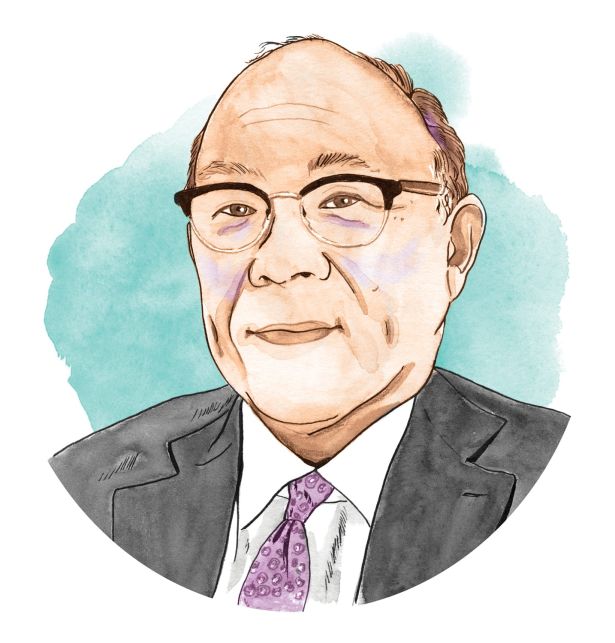

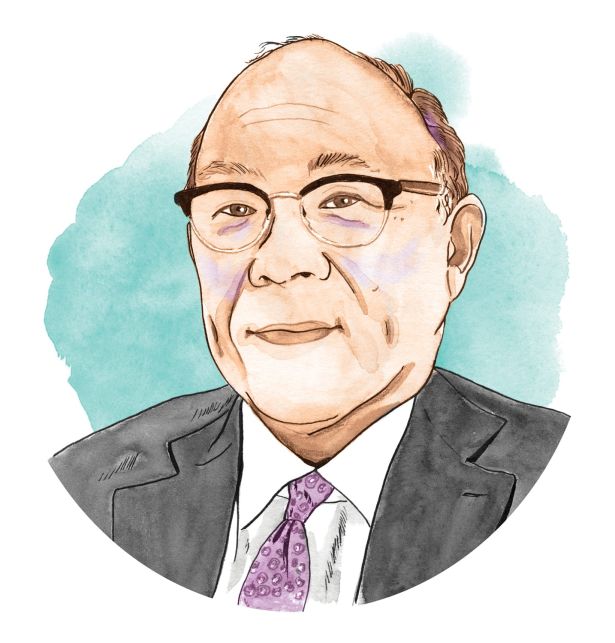

Anthony Wong.

Anthony Wong

Senior Vice President and Head of U.S. Commercial Real Estate Lending at Bank of China

What are the key lending opportunities you see as we round out 2021?

BOC’s approach to CRE lending has been steadfast throughout 2021. Our approach focuses on embracing dense, high-barrier-to-entry markets in gateway cities with high-quality assets that are consistent with BOC’s lending mandate. We structure loans with a margin of safety, including predictable cash flow from top tenants and a safe loan basis. As we look ahead to the new year, we see significant opportunities in well-leased and credit-tenanted offices, as well as stable multifamily assets. At BOC U.S.A., we remain focused on seeking out great sponsors that we can foster and build long-term relationships with. For example, we were recently mandated to finance a significant Class A New York City office and a Los Angeles luxury multifamily high-rise. Together, both mandates total approximately half a billion dollars, and are two great achievements to close out the year.

New York City: “I want to be a part of it”?

New York is a global financial, cultural, academic and talent hub. The city not only has one of the largest clusters of colleges and universities in the world, but also continues to attract a lot of talent, particularly as tech companies seek to expand and have become the largest buyers and tenants of real estate across the city in the past 24 months. While COVID-19 disrupted Manhattan’s rhythm, New York remains resilient, gritty and always lands on its feet, coming back better and stronger than ever before. New York’s ability to overcome setbacks proves that if we are patient and practice safe habits, the city will bounce back. So, yes, never bet against New York. I am long on New York City and very much in the bull camp!

What’s your favorite secondary market and why?

We are partial to markets with low taxes, favorable supply-demand fundamentals and a growing population — particularly among millennials. We also keep an eye out for markets that are witnessing an influx of new businesses, higher academia, accessible housing options and a great quality of life. One example is Nashville, Tenn. The city recently invested more than $1 billion in its local airport, enhancing its overall access and appeal.

Are you adding life sciences deals to your loan portfolio? Why or why not?

In the past decade, we began lending in Cambridge, Mass. — an epicenter of life sciences assets — prior to the popularization of such lending among other lenders. We continue to pursue life sciences deals because we value the fundamentals, inelastic demand and since new supply is constrained. Technology, biology and science will continue to converge, and the velocity of new therapeutic rollouts is fast-paced. Tenants here are very sticky and provide a recurring and predictable cash flow stream, which aligns with our focus on established cluster submarkets and seasoned sponsors.

How prominent do you envision C-PACE financing becoming? Is it here to stay?

The global momentum to generate a carbon-neutral presence will become a core consideration for property owners evaluating financing options. C-PACE is in its infancy now, but it — alongside other green financing options — will grow in importance and factor more into many investment decisions. Stakeholders will need to understand how cash flows are impacted and underwrite appropriately.

What keeps you up at night?

I never lose sleep over what I cannot control or what I cannot mitigate through structure, but when there are major legislative changes that can affect behavior and influence valuations, to the detriment of commercial real estate, I count sheep!

Lightning Round

Stabilized or transitional assets?

Both types of assets are not mutually exclusive. BOC pursues loans on both asset types and has had historical success on both fronts. With transitional assets, we look to lend with a well-seasoned sponsor, mission-critical space, and tenants with credit characteristics and long lease tails.

Fast-food guilty pleasure?

A double helping of anything with lots of salt and fat … and then a nap after (but not, of course, during work from home).

Peloton bike or outdoor cycling?

I would rather be on a road bike doing loops around Central Park, but, please remember, always wear a bike helmet.

Who would play you in the biopic of your life?

Anthony Hopkins.

“If I hadn’t pursued a lending career I’d be …”

I would love to have been the permanent conductor for the Leipzig Gewandhaus Orchestra, but, regrettably, I cannot read sheet music, do not play an instrument, and cannot hold a tune.