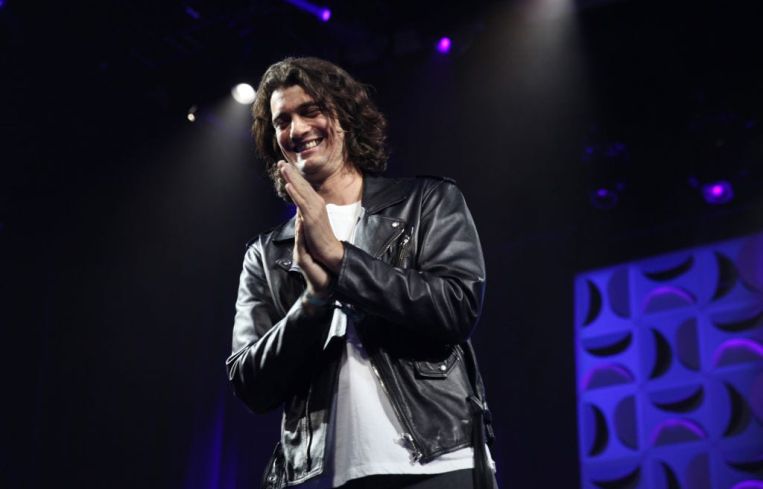

Adam Neumann Says His WeWork Golden Parachute Was a ‘False Narrative’

By Celia Young November 9, 2021 3:15 pm

reprints

Adam Neumann’s greatest regret when running WeWork was the thousands of employees who lost their jobs and income, but news of him falling from grace with a golden parachute was a “false narrative,” he said in his first public appearance since he was ousted in 2019.

Neumann said he didn’t walk away with any money he didn’t earn during his tenure at WeWork, and tried to build a thriving business, WeWork’s co-founder and former CEO said during a public interview with The New York Times’ Andrew Ross Sorkin on Tuesday.

“It was never my intention for the company not to succeed,” Neumann said. “But when you take equity when you join a startup, you take a risk. I wish it would have worked out differently for everybody. But the market now decided that it’s worth $9 billion … I actually think WeWork today has a bigger opportunity [now] than back then.”

Thousands of staff were laid off as WeWork tried to find a path towards profitability after the company failed to go public in 2019, nearly running out of cash as investors lost confidence. Its huge valuation drop — eventually holding steady at around $9 billion — meant employees could hope for very little if they sold their holdings. But Neumann said the IPO hurt him too, and that his wife feared that the family would go bankrupt.

“Everyone thought it was a golden parachute,” Neumann said. “It wasn’t.”

But when SoftBank agreed to buy $3 billion worth of shares in WeWork from stockholders as part of its multibillion-dollar buyout of the struggling coworking company, its offer included more than $1 billion for Neumann. Through his stock sales, cash settlement payments and exit deal, Bloomberg estimated that Neumann pulled out more than $2.1 billion from WeWork during his tenure, even as the company lost more than $11 billion.

Neumann said that he didn’t see much of that money during the coronavirus pandemic thanks to Softbank delaying payment until just a few months ago, after Neumann sued to get paid. He also said that he wasn’t taking the funds from WeWork directly — Softbank was paying him for $3 billion worth of stock, of which he happened to own around 30 percent.

As for WeWork employees who lost their jobs and saw their holdings in the company plummet, Neumann said he considered giving some of the funds he extracted from the company to those individuals, but wouldn’t speak about those plans publicly.

“We do a tremendous amount of giveback,” Neumann said, declining to provide any concrete examples. “And there’s a lot more in store on that topic, but it’s all done quietly.”

Before the company’s 2019 IPO process, Neumann was riding high with an eye-popping $47 billion valuation and becoming a household name in the real estate industry. That encouragement — from investors, the media and elsewhere — may have made him overconfident, even as the company burned through money, he said.

“Maybe it went to my head [and] I do think at some point it did,” Neumann said.

Neumann saw some of his former employees during WeWork’s successful IPO process in October when the company began trading on the New York Stock Exchange with the ticker “WE.” It snagged a $9 billion valuation going public in a special purpose acquisition company deal (SPAC).

Neumann said he called the head of BowX Acquisition Corp, Silicon Valley tech entrepreneur Vivek Ranadive, to push for a SPAC IPO for WeWork. The ex-CEO threw a party to celebrate the IPO, and in the spirit of his tenure at WeWork, drinks were served early in the day, Forbes reported.

As for the party-hard, late-night and alcohol-friendly culture of the coworking company under his tenure, Neumann said that he was glad WeWork had a fun office environment but understood that his style did not mesh well with Wall Street — part of the reason for the company’s failures.

That culture is expected to be on display in the upcoming Apple TV+ adaptation of the WeWork story starring Jared Leto as Neumann. But Leto apparently told Neumann personally not to watch it, he said.

That’s not the only televised portrayal of the company. HBO Max released a series that Neumann managed to have some input in. The WeWork co-founder’s lawyers got the television network to tweak the show’s content as well as its description online, according to Neumann and The Verge. Neumann has also already been the subject of two books: “The Cult of We: WeWork, Adam Neumann, and the Great Startup,” by The Wall Street Journal reporters Eliot Brown and Maureen Farrell and “Billion Dollar Loser: The Epic Rise and Spectacular Fall of Adam Neumann and WeWork,” by Reeves Wiedeman.

So what’s next for the charismatic WeWork co-founder? Neumann says he has a new interest: a cryptocurrency that can be used to sell carbon offsets to curb carbon emissions and as a result climate change. His family firm, the Neumann Single Family Office, has purchased stakes in three cryptocurrency-related companies, he said.

Celia Young can be reached at cyoung@commercialobserver.com.