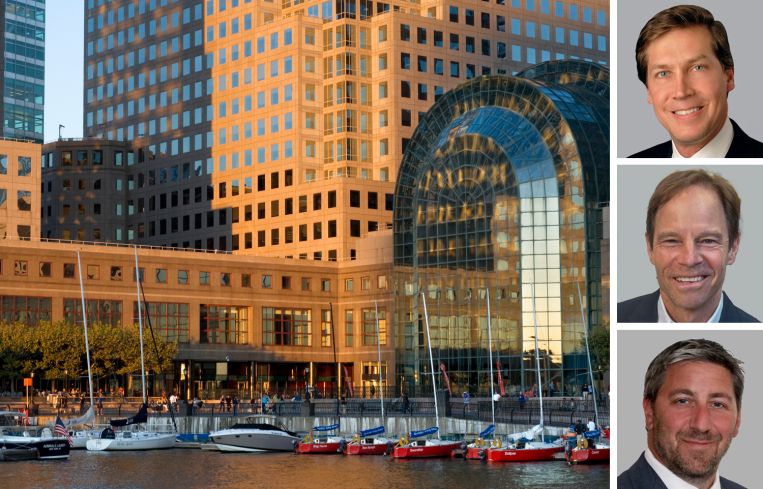

Trading Firm Jane Street Grows to Nearly 1M SF at Brookfield Place

By Nicholas Rizzi February 14, 2025 2:12 pm

reprints

Trading firm Jane Street Capital has signed on to stay put at Brookfield Place and nearly double its footprint in the process.

Jane Street signed a “long-term” lease to grow to nearly 1 million square feet at 250 Vesey Street, where it’s been a tenant since 2014, a source with knowledge of the deal confirmed. Bloomberg first reported the deal.

A spokesperson for Brookfield declined to comment, and a spokesperson for Jane Street did not immediately respond to a request for comment.

The asking rent was unclear, but asking rents in Lower Manhattan averaged $56.51 per square foot in January, according to a CBRE report.

Brookfield handled the deal in-house via Duncan McCuaig, Mikael Nahmias, Hayley Shoener and Dan Roberts while Rob Lowe, Augustus Field and Jon Herman of Cushman & Wakefield represented Jane Street. A spokesperson for C&W did not immediately respond to a request for comment.

Jane Street — which focuses on exchange-traded funds — moved its headquarters to 140,000 square feet at 250 Vesey Street in 2014, as Commercial Observer previously reported. It later grew to about 600,000 square feet at the property, the source said.

The firm, which has locations in London and Hong Kong, was on the hunt for bigger digs in the fall and considered taking space at Brookfield’s neighboring 300 Vesey Street, the New York Post reported. But Brookfield put in work to make sure Jane Street could stay in one building. The owner gave up some of its own corporate offices to make room for Jane Street’s expansion at 250 Vesey, Bloomberg reported.

And, with good reason, as the deal is seen as a boost to Lower Manhattan’s office market, which has lagged behind the recovery seen in other parts of the city.

While Midtown and Midtown South saw year-over-year leasing growth last year, downtown activity fell by 9.3 percent, according to a C&W report. Plus, the 382,744 square feet signed in the fourth quarter of 2024 didn’t include any deals above 50,000 square feet, and the average deal size was only 5,530 square feet, the report found.

The neighborhood had a mixed start to 2025. It saw 315,000 square feet signed in January — including Axsome Therapeutics‘ 96,293-square-foot deal at 1 World Trade Center — an amount that was 44 percent better than its monthly average over the past five years, CBRE found. Its availability rate also fell 90 basis points year-over-year.

However, the leasing total in Lower Manhattan was down 3 percent annually and the area’s availability rate of 21.4 percent was up 80 basis points from December.

Nicholas Rizzi can be reached at nrizzi@commercialobserver.com.