Office Space Demand Remains Sharply Down From Pre-COVID

That return to normalcy in major markets appears to be taking its time, a new report shows

By Tom Acitelli January 28, 2021 9:01 am

reprints

One of the axioms sustaining the U.S. office market like a mantra for meditation is that things will return to where they were before the coronavirus pandemic, at least in terms of the pace and the volume of leasing deals (the setup of the office is a different story).

Yet, new research shows just how far off that return to the leasing status quo likely is, and whether it will ever happen.

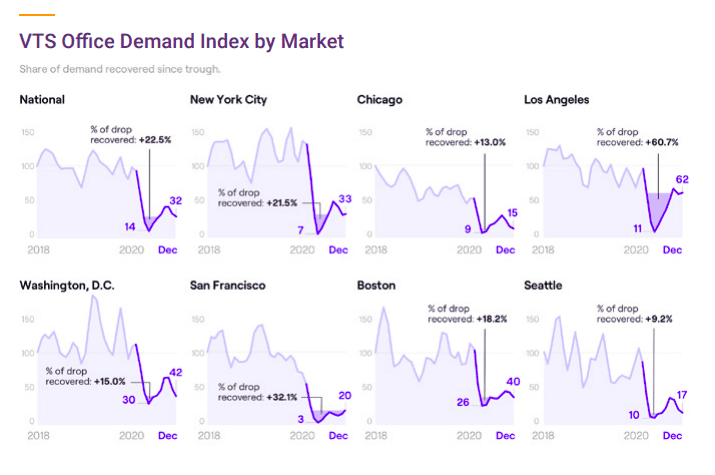

Demand for leasing office space was down 61 percent annually in December, according to new data from proptech firm VTS, which tracks virtual and in-person tenant tours of space in central business districts in major markets nationwide. The VTS index is seen as one of the more reliable barometers of tenant demand for office space and a measure of just how much leasing is on the horizon.

The index shows that there’s not as much as many in the industry would probably like. VTS’ demand index dropped 26 percent in the fourth quarter of 2020 compared with the quarter before. That represented a decline, too, from a brief uptick in demand over the summer, when it looked like more companies would be returning their workers to the office post-Labor Day. (That didn’t happen.)

“The fourth quarter typically experiences a drop-off in demand due to seasonality,” VTS said in a statement on its stats. “While the fourth quarter of 2020’s decline was not as steep as in previous and more active years, relative to the much lower levels of demand during this crisis, the decline of 26 percent was more severe than typical. Only two markets, Los Angeles and San Francisco, bucked seasonality, netting positive growth between the months of October and December.”

As for New York City, demand for office space was down 74 percent compared with before COVID. Much of this demand is for Class A space, with tours of such offices accounting for 69 percent of the total volume in the fourth quarter, according to VTS.

That might seem like good news for landlords intent on maintaining rental rates and curbing the flow of incentives needed to fill space. But, look a little closer, and the high demand for Class A space reflects bargain hunters smelling deals in some of New York’s more marquee addresses.

In fact, New York stands alone among the markets that VTS tracks in that the pandemic-spurred loss of demand has actually spurred a tenant land rush toward higher-end offices.

“… Class A and trophy spaces are still taking up more than their typical share in the market at 69 percent in the last quarter of 2020, positioning New York City as the only market with a significant and measurable flight to quality,” the report said.

Other year-end stats show a New York market — Manhattan in particular — awash in sublease space. That trend is driving down rents and creating the need for monumental incentives to draw and retain tenants. The average asking rents for Class A, B and C space all dropped between 2 and 5 percent from the third to the fourth quarters, according to brokerage Colliers International.

And the number of office leases in Manhattan for at least $100 a square foot was down 75 percent in 2020, to 60, compared with the 145 signed in 2019, according to brokerage JLL. Those 145 leases, too, represented a lot more space: 8.8 million square feet vs. 2.1 million. Also, in 2020, 35 Manhattan buildings hosted rents that commanded at least $100 a foot; in 2019, that figure was nearly double.

Meanwhile, many companies continue to have their employees work remotely — estimates suggest that less than one-fifth of Manhattan’s office space is occupied on any given workday — and even commercial real estate firms that service the industry are planning for a future with much less leased space.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)