Proptech Firm Enertiv Raises $9M to Expand Services

By Mark Hallum May 19, 2022 2:49 pm

reprints

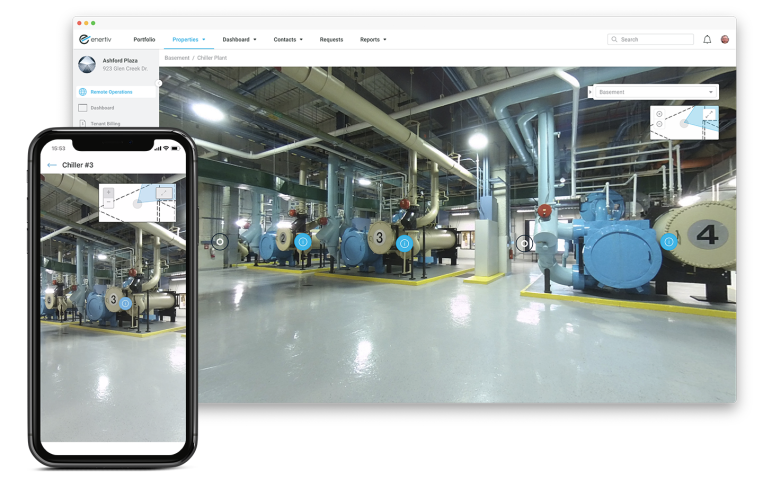

Enertiv, an operational intelligence platform for reducing carbon emissions in commercial real estate assets, raised up to $9 million to expand the bandwidth of its service — at no extra cost to users.

The Enertiv software helps clients collect information about where building resources are being spent and informs managers when, where and how to reduce energy, according to Nate Loewentheil, founder of Commonweal Ventures.

The fundraising — led by Commonweal Ventures and GroundBreak Ventures — comes as the New York City Council has forced demand for innovation in how landlords reduce emissions through Local Law 97, enacted in 2019 and set to take effect in 2024. Buildings spanning 25,000 square feet or larger will be required to reduce carbon emissions by 40 percent by 2030, and by 80 percent by 2050.

“Enertiv is about having access to granular data that identifies where meaningful changes

can be made day to day,” Connell McGill, CEO of Enertiv, said. “Enertiv serves as a centralized platform for all ESG reporting, as well as providing real estate operators with the solutions that they need to reduce carbon emissions and optimize performance at the asset level. This latest raise will enable us to further develop our capabilities in this area as we look to meet the growing demand for our technology.”

The Enertiv platform is advanced enough to provide alerts when leaks are detected, report on air quality and collect information from tenant submeters. This has benefits for informing tenant billing and forming capital plans for major improvements. Work orders can be managed as well through the platform, according to the developers.

But Enertiv is not the only company in the game.

Several other platforms are either in development or building a name for themselves. These include ClearTrace, which has a building dashboard already in use at 1 Manhattan West, or Measurabl, which gives clients the ability to customize what kind of data is gathered.

Another example would be Hatch Data, which serves clients such as Boston Properties and Hines by analyzing data gathered from other management systems and offering its own recommendations.

Mark Hallum can be reached at mhallum@commercialobserver.com.