Harry Macklowe Reimagines a Downtown Manhattan Office Tower

Macklowe Properties' conversion of the landmarked One Wall Street into 566 condos represents the largest such conversion in NYC history

By Tom Acitelli March 8, 2022 10:00 am

reprints

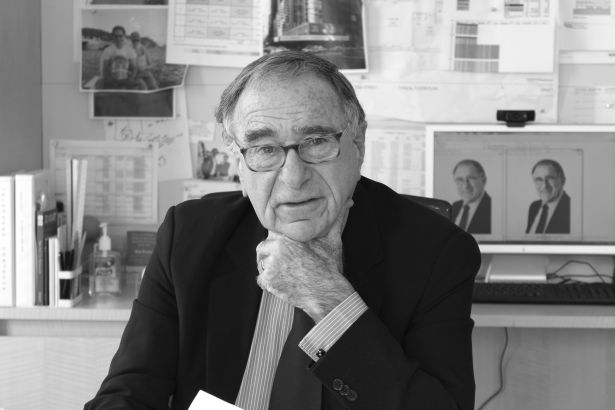

Harry Macklowe has bet big before in New York.

He built the nearly 70-story Metropolitan Tower condominium at 146 West 57th Street during the height of the city’s bad, old days in the mid-1980s; it sold out, and sells still. He convinced Steve Jobs in 2006 to open what at first appeared an incongruous Apple store in a plaza at the base of Macklowe’s General Motors Building at 767 Fifth Avenue; the store quickly became one of Midtown’s major attractions (and it embiggened the value of the GM Building manifold — Macklowe sold that for $2.9 billion in 2008, more than twice what he paid for it).

A year after the Apple opening, Macklowe snapped up several office buildings from Blackstone for around $7 billion at what turned out to be the peak of the last commercial real estate boom in New York. It was probably the boldest buy of an exceptionally brash era. He lost seven of the buildings within 18 months after failing to find longer-term financing for the deal, and had to sell the GM Building to boot.

No matter. Macklowe was back the next decade with what turned out to be one of the more prescient residential developments in New York: the supertall 432 Park Avenue, a catalyst for what became Billionaires’ Row on 57th Street. Developed with CIM Group, it’s proven one of the most lucrative residential buildings in the world.

(It’s also drawn a lawsuit from some buyers, who allege shoddy craftsmanship. Macklowe’s Macklowe Properties told Commercial Observer, “CIM is the sponsor and manages 432 Park Avenue so they are the only ones that can comment on behalf of those entities in regard to the alleged issues and lawsuit. Communication with residents and the residents-controlled board has been with CIM only and not Macklowe.”)

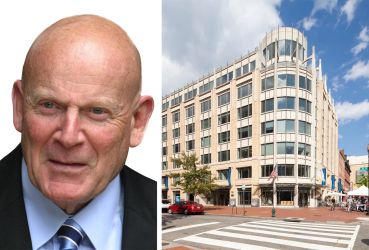

Now, Macklowe, 85, is betting on Downtown Manhattan: namely the 56-story, 566-unit luxury condo tower at One Wall Street, which supplants the landmarked Art Deco ex-headquarters of the former Irving Trust Company Building that dates from the 1930s.

The highly amenitized spire — which Macklowe’s company touts as the biggest office-to-condo conversion in New York history — will wrap up construction before the end of 2022, and closings are expected to start mid-year. It will include a Whole Foods outpost, too, and prices are not for the light of wallet: they start at $2,500 a square foot in a Manhattan where the average price per square foot for new condo units was $2,346 at the end of 2021, according to appraiser Miller Samuel.

Macklowe talked with Commercial Observer late last week about his vision for the tower and about Downtown in general — plus his first-ever project in the Miami area, where he plans to build two 25-story towers next to the Dadeland Mall with 650 apartments as well as retail and parking.

The interview has been edited for length and clarity.

Commercial Observer: I’ve read that you deposited your first paycheck at what’s now One Wall Street. Can you explain that backstory?

