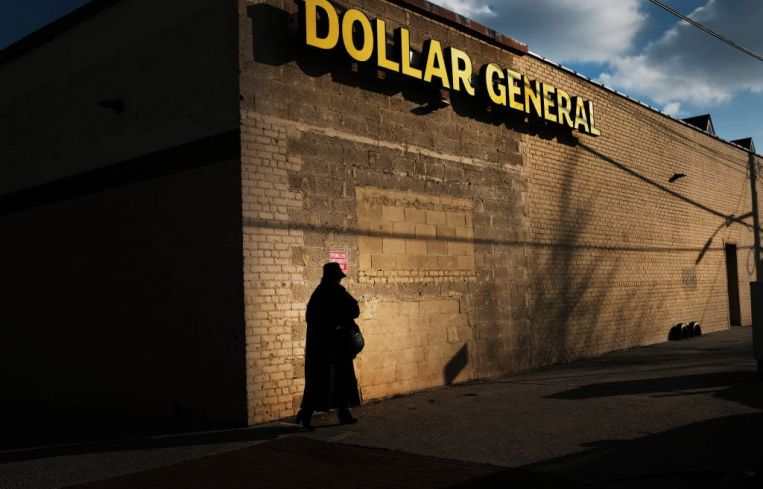

Dollar General Sees Increase in Super Saturday Foot Traffic as Most Retailers Slump

By Nicholas Rizzi December 29, 2020 12:41 pm

reprints

Dollar General saw an increase in the number of people visiting its stores this past Super Saturday — the last Saturday before Christmas — while most other retailers slumped, according to a foot traffic report from Placer.ai.

The dollar store chain had a 1.3 percent gain in foot traffic on Super Saturday, which fell on Dec. 19, compared to 2019, despite COVID-19 keeping shoppers out of stores this holiday season, Placer.ai data shows.

Of the 10 retailers Placer.Ai tracked during Super Saturday — Walmart, Target, Best Buy, Ross, Marshalls, Macy’s, JCPenney, T.J. Maxx and Kohl’s — Dollar General was the only one to see an increase compared to last year. JCPenney, which recently emerged from bankruptcy, had the biggest hit with a 41 percent drop in foot traffic compared to 2019.

Brick-and-mortar retailers faced a brutal 2020 shopping season as the coronavirus made shoppers buy gifts online instead of in physical stores.

Black Friday, typically the busiest shopping day of the year, had a record of $9 billion in online sales, but visits to physical stores decreased by 52.1 percent compared to 2019, leading some to posit the end of Black Friday as we know it. But Super Saturday could soon overtake Black Friday’s mantle in the future.

Despite the 10 retailers Placer.ai tracked as having a 21.2 percent drop in foot traffic compared to last Super Saturday, they averaged 18 percent more visits on Super Saturday weekend this year compared to Black Friday weekend.

Retail sales reached a record $34.4 billion on Super Saturday this year, making it the largest, single shopping day in U.S. history and beating this year’s Black Friday sales by 10 percent, Bloomberg reported.

While other retailers have been battered during the pandemic — with dozens filing for bankruptcy this year — dollar and discount stores have thrived during COVID-19. They have seen an increase in foot traffic and sales, and even opened up new locations during the pandemic as most other brands slimmed their portfolios.