US Multifamily Investment Volume Sets Record in 2021

Demand drives rent increases as the pandemic’s urban exodus flames out and other sectors, like office and industrial, fail to catch as much attention

By Tom Acitelli February 1, 2022 10:55 am

reprints

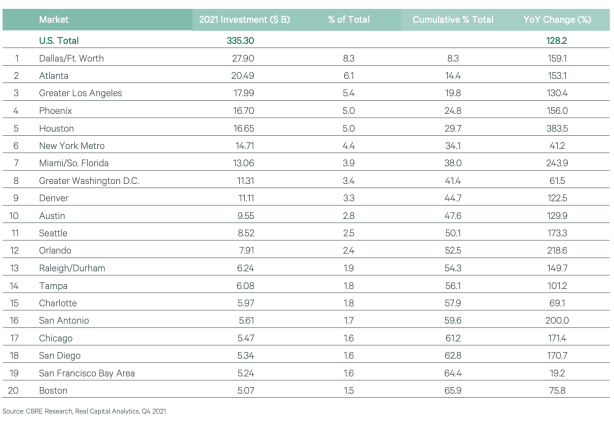

Metro markets in the Sun Belt drew the most investment in multifamily properties in 2021, with the Dallas-Ft. Worth and Atlanta areas leading the way, according to a new report from brokerage CBRE and analytics firm Real Capital Analytics.

Investors poured an annual record of $335.3 billion into the nation’s apartment market. Dallas-Ft. Worth drew $27.9 billion of that — or 8.3 percent of the total — and Atlanta $20.5 billion, or 6.1 percent. The Los Angeles area clocked in at No. 3, drawing just shy of $18 billion in investment, or 5.4 percent of the 2021 total.

In fact, it’s not until No. 6 on the list — New York City and its surroundings — that a colder-weather locale shows up. The New York area drew $14.71 billion in investment, or 4.4 percent of the total (see chart via the CBRE/Real Capital report).

Investors in the U.S. hit the gas particularly hard in the last three months of 2021, according to the report. Multifamily investment volume increased annually 128.2 percent, to $148.9 billion, in the fourth quarter. That’s the highest quarterly total CBRE has on record. In fact, it was heftier than the investment volume in all of 2020, a year racked by coronavirus disruptions.

Supply and demand drove the investment. Developers delivered 274,500 multifamily units nationwide in 2021, and there’s another 400,000-plus teed up. But demand remained so strong that these top markets are absorbing the new supply as it comes on. Blame (or credit) a strong labor market and the need to be in or near cities; higher for-sale housing costs in some areas are also aiding the multifamily market.

Not surprisingly, then, apartment rents are going up. All 69 markets that the CBRE-Real Capital report tracked saw positive rent growth in 2021. Many saw their multifamily rents jump by double-digit percentages during the year. So much for the great urban exodus due to the pandemic.

Where does the multifamily market go in 2022 and beyond? The CBRE-Real Capital report is bullish. Multifamily drew more than 41 percent of total commercial real estate investment in 2021, it shows, and favorably low interest rates as well as competition among lenders are expected to buoy the market in the near term. (The industrial sector was a distant second at 20.5 percent of 2021’s investment volume, and office far back at No. 3 at 17.2 percent.)

Such a performance, though, has more than one analyst worried about a possible multifamily bubble. The thinking goes that once other sectors return to some semblance of normal — including office as employees return to the workplace more and hotels as tourism and business travel pick up — some of multifamily’s luster will wear off. For now, it’s the busiest game in town.

“The 2021 multifamily market was extraordinary, by any measure,” Brian McAuliffe, president of multifamily capital markets for CBRE, said in a release on the report. “We expect the ongoing economic recovery, job creation, wage growth and household formation to support continued strong multifamily demand in 2022.”

Tom Acitelli can be reached at tacitelli@commercialobserver.com.