Harry Macklowe: My first job was for an advertising agency on 57th Street and Madison Avenue. Irving Trust was the bank on the ground floor, and so I opened my first bank account there. That was a while ago. I used them as a bank as a young man, and I continued my relationship with them, including loan officers who I’ve known throughout my business career. They went from Irving Trust to Bank of New York; then Bank of New York was acquired by Bank of America.

But I’ve continued my relationship — actually there’s a loan officer who ended up working for a British real estate investment trust; I actually ended up buying a building from him in California, now that I recall.

You ask me a question, it stimulates my memory.

What sort of demand do you expect for One Wall’s condos? And who might be the typical buyer or buyers?

The majority of the people who have been into our office live in the neighborhood or work in the neighborhood. The turn from financial to residential and financial [in the Financial District] has been remarkable over the past five years. I anticipate that continuing.

As we go forward, the people in the neighborhood are finding it more attractive to live-work. The number of restaurants and shops are increasing; and our activity has picked up considerably and we’re not even formally open for sales. We’re showing apartments to people who’ve visited us online.

I’m going to tell you it’s an outstanding building on the design and the construction and the readaptation of a bank world headquarters to a very large condominium. But I’m like a parent who says his children are the handsomest and the brightest. Have you ever heard a parent who didn’t have the brightest, handsomest kids?

In your opinion, what makes it exceptional?

The quality of work, the design, the planning, the room, the size of the rooms, the ceiling heights, the carpentry and trim, the effort that was put into making each one of the apartments seem more personal, more at home. Over 50 percent of the apartments in the building have space for home offices.

In addition to which, the amenities package — the lounge, the free work area, the gym facilities, the Whole Foods, and the One Club, with the swimming and the therapies and all of that — it makes it a very distinct, very unique package.

Were the home offices intentional due to the pandemic and the work-from-home trend?

They were a result of planning four years ago, five years ago. We thought there would be a significant population working at home. We were not anticipating what has happened because of the pandemic. But, by serendipity, it works out perfectly.

Wall Street doesn’t really have any banks headquartered on it anymore. Can you talk about the evolution of the Financial District and Lower Manhattan in general?

The history of the capitalist system is there. We are exactly 40 feet away from the New York Stock Exchange. As a matter of fact, a few of the apartments look into the trading floor of the New York Stock Exchange. You can see the activity during the day.

The buildings surrounding the Stock Exchange were all financial; either banking or stock clearing or insurance. And that has gradually changed, and it changed dramatically after 9/11. Our financial society migrated uptown. Chase Manhattan sold its beautiful bank building and is now building a nearly 3 million-square-foot one at 270 Park Avenue. Bear Stearns moved from Downtown to uptown, and Merrill Lynch moved uptown; and Morgan Stanley went to Seventh Avenue. So the migration uptown has been a stimulus by creating a void; 9/11 really accelerated it. But, before that, there were conversions of buildings on John Street and on Pine Street to residences.

Now, you have a population that is somewhat more than 60,000 people and less than 100,000 that are living below Canal Street. So we’re responding to what we think is the continuing need for housing, and this is a statement in a landmarked building; it’s a statement of working within that landmarked building to create 566 apartments. We assume that there will be two or three people living in each apartment. So there will be a population of 1,500 people in the building, give or take.

We’ve got a 50,000-square-foot Whole Foods. And we have 75,000 square feet in amenities that serve the residences of our microcosm of the city within the city.

What sort of prices do you anticipate?

Our prices have been in the range of $2,500 to $3,000 [per square foot] — $3,500 to $4,000 for the tower, a little lower for the lower part of the building. We are clearly not a building where you’re going to buy because of price; it’s a building where you’re going to buy because it’s a home and it will only enhance in value.

It’s also an office conversion. Do you foresee more empty office spaces in the city being converted into housing.

Yes, I do.

And condo sales were not particularly robust before the pandemic. They’ve picked back up again. But you’re not worried about potentially slow sales?

