Office Was in Trouble Pre-COVID — WeWork Just Hid It: MIPIM Panelists

By Nicholas Rizzi March 15, 2023 10:04 am

reprints

Mostly everybody at the MIPIM 2023 convention this week in Cannes, France, laments the state of the office market, but they also say it was in trouble long before COVID hit.

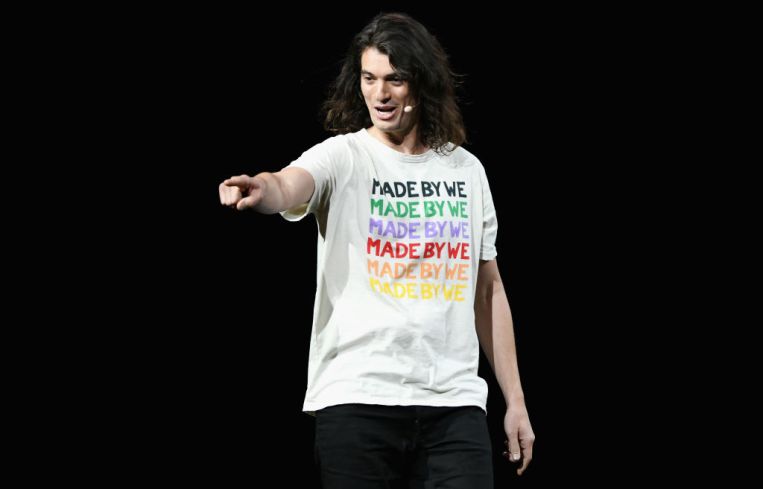

Adam Neumann just helped hide it.

The office market in the U.S. had been dealing with an oversupply of aging, obsolete stock for years, but Neumann’s insatiable appetite to open new WeWork locations when he was at the helm of the coworking giant pumped up leasing numbers for office stock.

“One of the things that really [masked] the supply-demand imbalance was WeWork,” Bradley Weismiller, a managing partner of real estate capital markets for Brookfield Asset Management, said Wednesday morning during a panel on office market trends. “A lot of what looked like office demand in the sector — not just in the United States but all around the world — was WeWork leasing. That was making it appear to be much more balanced.”

Weismiller said the often-talked-about flight-to-quality trend was already in place pre-COVID. It was just that WeWork tended to gobble up space in buildings “that might not have had any tenant.”

Kwasi Benneh, a managing director and the head of North America commercial real estate lending for Morgan Stanley, agreed that the U.S. has an oversupply of aging office stock — with a recent Cushman & Wakefield report estimating that 1.4 billion square feet of office in the country will become obsolete by 2030 — but he’s not convinced the office-to-residential conversions everybody is talking about will be the solution.

“People fail to ask the basic question: Do people want to live here?” Benneh said. “A lot of these Class B office buildings that are the suspects for conversion, they are basically in places people don’t want to live.”

Benneh pointed out that after 2008’s financial crash there were plenty of plans to convert office buildings around Wall Street into residential condominium projects. Many failed to get off the ground — though some have restarted recently. The city has also been targeting Midtown as a spot for more conversions.

Michael Lascher, a senior managing director at Blackstone, says he looks jealously at the office districts in Europe, where a stronger return-to-work push means a busier, fuller workweek — usually five days as opposed to three in much of the U.S. — and hopes that that would catch on in the States.

“The most recent data shows that, on average, 50 percent of the [U.S.] workforce is back in full-time and that’s just not going to sustain the office market,” Lascher said. “It does feel like if the economy is slowing and the power dynamic shifts a little bit, it will help get more people back to the office.”

The panelists didn’t lament just the state of the office market. They highlighted how retail — which went through the ultimate test during COVID — has started to rebound, and there’s still plenty of interest in logistics, self-storage and multifamily. But with interest rates continuing to rise, a lot of lenders are waiting on the sidelines unless they find some “fallen angels,” Benneh said.

“These are deals that in normalized times could refinance very easily, but because of the markets you’re having a tough time stabilizing them,” Benneh said. “There’s a lot of trial and error going on with refinancing deals.”

Nicholas Rizzi can be reached at nrizzi@commercialobserver.com.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)