Michael Philips

Michael Philips

Principal and President at Jamestown

Have you refinanced anything in 2022? How difficult/easy was it?

It has been a challenging environment, but, within that, we’ve been able to refinance seven projects totaling $874.5 million so far in 2022.

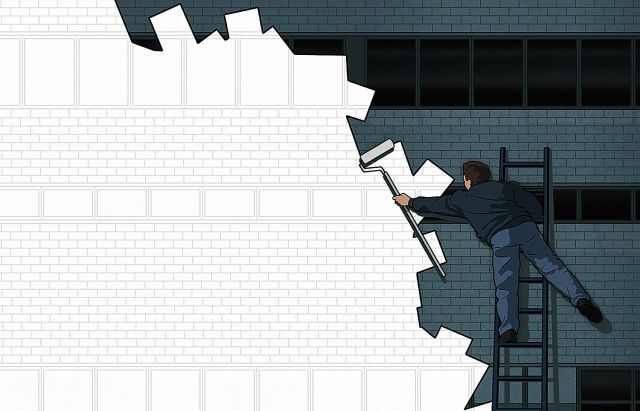

There’s a lot of Class B and C office in NYC. If you could lay your hands on them at a really great price, what would you do with them?

Depending on the location, I would convert the buildings to mixed-income residential or student housing — with a community-centered pedestrian ground plane consisting of chef-driven food concepts and placemade retail.

What market outside of NYC do you like and why?

Domestically? We have been in Atlanta for years and continue to invest there as well as in other metropolitan areas throughout the South. Sunbelt cities have been the beneficiary of long-running migration trends, driven by both baby boomers and millennials seeking warmer climates, as well as sustained job growth. Our approach to adaptive reuse and mixed-use urban development has proven successful at Ponce City Market in Atlanta. We’re now translating that approach to additional sites in Atlanta, as well as large-scale developments in Raleigh and Charleston.

There’s a midterm election this year. How closely are you following, and do you think the national political climate will have an effect in New York?

I’ve been closely following the election and believe the national political climate dictates, in part, the tenor of political conversation and engagement locally in New York.

How many days per week are you in the office?

I work from one of Jamestown’s offices three to four days each week.

How many days per week are your tenants in the office?

It varies across geographies and tenant types, but, on the whole, we’re seeing about three days per week. The post-Labor Day uptick has yet to be fully appraised.

NYC apartment rents have reached never seen levels. How much further can it go? How does the housing squeeze play out?

On one hand, it’s a great indication of the continued demand for New York, in contrast to the negative headlines and narratives of the past few years. On the other hand, it’s critical we make affordable, middle-income and student housing a top priority in the years to come to serve demand in a holistic and inclusive way.

ESG: fad or fixture?

Fixture. The trend toward ESG investing is permanent. The prominence of ESG among our tenant base is expanding. We’re intensely focused on the future of work, retail and built environments, and believe an integrated ESG strategy will be a core component of our future success. Beyond it being the right thing to do, we believe our efforts can be profitable when it creates environments that help prospective tenants meet their own ESG corporate responsibility goals. We aim to align our ESG efforts and value systems with those of our tenants. Alignment can present a significant value add for our existing tenants and a competitive advantage with prospective tenants.