Sunday Summary: Power 100, the Death of a Legend, and Disney Wars

By The Editors May 21, 2023 9:00 am

reprints

So, how was your week?

There was no shortage of news, that’s for sure.

It might be telling that a piece of news that nearly slipped our mind because it happened in the long, long ago of Tuesday, May 16, was that Sandeep Mathrani announced he was stepping down as head of WeWork to join private equity firm Sycamore Partners.

Mathrani is one of the more esteemed names in the real estate industry, having made his bones by turning a massively indebted, bankrupt GGP into the second-largest mall REIT in the country by the time it was purchased by Brookfield. When Mathrani was tapped for the role of CEO of the struggling coworking company back in 2020, the choice seemed like an interesting corrective to the freewheeling, fiesta atmosphere cultivated by the company’s previous CEO, Adam Neumann.

David Tolley is stepping in as temporary CEO as WeWork figures out a permanent chief.

But, then, there were a lot of comings and goings last Tuesday.

Joseph Fingerman, the head of Signature Bank’s commercial real estate originations team, was laid off along with 11 other essential players. The news broke as Signature executives (along with Silicon Valley Bank honchos) were facing withering criticism under the klieg lights of a Senate hearing about the banks’ implosions.

“It seems like big losses and a struggling stock price motivated management to jump-start profits and boost the stock price, and in doing so you just didn’t seem to care about increasingly obvious risk,” Ohio Sen. Sherrod Brown said to ex-SVB CEO Greg Becker. “Mr. Becker, your version of events blames SVB’s failure on too many interest rate hikes … and the regulators for being too slow to highlight longstanding problems. It sounds a lot like the dog ate my homework.”

Louisiana Sen. John N. Kennedy was even blunter.

“Mr. Becker, you made a really stupid bet that went bad, didn’t ya?” Kennedy said. “And the taxpayers of America had to pick up the tab for your stupidity, didn’t they?”

Of course, while the SVB fallout is something that the finance industry (not to mention the politicos) will be untangling for quite some time, an even bigger potential economic threat is looming in the capital — potential default on the federal debt.

Also on Tuesday, President Biden was meeting with Speaker of the House Kevin McCarthy at the White House, where they attempted to stave off an expected breach of the debt ceiling on June 1.

Default would, in the opinion of a number of real estate experts, prove catastrophic. It “would upend one of our most fundamental assumptions of how the global financial system works — the characterization of Treasurys being risk-free — if the U.S. fails to meet its obligations,” NYU’s Sam Chandan told Commercial Observer.

“All of us are just assuming they’re going to solve it because there’s nothing else we can do,” opined GFP’s Jeff Gural. “If we really thought we’d default on our debt, we might as well leave the country.”

Somehow, that didn’t make us feel better.

The mouse that roared

The intersection between real estate and politics was not confined to the nation’s capital.

In Florida, the war between Disney and Gov. Ron DeSantis leveled up when Disney announced that it was canceling plans to build an $864 million mixed-use development in Orlando and closing its Star Wars-themed hotel.

“Given the considerable changes that have occurred since the announcement of this project, including new leadership and changing business conditions, we have decided not to move forward,” Josh D’Amaro, head of Disney’s parks, experiences and products division, said in a memo to staff that was obtained by the Wall Street Journal.

This comes as Disney has been feuding with the Florida governor after the previous Disney CEO, Bob Chapek, criticized the state’s “Don’t Say Gay” bill, which resulted in Florida legislators attempting to strip Disney of its governing power over the site of its themed park.

Well, the Sunshine State can always turn to Lincoln Road to try to make up the shortfall.

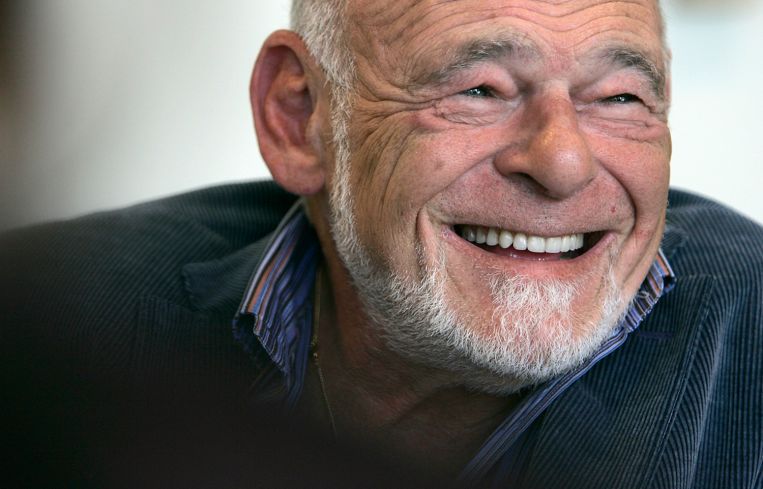

The death of a legend

One of the very biggest shocks of the week, however, was the news that Sam Zell had died.

The shock might have something to do with the fact that he was such a potent and seemingly immortal force in real estate.

From his plucky, humble beginnings (he would buy Playboy magazines and resell them to his schoolmates for six times what he paid for them) he became a force of nature within the business, having amassed a property portfolio where the office portion alone was worth an ungodly $39 billion by the time Zell sold it to Blackstone in 2007.

Two days before he died, Commercial Observer had named him No. 11 on our Power 100 list along with Equity Residential CEO and President Mark Parrell.

Speaking of Power 100…

The big news around the CO offices, though, was the publication of our annual list of the 100 most powerful people in commercial real estate!

We have to admit, it is getting tougher and tougher to rank the high and mighty of the industry.

A lot of office owners seemingly owned the Power 100 in past years, but they’ve taken a considerable hit in the last couple of years in our estimation — particularly flex operators, who have been repped by at least one company (if not more) in the last few years. But not in 2023.

Likewise, we had to cast a cold eye over a lot of politicians who have graced the list in years past. It was always a given that New York’s governor and mayor (even when they hated each other) would be ranked among the powerful real estate players, given that their decisions carried so much weight around New York City … but do they anymore?

Gov. Kathy Hochul and Mayor Eric Adams are pretty openly pro-development, and yet they’ve been stymied at just about every turn by the NIMBY folks in the state Senate and City Council.

Given the bankruptcies, the delinquencies and other woes besetting the industry, it’s probably a better time (or a more active time) to be a lawyer in CRE than a politician.

But just as office owners and politicians might have suffered in 2023, there were others who rose in our estimation. The multifamily developers? The industrial owners? The data center gurus? The heads of the Federal Reserve? They shot sky high.

And, as one of CO’s missions has long been to look at the national real estate picture, we tried to inject as much new blood as we could.

We hope it’ll make for interesting reading — happy Sunday!