CRE Debt Market Better Positioned Today Than During GFC: Stats

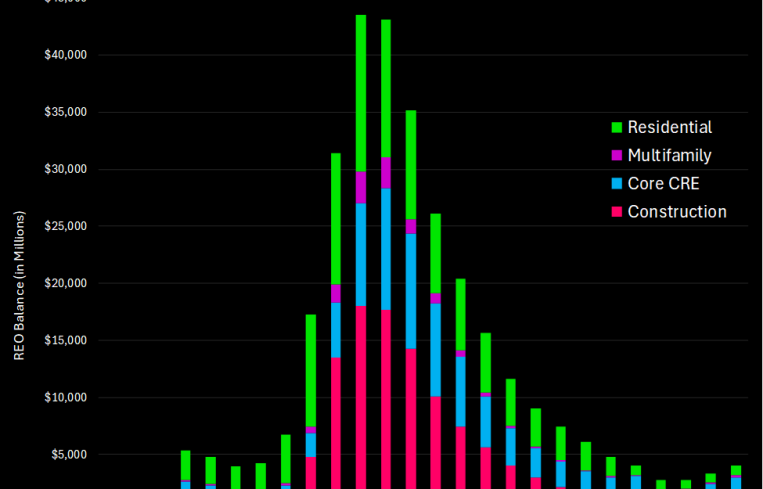

The second-quarter 2025 real estate owned (REO) balances across property sectors are substantially lower than the peaks witnessed during the Global Financial Crisis (GFC) and its aftermath from 2008 to 2012, signaling a more resilient commercial real estate environment and improved asset quality for lenders and investors. As a reminder, REO assets refer to properties (such as office buildings, retail spaces, industrial facilities or multifamily units) that have been foreclosed upon by a lender — typically a bank or a financial institution — and are now directly owned by that lender after an unsuccessful foreclosure auction or when the borrower defaults on their loan.

Q2 2025 vs. GFC REO levels

REO balances reached extraordinary heights between 2008 and 2012, with total real estate owned surging to over $51 billion in second quarter 2011, according to CRED iQ data. Each major property type saw dramatic increases: Nonfarm nonresidential peaked above $17 billion, with multifamily, construction and residential sectors all seeing multibillion-dollar REO volumes. By comparison, second quarter 2025 shows markedly lower balances: Total REO is about $4.1 billion, with core CRE (nonfarm nonresidential) at $2.4 billion, construction at $588 million and multifamily at $231 million.

Sector breakdown and trends

Core CRE: After cresting above $17 billion in second quarter 2011, this sector now holds only $2.38 billion of REO, showing how far distress has receded.

Construction: The current $588 million in construction REO is a fraction of the GFC peak of over $18 billion, as riskier development loans have been managed more conservatively in recent cycles.

Multifamily and Residential: Multifamily REO hit over $2.7 billion during crisis years but sits at $231 million in 2025. One- to four-unit residential peaked above $13 billion in 2010, now just $852 million, reflecting more robust borrower performance and tighter underwriting.

Office example

A four-story, 137,731-square-foot office building at 120 Mountain View Boulevard in Basking Ridge, N.J., entered foreclosure after a failed balloon payment upon loan maturity in June 2024, resulting in REO status. Originally valued at $27.2 million in 2014, the property’s value plummeted to $7.7 million by mid-2025 as its occupancy dropped from 100 percent in 2022 to just 45.64 percent in March 2025, contributing to a low debt service coverage ratio of 0.46 as of May 2025. The asset’s financial distress led to the appointment of a receiver and foreclosure proceedings as the lender moved to resolve the nonperforming matured loan transferred from the JPMBB 2014-C22 conduit

Macro implications for investors and lenders

REO levels are now in line with — or lower than — pre-GFC averages, confirming that lenders are carrying far fewer distressed real estate assets on their books than before. This shrinkage reflects not only the economic growth following the crisis, but also dramatic improvements in risk management, property valuation and loan workout strategies that have reduced the systemic buildup of troubled assets.

Opportunity and risk outlook

While lower REO supply suggests fewer forced-sale buying opportunities for opportunistic investors, it also signals healthier loan books for lenders and higher confidence in collateral values. Should economic headwinds intensify, early detection and workout mechanisms in today’s market will likely prevent a repeat of GFC-level asset distress, offering greater stability for commercial real estate stakeholders.

Overall, today’s REO environment tells a story of cautious optimism, where lessons from the GFC have reduced risks and left both lenders and investors better positioned to weather future shocks.

Mike Haas is the founder and CEO of CRED iQ.