ESRT Reports Fewer Empire State Building Observatory Visits Amid Tariffs

The real estate investment trust saw a slight dip in earnings for the first quarter of 2025

By Isabelle Durso April 30, 2025 3:24 pm

reprints

The Empire State Building observatory saw a slowdown in ticket sales during the first quarter of 2025, according to Empire State Realty Trust’s earnings report released Wednesday, as the country faces a drop in international tourism caused by President Donald Trump’s policy shifts and the current tariff environment.

During the first quarter, the observatory — deemed the No. 1 tourist destination in the world by TripAdvisor in 2024 — generated a net operating income of $15 million, a drop from $28.5 million during the holiday-laden fourth quarter of 2024 and a slight decrease from the $16.2 million from the same time last year, the report shows.

The commercial real estate world is in a “period of heightened uncertainty,” as tariffs and political unrest have caused a reduction in tourism, ESRT said during the earnings call.

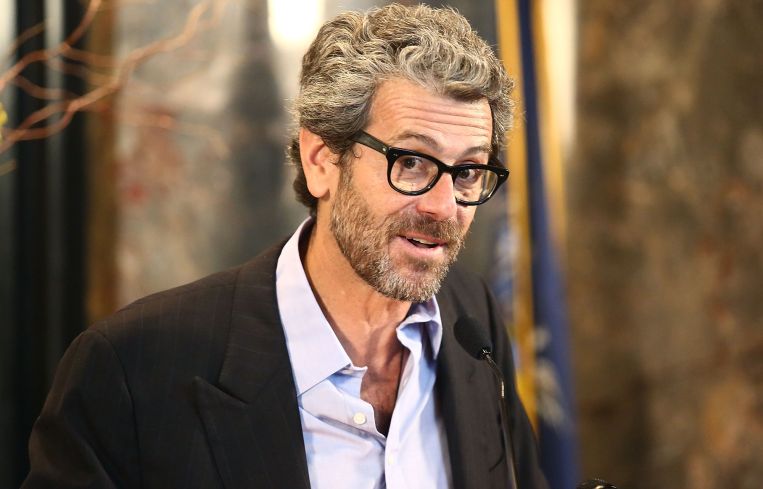

However, ESRT CEO Anthony Malkin attributed most of the observatory’s drop in earnings during the first quarter to two things: “bad weather” on holiday weekends during the quarter and Easter shifting to the second quarter of the year. Notably, the observatory’s numbers over Easter were “solid,” Malkin said.

Going forward, ESRT President Christina Chiu said the company will still “monitor shifts in demand” and be “prepared to go on offense” amid the “uncertain” political environment.

“We are balancing against an environment that’s highly uncertain,” Chiu said during the call. “Within that uncertain backdrop, there could also be more potential investment opportunities, and we want to be prepared to be able to go on offense if those opportunities arise.”

ESRT also saw a dip in earnings during the first quarter, with a net income of $9.2 million, or 5 cents per share, compared to $11.2 million, or 7 cents per share, during the fourth quarter, the report said.

However, things seem relatively good on the office, retail and multifamily front for ESRT, despite slight drops in numbers.

The real estate investment trust signed approximately 229,000 square feet of office leases during the first quarter, a decrease from the approximately 379,000 square feet signed during the fourth quarter of 2024, as Commercial Observer previously reported.

ESRT’s Manhattan office portfolio ended the first quarter at 93 percent leased, down from 94.2 percent at the end of the fourth quarter — a dip that the company said it saw coming since many of its tenants’ move-outs were scheduled for the beginning of this year, Thomas Durels, ESRT’s executive vice president of real estate, said during a Wednesday earnings call.

But ESRT said its leasing momentum has not slowed under current political policies. In fact, the REIT has 160,000 square feet of office leases currently in negotiation, Durels said.

“In the last 60 days, we have noticed absolutely no change in any of our lease negotiations underway with any tenant throughout our entire portfolio,” Durels said. “I think that’s quite remarkable.”

Notable office leases for ESRT during the first quarter include financial and business consulting firm Gerson Lehrman Group’s 77,382-square-foot renewal at One Grand Central Place; human resource and finance management firm Workday’s renewal and expansion for 39,069 square feet at the Empire State Building; and luxury fashion brand Carolina Herrera’s expansion to roughly 34,000 square feet at 501 Seventh Avenue.

As for retail storefronts, ESRT’s retail portfolio ended the first quarter at 94 percent leased, mainly thanks to its purchase last year of $221 million worth of retail properties along North Sixth Street in Williamsburg, Brooklyn.

The landlord’s North Sixth Street portfolio — which includes prime retail tenants such as Google, Warby Parker, The North Face and Nike — has one vacant, roughly 2,4000-square-foot unit left, ESRT said.

In addition, ESRT’s multifamily portfolio, which comprises a total of 732 residential units, was 99 percent leased by the end of the first quarter, according to the earnings report.

Isabelle Durso can be reached at idurso@commercialobserver.com.