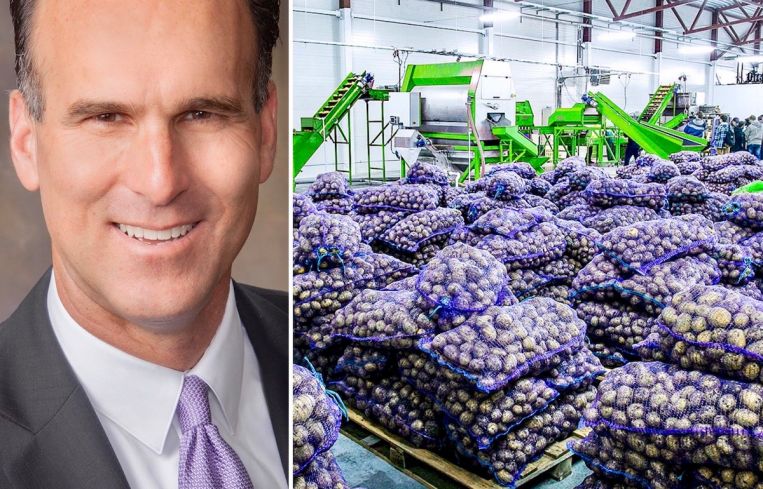

Red-Hot Cold Storage: Q&A With CBRE’s Kurt Strasmann

Kurt Strasmann, executive managing director at CBRE, explained to Commercial Observer how the firm sees demand playing out for the cold storage sector in Southern California and around the country.

By Greg Cornfield April 24, 2020 5:45 pm

reprints

With the majority of Southern Californians stuck at home amid the spread of coronavirus, demand for industrial cold storage space is expected to surge, according to research by CBRE.

The pandemic created a massive disruption in the food industry by restricting restaurants to delivery or takeout throughout the state. That will lead to increased demand for cold storage industrial space for online grocery sales, which have increased dramatically since the pandemic hit the United States, according to CBRE. And when the state does begin to reopen, capacity restrictions are expected for public places and restaurants.

Approximately 95 percent of food produced in or imported to the U.S. goes through third-party distribution centers before reaching consumers. Prior to the outbreak, research from CBRE suggested that an additional 75 million to 100 million square feet of industrial freezer and cooler space would be needed throughout the country to meet the demand in the next five years. But the pandemic will likely accelerate that need.

The firm expects e-commerce grocery to become more widely adopted as consumer comfort grows with the practice, and public refrigerated warehouse companies will likely consolidate to gain more control of the cold storage footprint.

Kurt Strasmann, executive managing director at CBRE, explained to Commercial Observer how the firm sees demand playing out for the cold storage sector in Southern California and around the country.

Commercial Observer: Have you seen an increase in activity in cold storage real estate since the economic shutdowns in Southern California? How so?

Kurt Strasmann: It’s a little early for hard data points due the most recent events of COVID-19 affecting this sector, but across the board our professionals confirm that activity levels from cold storage operators have increased tremendously. Along with various e-commerce-related industries, cold storage is one of the most active sectors. The comp data is just starting to come out, and I expect in 90 days we will have the hard facts to validate all the realtime user demand levels in this sector, particularly in our region.

Have tenants and investors been more active? If so, which ones?

Again, there is lots of interest in cold storage from users, investors and developers — all are showing a strong appetite for investing with build-to-suit opportunities. Most notably, some developers have suggested they might be getting close to considering spec projects, which would never have been in the cards in the past. We have not seen a spec project yet, but just the fact that there are conversations about this possibility is incredible.

According to the report, the pandemic will likely accelerate the need for cold storage space. By how much?

Cold storage had excellent momentum prior to COVID-19 and the current situation has only strengthened the fundamentals for the need for cold storage capacity exponentially. Think about purchasing behavior patterns relating to online groceries. E-commerce has proven once consumers are comfortable with the process of buying online, rarely do they go back to brick and mortar, at least for some established goods. We see this sector very well-positioned for further growth moving forward.

What other real estate examples or data points are there for increased demand for cold storage property — particularly in Southern California — other than people becoming more accustomed to staying home, and needing groceries delivered because of stay-at-home orders?

Online orders have exploded over the last six weeks. According to recently completed consumer research done by Brick Meets Click and Shopper Kit, 31 percent of U.S. households have used an online grocery delivery or pickup service in the past month (the survey was conducted March 23-25). This is more than double since the previous survey in August 2019 at 13 percent of households. Secondly, think of the speed with which all of this has occurred.