Lagging Occupancy in Q1 Shows Vornado Still Not Out of the Woods

Vornado’s office occupancy rate dipped to 89.3 percent in the first quarter of 2024

By Abigail Nehring May 7, 2024 3:40 pm

reprints

Manhattan’s second-biggest office landlord needs to fill some big gaps in its portfolio, and it’s willing to make concessions to do so.

Occupancy across Vornado Realty Trust’s 20.4 million-square-foot office portfolio fell to 89.3 percent in the first quarter of 2024 from 90.7 percent at the end of last year, according to the real estate investment trust’s earnings report released Monday night.

Once upon a time, before the pandemic, the firm’s office occupancy rate was north of 97 percent. But occupancy has been sliding for five years now, and executives at Vornado say it hasn’t yet reached the bottom, with Facebook parent Meta planning to vacate its 275,000 square feet at 770 Broadway in June, among other lease expirations coming up this year.

Large vacancies at 770 Broadway, 280 Park Avenue and 1290 Avenue of the Americas have been largely to blame for last quarter’s slip in occupancy, but Vornado thinks this will be a fairly short-lived drop, Chief Financial Officer Michael Franco told investors during a Tuesday morning earnings call.

“We expect this impact to be temporary, as we have already leased up a good chunk of the space,” Franco said. “But the earnings from these leases won’t begin until sometime in 2025.”

For the time being, the dipping occupancy caused Vornado’s earnings to take a hit. Vornado reported $108.8 million in funds from operations, as adjusted, in the first quarter declining quarter-over-quarter from $123.8 million and year-over-year from $116.3 million.

Meanwhile, revenue for the quarter fell 2 percent from $445.9 million in the first quarter of 2023 to $436.4 million last quarter.

Shares in Vornado dipped more than $2 from its Monday opening as traders responded to the figures, closing at $24.21 on Tuesday. The REIT’s stock price plummeted to $12.31 per share last May — cheaper than any time since the 1990s — before recovering to the mid-$20s per share in the second half of 2023. In early 2020, before the COVID-19 pandemic arrived, Vornado’s stock price was near $69.

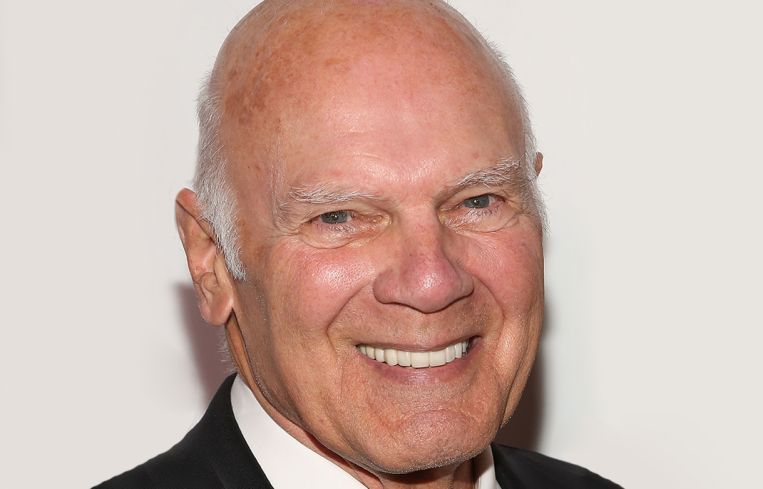

Vornado CEO Steven Roth said earnings will recover as Vornado finds new tenants to fill vacancies, but it will take some time.

“As we get back from whatever we are now to our normal 96 to 97 percent occupancy, that adds a big number to our earnings,” Roth said.

One of Vornado’s biggest office tenants took advantage of its newfound leverage. The landlord agreed to a unique package of concessions in order to keep Bloomberg on as a tenant at 731 Lexington Avenue. The media company renewed its 946,815 square feet in the property until 2040, Vornado announced Monday.

The deal creates a sliding scale to lower Bloomberg’s $98-per-square-foot rent by up to 10 percent, according to Vornado’s quarterly Securities and Exchange Commission filing released Tuesday.

Roth described it as “a fair deal and a clever way of handling the future.”

At the 60-year-old 280 Park, which Vornado co-owns with SL Green Realty, a $1.1 billion commercial mortgage-backed securities loan tied to the property that went into special servicing earlier this year was saved last month as the firms managed to extend the deadline by two years.

Vornado has attracted a few major office tenants to its recently redeveloped Penn 1 and Penn 2 office towers directly above Pennsylvania Station, including Major League Soccer, which took 126,000 square feet at Penn 2 in March.

But the stalled development site of Penn 15 across Seventh Avenue remains a sore spot for Roth.

Roth remains an eternal optimist about the Midtown neighborhood, telling investors, “great things are happening in our Penn District.”

Plus, the recently redeveloped Penn 2 will bring in about $100 million in new annual revenue when it’s fully leased, Roth predicted.

“The company has the potential of earnings being, we think, pretty spectacular,” Roth said. “We’re looking at it not on a one-month or one-quarter basis. We’re looking at what the company’s earning power would be two or three years out, and we are extremely excited about that.”

Abigail Nehring can be reached at anehring@commercialobserver.com.