It’s Commercial Real Estate’s Busiest Era of Big-Name Turnover in 20 Years

Yes, the market’s not what it used to be — but there’s a lot more to it

By Celia Young March 4, 2024 6:00 am

reprints

Commercial real estate has always been made up of movers and shakers. But these days the industry’s biggest names in brokering (leasing and sales), management (including top executives) and lending (up and down the capital stack) have been doing a lot of moving in large part due to a shaky market.

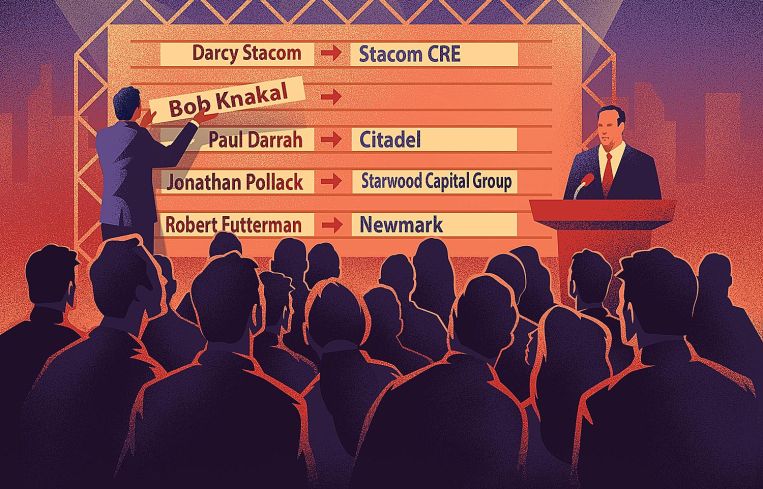

Just in the past two months, Darcy Stacom left CBRE to start her own firm. JLL abruptly ousted Bob Knakal. Marty Burger, the former CEO of Silverstein Properties, is launching a new real estate company with Andrew Farkas. Paul Darrah parted ways with Google to head up Citadel’s real estate operations. Jonathan Pollack walked away from Blackstone Real Estate Credit to join Starwood Capital Group as president. And there’s more.

Robert Futterman returned to Newmark after a 2019 termination, Jonathan Firestone ditched Eastdil Secured for Newmark, Christopher Lawton left Bank OZK for Nuveen Green Capital, office brokers Howard Hersch and Steven Rotter said goodbye to JLL for posts at Newmark, and the list goes on, including out to the West Coast.

There’s certainly something in the air: distress. The value of all New York City investment sales totaled $21.6 billion in 2023, in one of the sorriest annual totals of the past decade and a 41 percent drop compared to 2022. The number of buildings sold also fell 27 percent to 2,516 properties in that same period. Manhattan office leasing dropped last year, too, and a few landlords even handed over some building keys to their lenders.

Still, there is a bright side — for companies at least. Distress often makes it easier for brokerages to recruit talent at a discount, said Woody Heller, a founding partner of Branton Realty Services and a 35-year veteran of Gotham’s commercial real estate scene.

“If you’re trying to acquire new talent, doing it when the market is doing fantastically well is much more difficult and expensive,” Heller said. “I think that firms looking to grow are always seeking to embolden their bench, and this is certainly a moment for them to do that.”

Distress also gives brokerages a chance to beat out their competition, said David Schechtman, a senior executive managing director for investment sales at Meridian Investment Sales. This can be a boon to the bigger names who’ve recently jumped ship — or been pushed — and those thinking of potentially greener pastures.

“Whenever there’s market dislocation, whenever things kind of start heading for one extreme or another, you start seeing brokerage firms jockey for more market share,” Schechtman said. “Particularly when things get bad, a lot of firms realize that volume as a whole is down but that it won’t stay like this forever. For brokers who are slightly dissatisfied or who can be incentivized, now may be a time to pick up talent.”

Turnover happens in every down market, Schechtman said. But what’s unique about this environment is the “precipitous decline” in deal volume that has challenged brokers and companies alike, Schechtman said.

And many brokerages saw declining revenues in 2023. Cushman & Wakefield recorded a 6 percent drop in its annual revenue, according to a Feb. 21 earnings call, with revenue from its capital markets business shrinking 41 percent last year. Annual revenues remained roughly flat at JLL at $20.7 billion from 2022 to 2023. Newmark’s total 2023 revenue hit $2.47 billion, a decline of almost 9 percent from 2022, though it posted strong earnings in its fourth quarter.

Meanwhile, Avison Young had to restructure an unknown amount of debt with an unspecified lender this year, though the company maintained that it has never missed a loan payment. Marcus & Millichap saw its total revenues drop by roughly 50 percent from $1.3 billion in 2022 to $645.9 million in 2023, according to its earnings report.

At the same time, Marcus & Millichap lost 121 investment sales and financing professionals, ending 2023 with 1,783 such staffers compared with 1,904 in 2022. One Marcus & Millichap broker said the departures were likely due to attrition because of the tough market. (Spokespersons for JLL, Avison Young, Newmark and C&W declined to comment. A spokesperson for Marcus & Milichap did not respond to a request for comment.)

