Law Firms Seizing Office Opportunities, Subletting Space Amid COVID

Forget more hoteling and other drastic office-use changes for now, though

By Tom Acitelli March 8, 2021 1:52 pm

reprints

Law firms in major U.S. markets are seizing on opportunities during the pandemic to cut back on their office space and to reassess such needs in the future. But the industry is not expected for now to embrace drastic changes like widespread use of hoteling.

That’s according to a new white paper from commercial real estate services firm Newmark. The paper, authored by Newmark research director Bethany Schneider, examined past trends in law firms’ office use in major markets, such as New York, Los Angeles, Washington and Chicago, and how the pandemic not only spawned new trends, but also accelerated or altered those existing ones.

Much of the opportunism is due to the general topsy-turviness in an office market driven by the coronavirus pandemic, which has emptied work hubs, including via a wave of subletting that has knocked the floor out of asking rents in major markets. Some available sublease space in Midtown Manhattan, probably the nation’s premier office district, has gone for nearly half what it normally would.

“Many firms have taken advantage of the tenant-favored environment to renegotiate their existing leases and return excess space to the asset owner,” Schneider wrote in the Newmark white paper. “In short, many of the transactions that occurred after the pandemic started were driven by opportunism rather than a change in space usage or configuration resulting from a need for social distancing.”

Lease adjustments dominate law firm leasing transactions now, including taking space for less time and extracting more concessions from landlords. As the white paper noted, the five largest law firm leasing deals in New York City since the pandemic started have been for no more than five years (identical to a trend toward shorter leases seen in the wider New York office market).

Still, even with the adjustments or, perhaps, in part, because of them, law firms’ leasing activity has declined steeply during the pandemic. Total gross leasing activity by law firms dropped 41 percent from 2019 to 2020, according to a sample of gateway markets in the Newmark paper. Most leasing deals, too, were for non-headquarters offices. Firms have not wanted to commit to such major decisions amid the uncertainty of the pandemic, according to the paper.

At the same time as firms pumped the brakes on new leases, they hit the gas on subletting. Examples abound. In Los Angeles, at least three law firms were offering sublease space of at least 25,000 square feet each in the downtown and Century City submarkets, as of the Newmark paper’s publication in early March. In Midtown, another three firms have listed “significant blocks of sublease availability that are pandemic-related.”

In Chicago, some 37 firms are subletting downtown space with an average size of 8,585 square feet; and, in D.C., 20 firms have placed more than 500,000 square feet on the sublease market since the pandemic started — a remarkable 34 percent of law firms’ footprint in the nation’s capital.

A lot of companies in myriad industries are subletting their space right now, not just law firms, and are also reassessing their office needs going forward. What makes such moves by law firms — and, for that matter, by banks, insurers, and a handful of other fields — is that the legal sector animates many major office markets.

In the New York area, law firms occupied 41.8 million square feet of space — or 4.8 percent of the office market — by May 2020, a couple of months into the pandemic, according to CoStar data. The sector also occupied between 4 percent and 5 percent of the office space in the L.A., Chicago, Washington and San Francisco metros. Office markets, then, feel any major changes in law firms’ leasing habits.

SIGN UP FOR COMMERCIAL OBSERVER’S NEWSLETTERS

Fortunately, for landlords, it looks for now like the subleasing and the general land rush to concessions and shorter terms is a product of the pandemic. Many, if not most, firms appear to be adopting a wait-and-see approach to their office leasing, according to Newmark’s Schneider.

“At many AmLaw 100 firms, decision makers want to wait to see how colleagues respond to the impact the pandemic has had on their work/life balance, and factor in workspace changes — if any — in future expansions,” she wrote, referencing a ranking of the 100 largest U.S. firms.

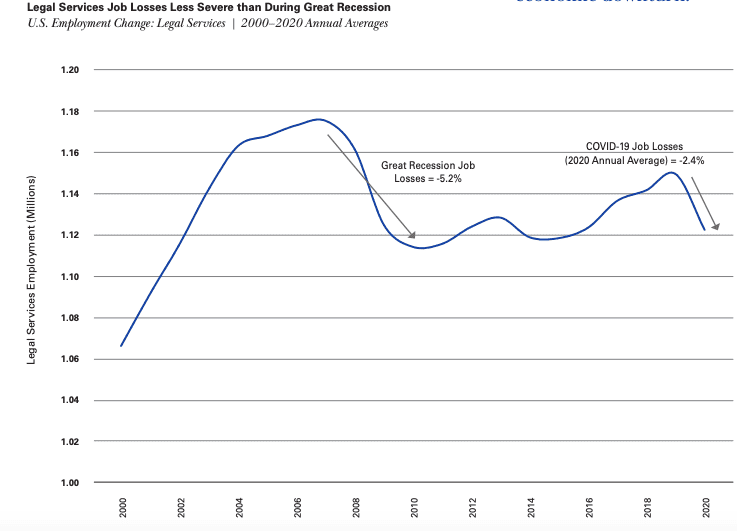

Indeed, like death, taxes, and the Yankees in the postseason, it seems like Americans’ need for lawyers remains a certainty in life. Job losses in the legal industry have yet to approach the losses during the Great Recession (see chart below). Industry employment in the U.S. dropped 2.4 percent in 2020, and 2.8 percent during the 12 months ending in November. Those are both well below the 5.2 percent drop from 2007 into 2010; and both periods started from a high number of jobs due to an early-century boom in legal employment.

At the same time, there’s nothing really new under the sun for law firms. They had been reassessing space needs for years before the pandemic, consolidating offices, and then densifying their presences in them. Part of this is due to digitization — there’s less need now, for instance, for space to keep paper records — and part of it is due to a generational shift as younger workers, including attorneys, are not as wedded to the need for private space within offices. Technology, too, enables more remote work, a trend COVID, of course, accelerated.

A Colliers International analysis found that space allocated to attorneys specifically in 19 North American markets fell 5.9 percent, to 836 square feet on average, from 2017 to 2019. For partners, the average amount of space had dropped 6.3 percent, to 1,825 square feet.

The office arc for law firms has for years, then, been bending toward less, more densely used space. The pandemic is likely to accelerate the trend, but it’s too soon to tell by how much.

One thing that won’t be driving the change that much further, according to Newmark, is hoteling, or replacing assigned seating with reservations. More firms had been experimenting with hoteling pre-pandemic, and it might fit in well with plans to transition some workers to a hybrid schedule combining in-office and remote work. But the industry has also come to see it as a drag on recruitment. What top law school hire wants to hunt for shared desk space in the morning?

“Most law firm office market experts consulted for this study predict that if there is an impact on workplace strategy resulting from the pandemic, it is more likely to be a move toward smaller offices and potentially some shared offices,” the Newmark white paper said. “[A] strong shift toward universal hoteling is unlikely, particularly among AmLaw 100 firms.”