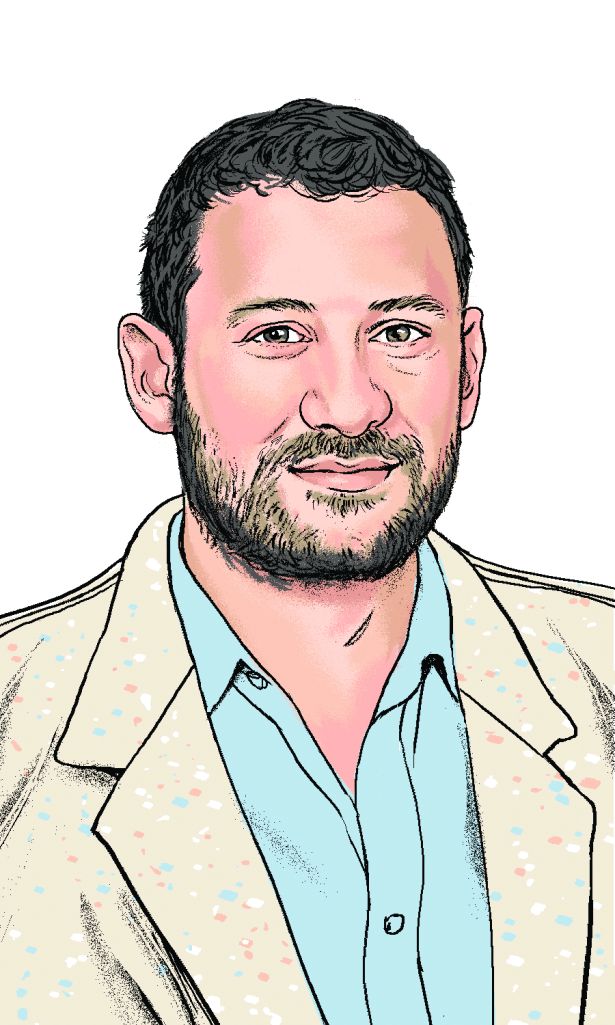

Jonathan Iger

Jonathan Kaufman Iger

CEO at Sage Realty

Have you refinanced anything in 2022? How difficult/easy was it?

Earlier this year we refinanced 77 Water Street, one of our Class A office properties in the Financial District. It’s a difficult market for refinancing right now, but, as a long-term owner with deep relationships, a trusted reputation, and a long history of navigating difficult real estate markets and recessions, we were very happy with the outcome. This was made possible through our partnership with Acore, who have been wonderful to work with and represent what we look for in our selection of a lender.

There’s a lot of Class B and C office in NYC. If you could lay your hands on them at a really great price, what would you do with them?

I am extremely optimistic about New York City’s turnaround and its future, so I would buy a Class B office property at a great price. We would evaluate each opportunity for its highest and best use, and achieve that. Our expertise is in repositioning buildings to Class A Sage properties, so that would be a possibility. The city also needs more housing, more logistics centers, and more cold storage, so, ultimately, we would achieve what we determine is the best use of the space.

What market outside of NYC do you like and why?

Charleston, S.C., is one of my favorite cities to visit. The combination of a high quality of life, a thriving local culture and a booming economy makes it an especially desirable market. Given everything that it has going for it, my outlook for Charleston is very positive.

There’s a midterm election this year. How closely are you following, and do you think the national political climate will have an effect in New York?

I am following the upcoming election closely. If the legislative and executive branches are split after the midterms, this may have the biggest impact on New York. If this happens, governance is going to grind to a halt, and this will ultimately have some level of impact on the city.

How many days per week are you in the office?

I am in the office four days per week.

How many days per week are your tenants in the office?

Our tenants are in the office every day of the week. Each company has a different hybrid schedule, and we’re finding that some days are busier than others. Overall, the amount of people in our buildings has been steadily increasing over the last several months, and right now we’re seeing the highest occupancy since the pandemic began. From everything we have seen, people are eager to return to the office.

NYC apartment rents have reached never seen levels. How much further can it go? How does the housing squeeze play out?

NYC apartment rents can and will go further, especially given the impact that rising interest rates will have on the sales market. This is resulting in less buying, more renting and, in turn, higher pricing. Until the city comes up with a concrete affordable housing plan that includes working with private developers by offering proper incentives like the reinstatement of the 421a exemption, rental levels will continue to increase. I also predict a continuation of urban sprawl, where more people will move to farther-out neighborhoods of the outer boroughs to find lower rental prices.

ESG: fad or fixture?

ESG is a fixture, and it will continue to grow and be an integral part of how companies in commercial real estate operate.

Class quote

“Now, go, and make interesting mistakes, make amazing mistakes, make glorious and fantastic mistakes. Break rules. Leave the world more interesting for your being here.” —Neil Gaiman