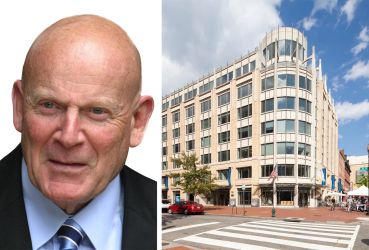

Sam Zell Buys Industrial REIT Monmouth Real Estate for $3.4B

By Nicholas Rizzi May 6, 2021 2:32 pm

reprints

Sam Zell is jumping into the red-hot industrial market.

Zell’s Equity Commonwealth agreed to buy industrial real estate investment trust (REIT) Monmouth Real Estate Investment Corp. in a $3.4 billion all-stock deal, Monmouth announced Wednesday.

Under the deal, Equity will control a 65 percent stake in the company, while the New Jersey-based Monmouth will have 35 percent. The deal is expected to close in the second half of this year.

The move gives Zell a large foothold in the industrial market, which has boomed during the coronavirus pandemic. Monmouth’s portfolio consists of 24.5 million square feet spread across 120 properties in 31 states.

“The transaction provides Equity Commonwealth with a high-quality, net-leased industrial business with stable cash flows while preserving [Equity’s] balance sheet capacity for future acquisitions,” Zell said in a statement.

The industrial sector has exploded during the pandemic, as consumers flocked to online shopping in the wake of lockdowns and companies scrambled to meet the demand.

Net absorption for industrial space in the densely populated I-81/I-78 corridor from Maryland to New York City hit a record 23.5 million square feet in 2020. Meanwhile, industrial construction nationwide is expected to hit a five-year high in 2021.