Acadia Posts Robust Q2 Leasing Despite Tariff Concerns

The REIT expects its occupancy to climb above 94% by the end of this year

By Nick Trombola July 30, 2025 3:20 pm

reprints

Physical retail is rebounding despite ongoing tariff concerns, and Acadia Realty Trust is positioned to take advantage of the market’s tailwinds.

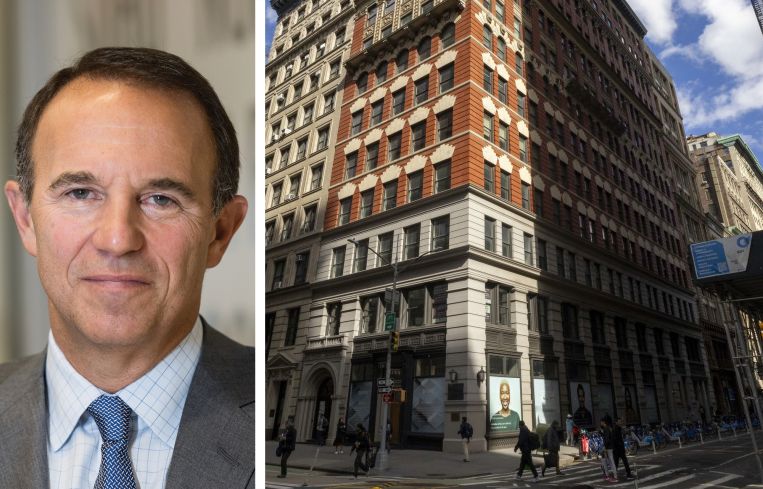

Acadia’s roughly 14 million-square-foot portfolio is dominated by street-level retail spaces in urban markets across the country, with a particular emphasis on New York City. While the real estate investment trust clenched its teeth earlier this year in preparation of President Donald Trump’s tariffs, the economic effects have so far been mild, and consumer and tenant resilience remains robust, according to Ken Bernstein, Acadia’s president and CEO.

Overall occupancy rates in particular rebounded after slipping earlier this year, as tenants rushed to take advantage of strong consumer spending and a glut of new supply. Acadia’s core portfolio occupancy rate rose 50 basis points to 92.2 percent in the second quarter, compared with 91.7 percent the previous quarter, according to its latest earnings report. The REIT expects occupancy to further climb to 94 to 95 percent by the end of this year.

“We seem to be in an ongoing tug of war, with fear of tariff induced stagflation on one side, and then surprising resilience on part of the consumer and the overall economy on the other,” Bernstein said during the REIT’s earnings call Wednesday. “So far, thankfully, team resilience seems to be winning. That is certainly what we are seeing as we look at our quarterly results. Resilience is showing up both in continued strong tenant demand for space, as well as retailers’ performance in our portfolio.”

That resilience is particularly evident in Acadia’s SoHo portfolio in New York City, which is currently 97 percent leased. The firm secured new leases in the second quarter and in the early third quarter from luxury brands Richemont and Veronica Beard, along with recent renewals from fellow brands Theory and Frame at Acadia’s Greene Street collection, according to A.J. Levine, Acadia’s senior vice president and head of leasing and development.

Leasing activity is currently twice the volume that Acadia saw this time last year, Levine told investors during the call, with most of that activity coming from high-growth streets. The momentum appears to be building as well, with more than $7 million worth of deals in the firm’s active leasing pipeline.

“The sales growth we’re seeing in our streets is staggering, with year-over-year growth on the majority of our streets well north of 20 percent,” Levine said. “And with strong sales and healthy occupancy ratios, our tenants remain focused on long-term growth. And as a result, we continue to see leasing momentum that’s ahead of the pace we’ve seen over the past several quarters.”

Still, Acadia’s second-quarter funds from operations were more modest compared to the first quarter of this year, dropping from $43.4 million to $38.1 million. However, the metric is still notably above the $37 million seen at the end of last year and well above the $28.1 million reported in the second quarter of 2024.

Acadia’s recent investment activity also slowed compared to the first few months of this year, as it treads more lightly due to tariff anxiety. However, the REIT spent $157 million on new acquisitions in the second quarter, most notably snatching up the storefronts at 70 and 93 North Sixth Street in Williamsburg, Brooklyn for $50 million. The deal is evident of Acadia’s continued interest in the hipster enclave, following its $60 million purchase of 95, 97 and 107 North Sixth Street in April.

All told, the firm spent $860 million on acquisitions over the past 12 months, including roughly half a billion dollars on street retail, Bernstein said — a development few would’ve predicted during the dirges of the pandemic.

“If I ever had a crystal ball, I threw it out during COVID,” Bernstein told an investor during the call’s question and answer segment.

Nick Trombola can be reached at ntrombola@commercialobserver.com.