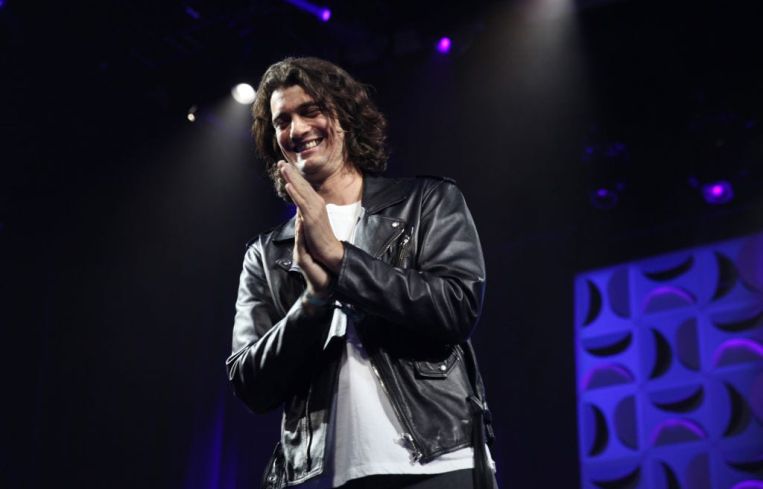

Adam Neumann Attempting to Buy WeWork Out of Bankruptcy

By Mark Hallum February 6, 2024 3:00 pm

reprints

Adam Neumann is trying to take back his very own Black Pearl, and the ousted WeWork/" title="WeWork" class="company-link">WeWork co-founder has the company right where he wants it: in bankruptcy.

Neumann and a group of investors including Dan Loeb’s Third Point" class="company-link">Third Point are putting together the cash to buy the coworking firm, which has been brought to its knees by hemorrhaging funds and filed for Chapter 11 bankruptcy protection in November, Bloomberg has reported.

But WeWork may not want Neumann back, with the company saying that it plans to hand itself over to creditors, according to Bloomberg. In fact, WeWork doesn’t even seem interested in negotiating, according to Neumann’s lawyer.

“We write to express our dismay with WeWork’s lack of engagement even to provide information to my clients in what is intended to be a value-maximizing transaction for all stakeholders,” Alex Spiro, an attorney and partner with Quinn Emanuel Urquhart & Sullivan representing Neumann, wrote in a letter obtained by Bloomberg.

Spiro and a representative for Neumann did not immediately respond to a request for comment.

A spokesperson for WeWork said company officials regularly “receive expressions of interest” from people trying to buy the company. The spokesperson added that WeWork is focused on working with landlords, creditors and the court system to reposition itself with fewer leases, having canceled many throughout the U.S., especially New York City.

“We and our advisers always review those approaches with a view to acting in the best interests of the company,” the spokesperson said. “We continue to believe that the work we are currently doing — addressing our unsustainable rent expenses and restructuring our business — will ensure WeWork is best positioned as an independent, valuable, financially strong and sustainable company long into the future.”

While Neumann coming back to WeWork would mark a homecoming, his time at the head of WeWork was marked by plenty of scandal.

Neumann grew WeWork at a staggering rate — inking leases all over the world at a rapid clip and dropping millions to buy other companies — and eventually grew it to an eye-popping $47 billion valuation.

However, that zest for expansion is part of the reason WeWork is currently in trouble, since paying for leases has been a huge drain on its balance sheets. Its huge revenue growth from 2016 to 2018 coincided with losses increasing at a similar pace.

Neumann left WeWork in September 2019 after a failed initial public offering, although WeWork later successfully went public in 2021. WeWork replaced Neumann with Sandeep Mathrani, a real estate legend who many considered a sign WeWork was growing up. Mathrani left his post in 2023, with David Tolley becoming the new CEO.

At the end of January, WeWork was seeking permission to keep its spaces at Madison Capital’s 71 Fifth Avenue just west of Union Square as well as its Dock 72 headquarters in Brooklyn Navy Yards, Commercial Observer recently reported.

This has happened as WeWork has faced a lawsuit from the owners of six buildings arguing that it withheld $33 million in rent that came due Jan. 1 and has canceled nine leases nationwide.

Mark Hallum can be reached at mhallum@commercialobserver.com.