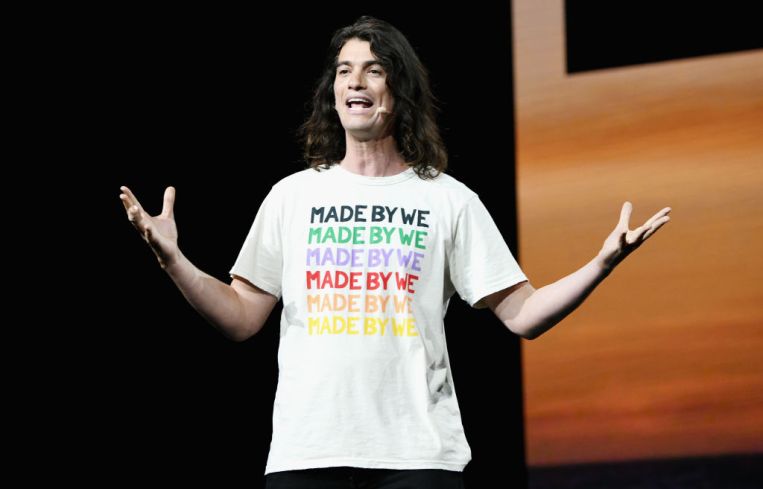

WeWork’s Ex-CEO Neumann Plans to Sue SoftBank Over Golden Parachute

WeWork ex-CEO Adam Neumann is planning to sue SoftBank over the loss of his nearly $1 billion golden parachute.

By Nicholas Rizzi April 20, 2020 4:40 pm

reprints

Former WeWork CEO Adam Neumann might have lost his billionaire status, but he’s not letting it go without a fight.

Neumann is planning on filing a lawsuit against WeWork majority backer SoftBank Group over the Japanese bank’s cancelation of a deal to buy $3 billion worth of shares in WeWork from stockholders, which included Neumann’s nearly $1 billion golden parachute, Bloomberg reported.

SoftBank lawyers revealed Neumann’s plans in an email last week to WeWork’s board, arguing that a similar suit filed by a special committee of WeWork’s board did not have the authority because of Neumann’s suit.

“Adam Neumann has also said that he intends to file a complaint,” SoftBank’s lawyer, Erik Olsen of Morrison Foerster, wrote in the email according to Bloomberg. “There is no need for WeWork to allow its cash reserves to be used to finance an expensive lawsuit intended to generate material personal benefits for the special committee directors and the funds they control.”

The special committee — started last year by members of WeWork’s board to “ring-fence” the company’s financial deliberations from SoftBank — argued in a letter to SoftBank today that its suit should stand.

“SoftBank is once again attempting to use its power as WeWork’s controlling stockholder to benefit SoftBank at the expense of WeWork’s minority stockholders,” the special committee said in a statement. “SoftBank’s ploy attempts to prevent the more than 850 current and former WeWork employees who tendered stock worth over $450 million from obtaining any remedy for SoftBank’s wrongful conduct.”

A spokeswoman for SoftBank declined to comment.

Earlier this month, SoftBank pulled out of the deal — called a tender offer — citing that WeWork failed to meet several conditions by April 1, including WeWork allegedly not receiving antitrust approvals or closing joint ventures in Asia. SoftBank also blamed several investigations into WeWork that were launched after its botched initial public offering last summer.

SoftBank previously said halting the tender offer mostly impacted Neumann, his family and institutional investors like venture capital firm Benchmark and would have “no impact on WeWork’s operations or customers.”

While the special committee said that $450 million from the deal was allocated to current and former employees of WeWork, a source with knowledge of the deal told Commercial Observer the amount is less than $300 million. The source added that Neumann and Benchmark have already sold more than $675 million of WeWork shares to SoftBank.

Less than a week later, WeWork’s special committee filed a suit in Delaware court against the cancellation of the tender offer, arguing it was a breach of contract while blaming the failure to close on joint ventures in China on SoftBank itself. On Friday, a judge denied the special committee’s bid to fast pace the start of the lawsuit and instead ruled proceedings would begin in January, Bloomberg reported.

The cancellation of the offer cut Neumann’s net worth by 97 percent to $450 million, kicking the bombastic WeWork co-founder out of the billionaire ranks, according to Bloomberg.

WeWork was facing a rough year after its disastrous 2019 — which included the failed IPO, losing Neumann, laying off thousands of workers and nearly running out of cash — before the coronavirus pandemic rendered most of its locations empty. The company is planning another round of layoffs next month.