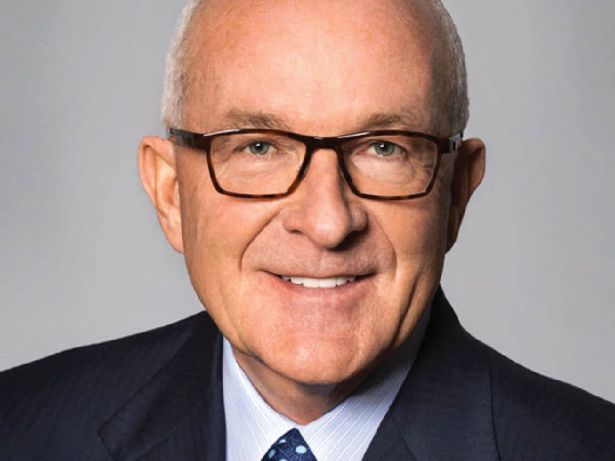

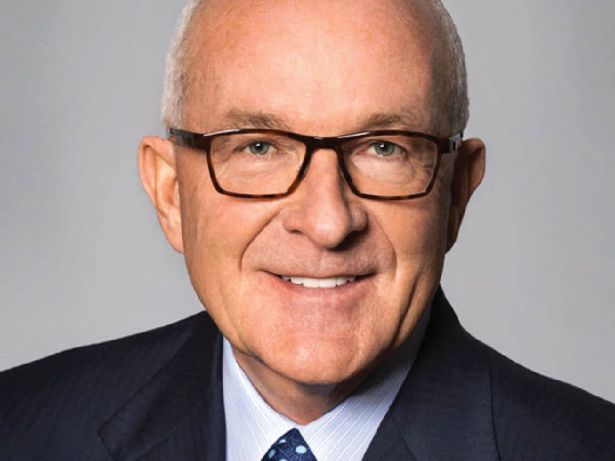

Albert Behler

Albert Behler

Chairman, CEO and President at Paramount Group

Last year's rank: 51

Quiet, conservative, timeless, stable. That’s Paramount Group’s style and it is not about to change just because of some virus.

Paramount, which was established by the German entrepreneur Werner Otto in 1968, has kept its approach steady since then, owning such stately corporate assets as 1633 Broadway (also known as Paramount Plaza), 1301 and 1325 Avenues of the Americas, 712 Fifth Avenue, and One Market Plaza and 300 Mission Street in San Francisco.

Where there is a global investment bank — like Deutsche Bank, Morgan Stanley, Barclays and Crédit Agricole — there’s Paramount as its landlord.

Albert Behler joined Paramount in 1991 as president and CEO. Not that he never buys or sells anything, but he has maintained Paramount’s low-key approach through the succeeding decades.

That approach proved helpful as the COVID virus took its toll on the markets.

“There is no question that gateway cities were affected disproportionately,” Behler said in an email. “This should not have come as a surprise as these urban cities employed more stringent measures such as ‘pause orders’ and ‘shelter-in-place rules.’

“As these places recover, Paramount will be the beneficiary,” he wrote. “I also fundamentally do not believe that people move to these urban, amenity-rich gateway cities like New York and San Francisco to sit in their apartments.”

Paramount was able to collect 97.2 percent of the rent due from its tenants during the pandemic, too, according to Behler. “We fared better than most” due to the staff’s effort “to secure a blue-chip roster of enviable tenants.”

Paramount does have conspicuous vacancies, not the least of which is the Barclays block of 500,000 square feet at 1301 Avenue of the Americas. During the REIT’s most recent earnings call in February, Behler said his executives were “laser-focused” on filling those spaces. The Barclay’s vacancy goes back more than a year.

Late last year, the REIT also lost $12 million in the sale of 1899 Pennsylvania Avenue in Washington, which it sold for $103 million, a loss the company blamed on the pandemic and one Behler called “reasonable given current market conditions.” The sale completed Paramount’s strategic exit from the Washington market.—D.M.L.