Smaller shops have been hit hard, too. Investment sales firm B6 Real Estate Advisors was down to just three employees as of Feb. 28, including its founder Paul Massey, according to its website. (Massey did not respond to a request for comment.)

It’s not exactly surprising that commercial real estate professionals would look at new opportunities if they feel their current firm might go the way of the dodo, said Adelaide Polsinelli, a vice chair at brokerage Compass.

“There are some firms that are going to go out of business,” Polsinelli said. “So a lot of brokers are just thinking ahead: How much longer does this firm have the resources to stay alive?”

This environment does feel more challenging than past periods of distress, prompting big producers to rethink the companies they’ve allied themselves with, said Patrick McGrath, president of Savills’ West region. (For his part, McGrath says his brokerage is recruiting. The firm hired Eric Nelson to focus on capital market transactions out of Savills’ Los Angeles office, and Nelson said he plans to further expand his West Coast team.)

“If you really look at the competitive set, you’ve got some real distress at some of the major brokerage houses,” McGrath said. “When you’ve got financial distress on the horizon, you’ve got very talented deal producers and deal teams that have to look hard at whether they have the support and resources to really be effective on behalf of their clients. When else has that really been the case in the last two decades?”

To put McGrath’s words in simpler terms: Why give a big firm a chunk of your paycheck if you’re not getting much in return?

“Why do you need to be with that firm if they’re taking … 40 or 50 percent of your commission when you’re not getting the services and support that you did when you started?” Polsinelli said. “You’ve got a lot of firms cutting back, and when that happens brokers look around and say, ‘Why do I need to be here when I could be at that firm which is doing better, has stronger earnings, and will support me?’ ”

A few real estate professionals have decided to support themselves by starting their own businesses: Think Burger and Stacom. In Stacom’s case, she felt that she could have more freedom to focus on the projects she was most interested in through Stacom CRE, which she launched in February.

“The greatest opportunities always occur at the worst moments,” Stacom said. “In a super white-hot market, it’s really hard to not get a really good price for a property. You may not get the last dollars — which is what I will get somebody. But, in a difficult market, doing more research, reading more documents, analyzing and looking for unique trends and opportunities is where people need me. To do this now, to me, makes perfect sense.”

There’s also an additional level of freedom that comes from running your own business, such as the ability to tell your own story, Stacom said.

“The really giant firms are extraordinary in the depth of the platform that they can bring to bear,” Stacom said. “But with that can also come a different way of doing things. As I move onto my own [firm], those will be my choices — of what image I chose to project, of how I want to comment, and that will give me different opportunities.”

Speaking of storytelling, in Knakal’s case, the well-known broker reportedly got into hot water with JLL for a New York Times story discussing his collection of maps that plotted a career’s worth of sales activity and property values. JLL’s decision to cut Knakal was reportedly part of a very conscious choice to move away from individual brokers’ star power. Knakal declined to comment on his termination, though on Feb. 22 he did post a video on X (formerly known as Twitter) thanking those who reached out to him for their support.

“Everyone’s been asking me what’s next,” Knakal said in the video. “Truth is: I don’t know. I’m working to figure that out, and, as soon as I know, I will let you know. But there are a lot of exciting opportunities out there, and I’m looking forward to exploring those opportunities and figuring out what’s going to be best moving forward.”

Both Knakal and Stacom’s departures from two powerhouse brokerages were fairly unique — though this modern era of tumultuous turnover might’ve started in February 2023 with the simultaneous departures of investment sales brokers Adam Spies and Doug Harmon from Cushman & Wakefield to Newmark.

But their moves raise questions about whether a new generation of investment sales professionals in particular will emerge, and whether brokerages will continue to prioritize the investment sales business in a down market, said Nat Rockett, a broker with Marcus & Millichap.

“Is this a reset moment where firms rethink how much they care about investment sales?” Rockett asked. “Do they rethink how they approach investment sales?”

To add another question to that list: Do big firms start to rethink a focus on their star players?

To Rockett, the investment sales category is a lot like football. You can have great teams that, collectively, win championships, or you can have Tom Brady, who as quarterback carried the New England Patriots largely solo to six Super Bowl titles in nine appearances.Individual stars can easily become household names, but well-run teams also provide a lot of benefit to the client, added Brian Whelan, an executive managing director at Ripco Real Estate who focuses on investment sales.

“Some veteran senior brokers have obviously built up a brand within a brand,” Whelan said. “Some of the star brokers can move the needle no matter what shop they’re at. But I do think there is something to the team mentality that if you have a well-disciplined, organized team and you fly under the same banner, I think the market appreciates that.”

What every broker — star or otherwise — agreed on was that the market must rebound eventually. And firms and professionals alike want to be ready for investment sales to snap back. Until then, we likely haven’t seen the last of this game of musical chairs, said Polsinelli.

“There’s going to be more of this because the dust hasn’t settled and we’re not at the end of this cycle yet,” Polsinelli said. “It’s almost like musical chairs right now. Everyone is in flux because the market is in flux. Once there’s stability, everyone will grab a seat and it will be business as usual.”