TSX Broadway Seized by Goldman-Led Consortium After L&L, Fortress Default

By Andrew Coen August 6, 2024 4:57 pm

reprints

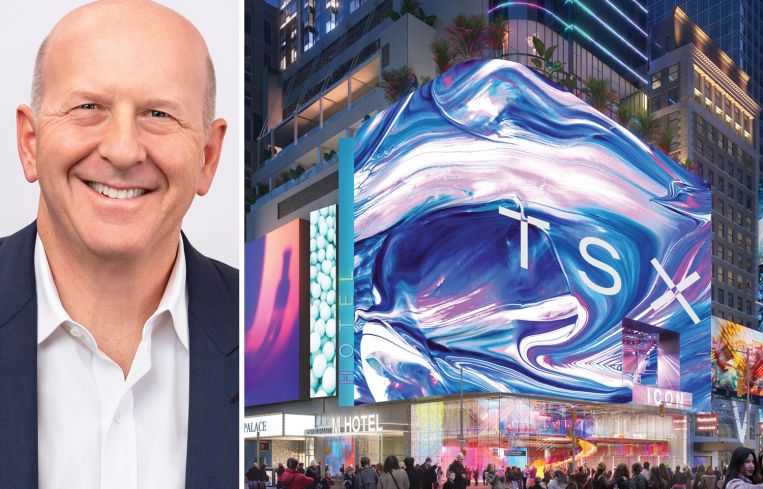

A Goldman Sachs-backed consortium of lenders seized control of the recently-completed TSX Broadway development in Times Square after the project’s owners defaulted on its debt, Bloomberg reported Tuesday.

The lending group has tapped SL Green Realty to take over management of the property at 1568 Broadway in a step that could position it for a possible sale, Bloomberg reported, citing people familiar with the matter. The development site includes an outdoor stage, a Hilton-branded Tempo hotel, the Palace Theatre and retail space.

Goldman Sachs was a senior lender on a 2018 financing for the $2.5 billion project, providing a $1.13 billion construction loan at the time. The developers, L&L Holding Company and Fortress Investment Group, failed to repay $543 million of mezzanine debt backing the property from foreign investors a year ago when it matured on July 1, 2023, The Real Deal reported at the time.

Officials at Fortress did not immediately return requests for comment. Goldman Sachs, SL Green and L&L declined to comment.

After years of demolition and excavation, L&L and Fortress finally started work on the 46-story TSX building in 2019. The $2.6 billion project includes a 669-room hotel and the developers dropped $50 million to renovate the historic Palace Theatre, lifting the landmark structure 30 feet into the air as part of the work.

Andrew Coen can be reached at acoen@commercialobserver.com.