Keith Rubenstein

Founder at Somerset

Are you going to buy in `25? If so, what asset class?

Well, it’s hard to say no to a good deal, but I’ll be cautious. The focus will likely remain on multifamily and mixed-use properties.

Is there a single “good” sign you see in a distressed property?

Absolutely! One thing is location potential. You can renovate, reposition and redevelop, but you can’t pick up a building and move it to a better part of town. If the property is in a transitional area or near a hub that’s ripe for revitalization, that’s good. Also, if fundamentals like zoning and structural integrity are solid, it’s worth exploring.

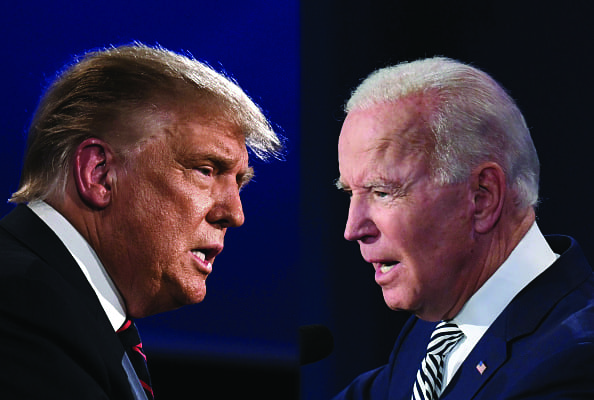

What real estate or tax policy would you like to see from a Trump administration?

Now that Trump won, we’ll see an emphasis on tax cuts and deregulation. Maybe a little less red tape for real estate, and integration of cryptocurrency into transactions.

If you could stack the new administration with people you know, who would you choose?

First up, I think Marty Edelman and Doug Harmon would be great in the mix. Marty can handle international matters like no one else, and Doug knows his way around an investment and can balance long-term vision with immediate returns. Beyond that, I’d want folks who understand how important the real estate sector is to the broader economy. Maybe people like, in no particular order, Jeff Blau, Scott Rechler and Ben Brown; and a few sharp land use attorneys like Jesse Masyr who get that speed matters.

Let’s talk office. Is the worst over?

I’d like to say yes, but honestly? Some offices are bouncing back, especially in cities where people actually want to go into work (imagine that!) but there’s still a ton of underutilized space. I think the worst is over for those who’ve adapted, and can pivot into mixed-use or creative reuses.

Let’s talk about retail. What’s the kind of tenant you want?

I’m all about experiential retail right now. I want restaurants, boutique fitness, art, entertainment spots, or high-end specialty shops that make people want to visit in person. Think about it: A rooftop bar or an artisan bakery is going to bring more traffic than a big-box store.

Let’s talk about multifamily. Do you ever see yourself building normal, middle-class rentals again? What would stop you?

I’d love to, but the math has to work. I’m hopeful that with the right policies in place — maybe some zoning changes or tax abatements — it could become a reality again. After all, everybody deserves a decent place to live. We are planning a great project that will include workforce housing in Ellenville, N.Y.

Which market do you like best? Which market are you fearful of?

Miami is looking great right now — lots of people relocating, and there’s a vibrant energy there. As for what I’m worried about, San Francisco comes to mind. With the tech exodus, high crime, and the ongoing challenges in the commercial real estate market, it’s become a tougher place to justify new investments. New York City is still solid, but we have to keep an eye on regulation and affordability. Cities near NYC are compelling as are cities like Syracuse — lots of action up there.

What’s going to be your biggest expense in 2025?

I hope it’s not litigation costs! Insurance is going to be a killer. That’s one cost we all wish we could negotiate down more easily. Thankfully my best friend handles all our insurance. He is the Patrick Mahomes of insurance!

What are your predictions for the mayor’s City of Yes, especially given the controversies within the Adams administration?

City of Yes? It’s more like the City of “Maybe, if you fill out these forms in triplicate.” The idea is great — streamlining development and making it easier to build — but execution is everything.

Lightning Round:

Your social media of choice?

Instagram.

AI: Helpful in CRE or a fad?

Very helpful — in fact I used it to answer half of these questions.

Last movie you saw in a theater?

“Civil War” in the great Sag Harbor Cinema.

You’re going on a six-month expedition into the Amazon rainforest. What’s your last meal before you get on the plane?

A lean steak and vegetables — and fries.

Tesla or BMW?

Tesla. It’s the future, and it parks itself.

Will interest rates be below or above 4 percent on July 1, 2025?

Above.

If you could partner with one person in the business on a property, who would it be?

My daughter Dani — we already have a great working relationship (she works for Brookfield!).

What are you tired of talking about?

Office space vacancies. Let’s move on!