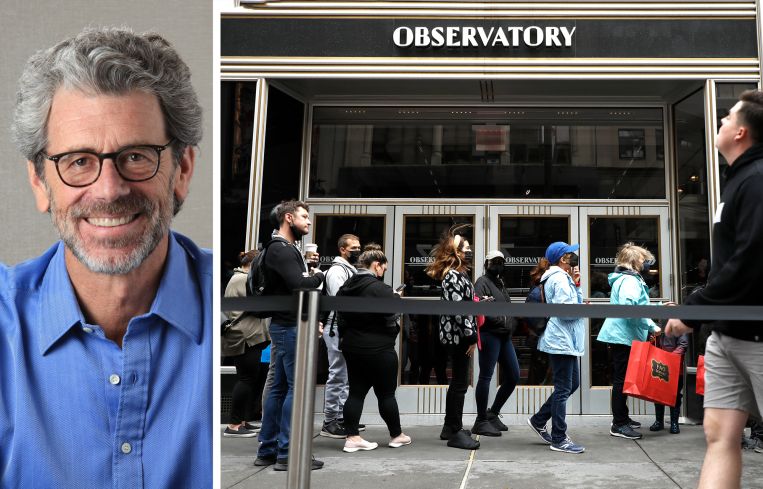

Income from visitors to the iconic skyscraper’s observation deck rebounded to $24.1 million following a drop to $15 million in the first quarter. The popular attraction saw $28.5 million in revenue during the fourth quarter of 2024.

The observatory failed to reach previous levels of visitations in the second quarter due to adverse weather in May and June and lower demand from international travelers, according to ESRT Chairman Tony Malkin.

“We do know that, historically, 60 percent of our [net operating income] comes in the second half [of the year],” Malkin said. “We’re conscious of challenges for brand America. That said, New York City is a strong tourism market, so we continue to pivot and focus on where the tourists come to deliver better results.”

Asked whether the political climate in New York City — with democratic socialist Zohran Mamdani winning the Democratic mayoral primary in June — could impact leasing and business overall, Malkin said the REIT hasn’t seen, and doesn’t expect, any negative impacts if Mamdani becomes mayor.

“We are always concerned about New York City’s quality of life and opportunities for growth,” Malkin said. “At the same time, we don’t do politics, we do policy. We’d just like to throw in our clear comment that the priority of every New York City mayor should be New York City safe streets, schools and businesses, and every New York City mayor needs to respect all of its residents. So with that in mind, we don’t see anything except for perhaps a slight pause in the transaction market of buying and selling of properties.”

ESRT’s overall net operating income declined by 5.9 percent year-over-year, which the company attributed to increases in real estate taxes and operating expenses, factors that were offset to some degree by higher cash flow from tenants.

Some new tenants welcomed by ESRT include law firm Elsberg Baker & Maruri, which signed a 39,237-square-foot lease in the Empire State Building that was announced earlier in the week, and construction firm Mott MacDonald, which took 25,372 square feet in the building, as Commercial Observer reported in July.

The company also paid $31 million for 86-90 North Sixth Street in Williamsburg, Brooklyn, in June, which is the third investment ESRT has made in that high-foot-traffic corridor. The REIT is planning to reposition the properties, but details were not provided in the earnings call.

Mark Hallum can be reached at mhallum@commercialobserver.com.

UPDATE: This article was updated July 25 with more recent leasing numbers.