Midtown’s Hilton Garden Inn’s $175M CMBS Loan Enters Special Servicing

By Andrew Coen February 19, 2025 4:53 pm

reprints

The $175 million commercial mortgage-backed securities (CMBS) loan securing the Hilton Garden Inn in Midtown Manhattan has once again transferred to special servicing, nearly five years after it was forced to temporarily close at the onset of the COVID-19 pandemic.

The loan — part of the MSBAM 2015-C22, MSBAM 2015-C23 and MSC 2015-MS1 CMBS conduit deals originated in 2015 by Morgan Stanley — is on course to default at its March 2025 maturity date, according to a report released by Morningstar Credit Wednesday afternoon.

The debt package, which also includes a $25 million mezzanine loan, was initially sent to special servicing in May 2020, shortly after its pandemic-induced temporary closure, before returning to the master servicer in June 2022, according to Morningstar.

David Putro, senior vice president at Morningstar Credit, said the 401-key hotel’s performance has lagged expectations from the loan’s issuance a decade ago with the trailing 12-month net cash flow as of September 2024 at $15.4 million compared to $16.7 million in 2015. He attributed the drop in large part to expenses rising from $18.4 million 10 years ago to $19.5 million in late 2024 while occupancy has stood “strong” at 92 percent.

“The total debt stack is $200 million including the mezzanine loan, so given where the cash flow is, the debt yield is at the lower end of where loans have been getting done,” Putro told CO.

Putro added that the loan was likely “having a hiccup” getting a refinancing, with a maturity fast approaching next month in a higher interest rate environment than 2015. He said that, while there has been no special servicer commentary around the transfer, the borrower will likely seek an extension.

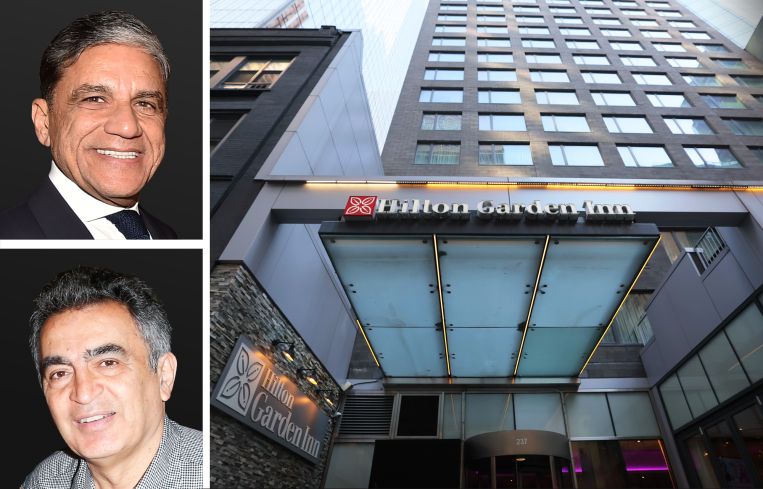

Starwood Capital and the Moinian Group co-developed the 34-story hotel at 233-239 West 54th Street before Starwood sold its stake in the property to investor Morad Ghadamian in February 2015, The Real Deal reported at the time.

Representatives for Moninan Group and Ghadamian did not immediately return requests for comment.

Andrew Coen can be reached at acoen@commercialobserver.com.