Markerr Makes an AI Data Scientist Minus the Scientist

Real estate analytics firm rolls out machine learning software for multifamily rent forecasting

By Philip Russo December 12, 2023 9:00 am

reprints

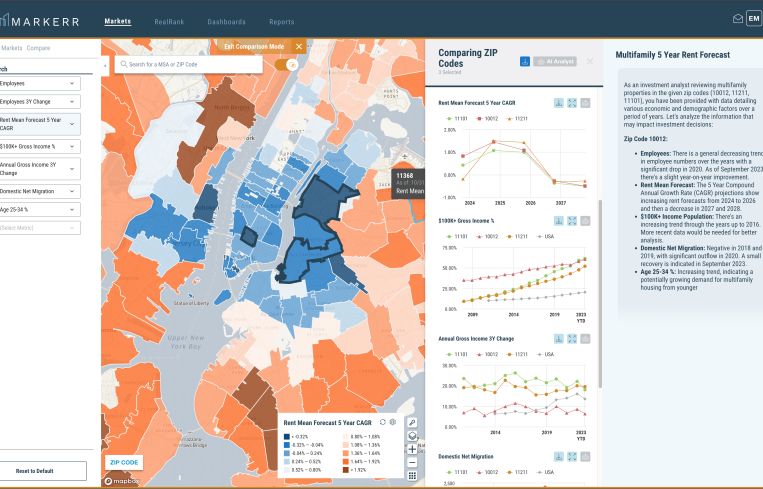

In proptech’s seemingly exponential effort to bring generative artificial intelligence (AI) to real estate, data analytics firm Markerr announced Tuesday that it has rolled out what it calls an AI Data Scientist function for multifamily rent forecasting.

Powered by machine learning, the product will allow commercial real estate professionals, including those not so technically skilled, to access advanced rent forecasting, while understanding the rationale and analysis behind forecasts, said Brian Lichtenberger, CEO and founder of New Jersey-based Markerr.

“Incumbent vendors take their survey data and they basically re-create a linear model to project out rent,” said Lichtenberger. “They assume that the relationship they’ve had is going to continue into the future. What we do is very different. We take all our data — demand, supply, rent data, home pricing data, population growth, income growth — and we put it all into a machine-learning model.

“We let the machines determine the relationships between all those inputs as relates to our ability to project rent forward. It’s a fundamentally different approach and more complicated, but we can create literally thousands of forecasts at the same time, leveraging machines at scale. This is truly AI and ultimately enables us to give a better forecast than what’s in the market.”

The fully automated AI Data Scientist uses only proprietary software, outputs results in chart and written formats, and is integrated into the Markerr Data Studio, the Manhattan-based company’s series of dashboards for its investor, owner and operator clients, Lichtenberger said. Markerr has been developing its AI Data Scientist dashboard for two years and the AI component over the last 12 to 15 months, with client testing since the summer, he added.

Markerr numbers Bridge Investment Group, Pretium Partners and RET Ventures among its investors, with national residential companies Invitation Homes and Pretium as two of the firm’s largest clients, Lichtenberger said.

“Markerr’s AI-driven approach to rent forecasting has been a game-changer for our investment strategies,” said Christian Evans, investment associate at The Dinerstein Companies, the Houston-based real estate firm (and Markerr client) that has developed 80,000 apartments and 44,000 student housing beds across the country. “With real-time insights and this groundbreaking AI Data Scientist feature, we’re experiencing unparalleled efficiency and accessibility in understanding complex machine-learning models.”

Unlike traditional econometric forecasts, Markerr’s approach uncovers hidden relationships within the multitude of proprietary inputs running at scale through its machine-learning software, according to the company product announcement. The methodology, which Markerr says is validated through historical data and backtests, claims to produce forecasts that outperform legacy models, while delivering quantifiable return on investment for real estate investors, owners and operators.

Philip Russo can be reached at prusso@commercialobserver.com.