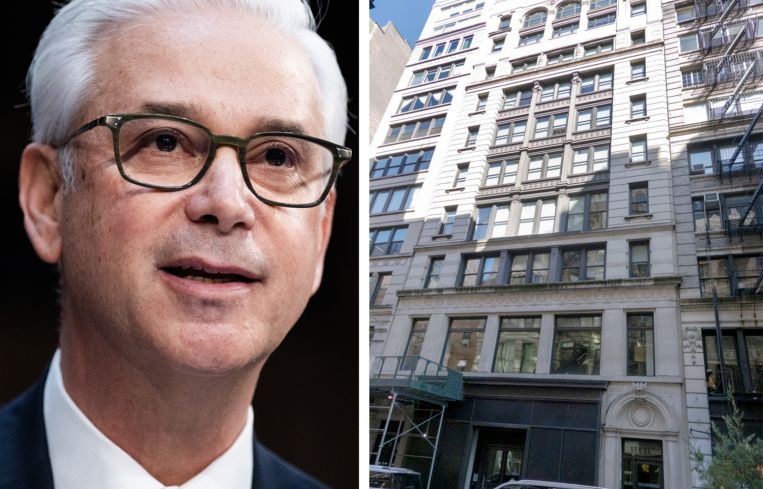

Wells Fargo Foreclosing on $55M Loan at Winter Properties’ 57 East 11th Street

The foreclosure comes after WeWork left the building as part of its bankruptcy

By Abigail Nehring August 8, 2024 1:05 pm

reprints

Coworking giant WeWork has left some wreckage in its wake at an 11-story office building near Union Square.

Landlord Winter Properties is facing foreclosure on a $55 million loan tied to 57 East 11th Street assigned to Wells Fargo, according to court records filed Wednesday by special servicer LNR Partners in Manhattan Supreme Court.

The move comes months after Winter Properties defaulted on the loan once WeWork — which leased the entire, 61,375-square-foot building in 2018 — left the property as part of its bankrupcty proceedings.

A spokesperson for Wells Fargo declined to comment. A spokesperson for Winter Properties did not immediately respond to a request for comment.

The Union Square building was one of the first co-CEOs David Winter and David Millstone snapped up after forming Winter Properties in 2014, an offshoot of the century-old real estate firm the Winter Organization.

Winter Properties paid $22.5 million for the property that year and planned to redevelop it into a high-end office building catering to media and advertising firms looking to move downtown, Winter told the New York Times in 2015.

Instead, Winter Properties leased up the entire building in one fell swoop thanks to a 15-year deal with WeWork during the coworking giant’s massive expansion.

The owners landed a $55 million commercial mortgage-backed securities (CMBS) refinancing on the property from Citigroup in 2019, as Commercial Observer previously reported. The debt was split into three notes assigned to Wells Fargo, with a fixed interest rate of 4.83 percent, according to the lender’s pre-foreclosure filing. The CMBS loan matures in May 2029.

But things turned south when WeWork got cold feet and rejected its lease in November, one of 40 coworking locations it abandoned in New York City a month after filing for Chapter 11. (The coworking company exited bankruptcy in April.)

Winter Properties allegedly defaulted on its loan a month later, according to court records. The $55 million loan hit special servicing in March, and has a loan-to-value ratio of 59.8 percent, according to Bisnow and Cred iQ data.

Abigail Nehring can be reached at anehring@commercialobserver.com.