We’d like to have a steady pace of sales because we’ve got more than 500 apartments to sell. But we’re very confident that the product is there and the market is there.

What about your Miami plans in Miami-Dade? There are a lot of New Yorkers active down there. Talk about your project there and your thoughts on the area.

I see a demand for office space and living; I see the population growing every week, every month. I feel that the growth in Florida had formerly been gauged by flight of capital from South America. Now it’s growth from within. Florida is very tax friendly.

I think we found with the pandemic that we don’t have to live in the urban centers. So, both working from home and working outside the city is much more acceptable than it had been 10 years ago. That’s much more readily apparent to all of us. I feel that Florida is a continuing growth center, as are several of the Sun Belt states and cities — Austin, Jacksonville, Nashville. I see them expanding, and you see companies diversifying around the country and making commitments to those areas. It’s interesting in Miami because you now see there is a substantial amount of culture there. The museums; there are opera houses; there are theaters.

Also, with One Wall Street, did the thinking on 432 Park enter into it? Or is it totally separate conceptually as a project?

We felt we could be the distinguished building Downtown because of the landmarked status and because of the beauty of the building. We thought that if we created the product with the same care and attention as 432 that we would stand out.

And we thought there were three important buildings Downtown. One was the Four Seasons that was very successful that Silverstein [Properties] built. The other was the Frank Gehry-designed 8 Spruce Street, which Bruce Ratner built and is very distinguished. And we thought One Wall Street would be the leader. So we felt, “OK, here’s an opportunity to create a very distinguished product.”

How was business during the pandemic? And how’d you keep things going, including the work on One Wall?

Firstly, things slowed down during the pandemic as everyone was extremely cautious. The caution on the flu was wise. Once the vaccines were established, they kind of broke the logjam, and created a safety factor. Before that, we were able to continue what were the essential parts of the building — the elevator shafts, the heating plant. So, when we had full construction, we had 650 people working; during the pandemic, we were down to 250 or 300. They were carefully monitored by themselves, by the trades and by us.

So it protracted the completion of construction but the quality of the project was maintained. We took our time and pursued construction carefully.

What was financing like for something like this during the pandemic?

[Laughs] Continued to pay interest to the bank, who was very indifferent to the pandemic. Mortgages are mortgages. They’re not landlords who can forgive rent. It’s a business deal and something that we just dealt with.

What bank was it?

It was a consortium of banks, major money-center banks. (Macklowe later confirmed through a spokesperson that Deutsche Bank remains the project’s lead bank among a syndicate of four banks total.)

This is the wayback machine, but how did you connect with Steve Jobs for the Apple store?

I was building a building in SoHo where [New York University] ends and SoHo begins on Broadway and Houston Street. Do you remember there was a carwash on the northeast corner? I was building that building — it was an office building — and I heard that Apple was interested in SoHo, and I made a presentation to the head of the real estate department, who I knew. And he said, “No, no, Steve Jobs is committed to another location Downtown.” I said, “I have the General Motors Building and I think that’s going to be unique and different. I’d like to present that to him.”

I had an invitation. I met with Jobs, and in a half an hour we shook hands. I presented to him, he presented to me; he had done his research, I had done mine; and we had an instant deal. He recognized what it could be. I had prepared studies and research on the pyramid at the Louvre, on the planetarium glass box on [West] 81st Street, and we hit it off immediately. It was a wonderful meeting.

And we’ve been able to maintain the relationship with the senior executives at the company because the Apple cube changed the image of Apple around the world. So I’ve often said I’m proud to build a building that changes the skyline; however, I was able to do it by building a building that was only 32 feet high. I think that that building and 432 Park, and my entire body of work, is a legacy, but those two are really outstanding. I’m very proud of them.

You said 432 Park and the Apple cube. Where does One Wall fit into this?

It’s right up there with the prestige products we’ve been able to develop.

Tom Acitelli can be reached at tacitelli@commercialobserver.com.