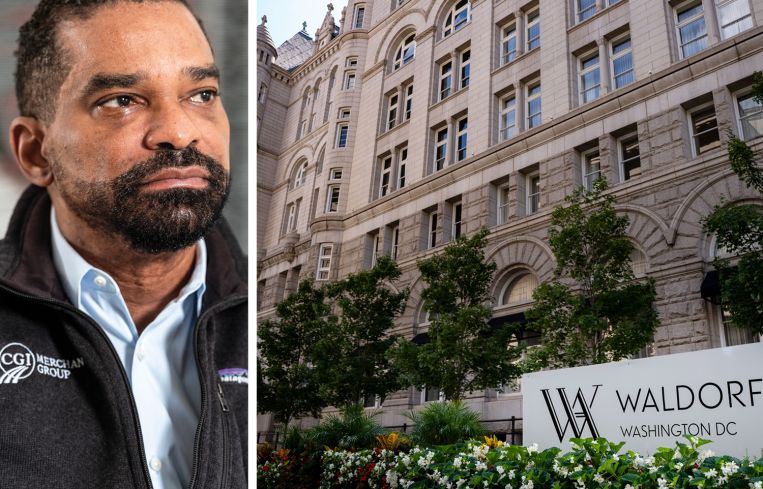

Former Trump International Hotel in D.C. Sold for $100M at Foreclosure Auction

The debt holder on the property — now branded as a Waldorf Astoria — was the sole bidder, though leaseholder CGI says the fight to keep the asset isn’t over yet.

By Nick Trombola August 5, 2024 5:45 pm

reprints

The debt holder on a leasehold interest in the former Trump International Hotel in Washington, D.C., has finally gotten its hands on the beleaguered building at a long-awaited foreclosure auction.

Merchant bank BDT & MSD Partners on Monday cast the sole bid of $100 million for the hotel at 1100 Pennsylvania Avenue NW, currently branded as Waldorf Astoria Washington D.C. The property, also known as the Old Post Office, is owned by the federal government, but the Trump Organization was granted a 60-year ground lease to redevelop it as a hotel. The Trump International Hotel opened in 2016, just months before its namesake was elected president.

Miami-based CGI Merchant Group, in partnership with Hilton, acquired the lease from Trump for $375 million in 2022. Yet, less than two years later, the firm defaulted on a $285 million loan tied to the property. CGI still owed nearly $257 million on the loan as of early July, according to the D.C. Recorder of Deeds.

“Since the first material event of default on the loan in July 2023, we have actively engaged with CGI in a constructive manner, allowing ample time for them to explore financing and alternative options,” BDT & MSD Partners said in a statement. “We have now taken control of the Waldorf Astoria Washington D.C. via foreclosure, and remain dedicated to our partnership with Hilton and confident in the future of the asset.”

A spokesperson for CGI told Commercial Observer that the firm had secured a refinancing package to cure the loan default prior to Monday’s auction, and had told BDT & MSD Partners as such, but the bank chose to move ahead with the auction anyway.

“Although this represents a disappointing development, we never walk away from a property — and we are not done fighting for the Waldorf Astoria,” CGI said in a statement. “CGI is fully committed to protecting the interests of its partners and investors, and we will utilize all resources at our disposal to prevail in this flawed auction process.

“Even though the auction has occurred, we remain in intense discussions with BDT & MSD Partners, and still have a finalized capital solution on the table to cure the loan default and recapitalize the asset.”

Sources with knowledge of the business dealings between CGI and BDT & MSD Partners presented conflicting accounts of how the asset ultimately made it to auction.

The foreclosure auction was originally set for June, but was pushed back to allow CGI more time to find a solution to its debt, one source told Commercial Observer. As recently as this past weekend, CGI was offered yet another extension, but this time needed to provide cash or a letter of credit enabling the firm to pay down a slice of the accrued interest, according to the source. But it became clear that CGI could not dispense it in time, the source claimed.

A different source, also familiar with the proceedings, refuted that claim and said CGI had presented BDT & MSD Partners several pathways to secure an extension deal, and had proposed options to the lender for more than six months before the auction date.

Nick Trombola can be reached at ntrombola@commercialobserver.com.